The XRP price has yet to recover from the latest exploit, which resulted in Ripple’s co-founder Chris Larsen being hacked and 213 million XRP worth $120 million carted away. This seems to have further spooked a depleting whale account base, as on-chain data points to XRP whales already exiting their positions in the past few weeks.

Particularly, on-chain data from whale transaction tracker WhaleAlerts points to a recent transaction of 29 million XRP tokens transferred from an unknown wallet to the crypto exchange Bitstamp.

Massive XRP Whale Transfer To Crypto Exchange

The actions of whales or large holders of cryptocurrencies seem to always tell the nature of general market sentiment. XRP, for instance, has been under selling pressure in the past week, as the crypto is currently down by 5.51% in a 7-day timeframe.

However, recent data points to continued selling pressure in the near term. For instance, according to whale alerts, 29 million XRPs worth $14.7 million were sent to Bitstamp. Similarly, 28.85 million XRP worth $14.6 million was sent to Bitstamp in another transaction. The nature of these transactions likely points to whales dumping their holdings, and moves like this could foreshadow further declines.

🚨 28,850,000 #XRP (14,628,631 USD) transferred from unknown wallet to #Bitstamphttps://t.co/ujvPfK3ezM

— Whale Alert (@whale_alert) February 5, 2024

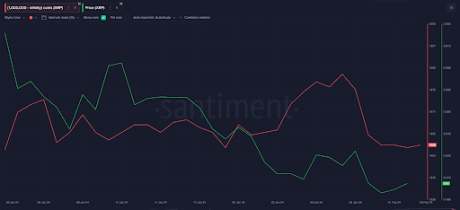

On-chain data from Santiment Supply by Addresses metric, which tracks the number of wallet addresses holding more than 1 million XRP tokens, tells a similar tale. According to this metric, the number of addresses in this category saw a steady increase, reaching 1,986 on January 28. This figure dropped to 1,957 on February 3rd, which indicated that 29 whale wallets cut down on their holdings during this period. At the time of writing, the metric stands at 1,962 wallets.

Source: Santiment

XRP Price Selling Pressure To Continue?

XRP recently crossed below $0.5 for the first time since October after news of the hack broke out. However, the price has since made a slight recovery from $0.49 and is trading at the $0.50 level at the time of writing.

Despite seeing a 27.43% increase in trading volume, the XRP price has failed to post gains in the past 24 hours and is down by 0.35%. On a larger timeframe, the crypto is down by 10.6% in 30 days, with price movement indicating the formation of lower highs and lower lows. Consequently, if the selling pressure continues and the current minor support at $0.501 fails to hold, XRP could break below to form a lower low around $0.48

According to crypto analyst EGRAG CRYPTO, known for his bullish stance on XRP, the current decline is a perfect opportunity to accumulate more tokens while suggesting the XRP price could spike to $22 very soon.

XRP price struggles amid unfavorable market headwinds | Source: XRPUSD on Tradingview.com