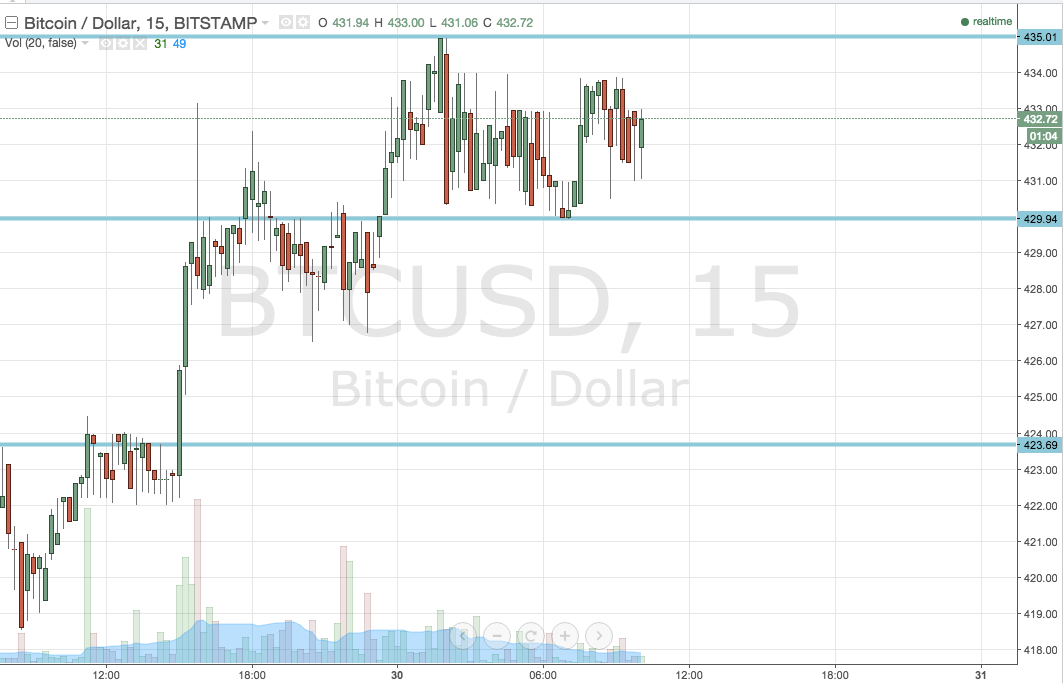

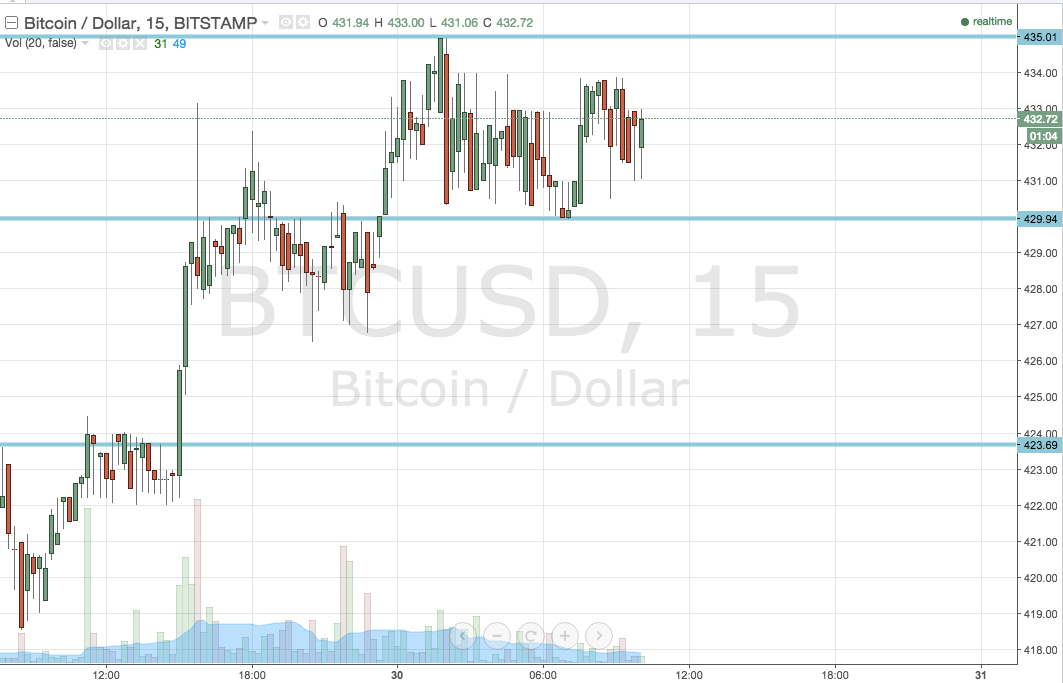

Yesterday afternoon we got an upside break in the bitcoin price, and on some pretty low volume managed to hold onto the gains overnight. We corrected a little bit earlier this morning, and just as the markets opened in Europe, we got another kick, and have since traded between a pretty tight consolidatory range. This tight range has given us something to play with during today’s session, but there’s not much room for manoeuvre, so our intrarange is out of the window. This said, breakout should work nicely, so lets look at implementing a scalp strategy on today’s key levels, and try to define some suitable risk management parameters. As always, take a quick look at the chart to get an idea of what we’re watching.

As you can see, the levels that define today’s range are in term support at 429.94, and in term resistance at 435 flat. As mentioned, it’s a pretty tight range, so our targets are going to be equally tight.

Let’s address the downside first, on the assumption that we get a corrective spike down. If price breaks below in term support, it will put us in a short trade towards an initial downside target of 423.69. A stop on this one somewhere in the region of current levels – 432 – will keep things attractive from a risk management perspective.

Looking the other way, and viewing things from a more optimistic perspective, a break (and a close) above in term resistance will put us in a long entry towards 440 flat. With about five dollars’ worth of reward available, a stop in the region of 433 will help us to maintain a positive risk reward profile.

Keep an eye on action as we head into European afternoon and the concurrent US open. We’ve got some pretty strong US data releases today and these could impact sentiment in risk off assets.

Charts courtesy of Trading View