Earlier on this morning, in our twice daily bitcoin price watch piece, we noted that after the rough and tumble week we’ve seen, we may see some sideways action throughout today’s session. We hoped it wouldn’t be the case (breakout trading is far more exciting than sitting flat in the markets) but we’re net black on the week so far and we wouldn’t want to jeopardize that with some recklessness, so we’d accept the sideways action if it came about. As things have turned out, that’s exactly what happened. After us having noted this morning’s key levels, the bitcoin price has remained pretty much flat, trading within a four or five-dollar range and giving us entries on neither the breakout or the intrarange side of things.

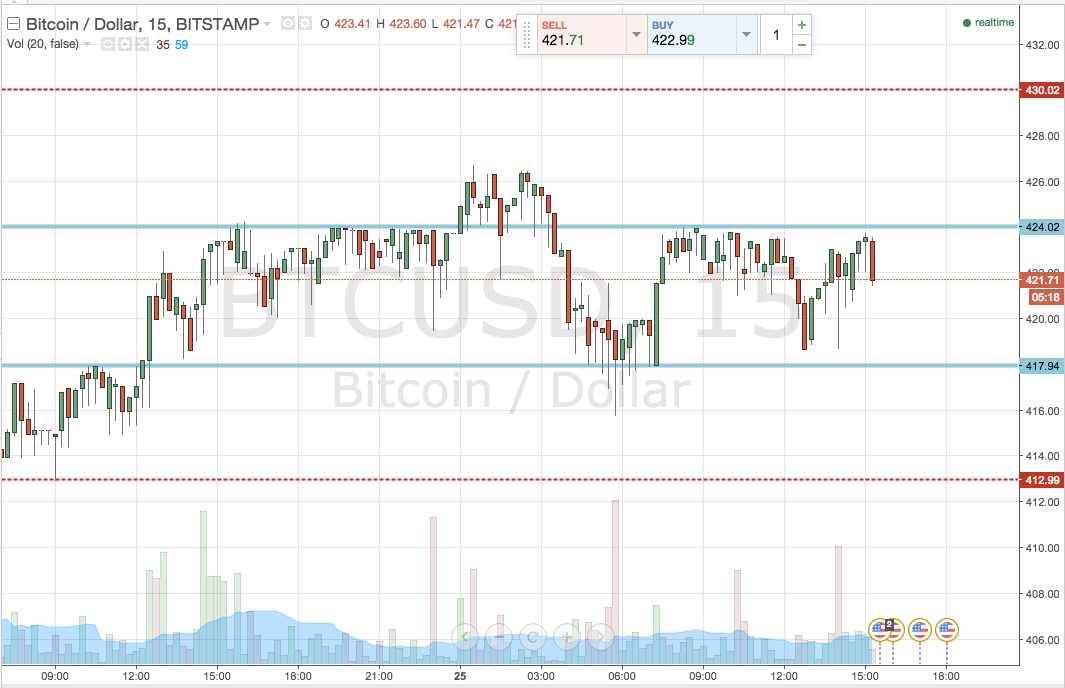

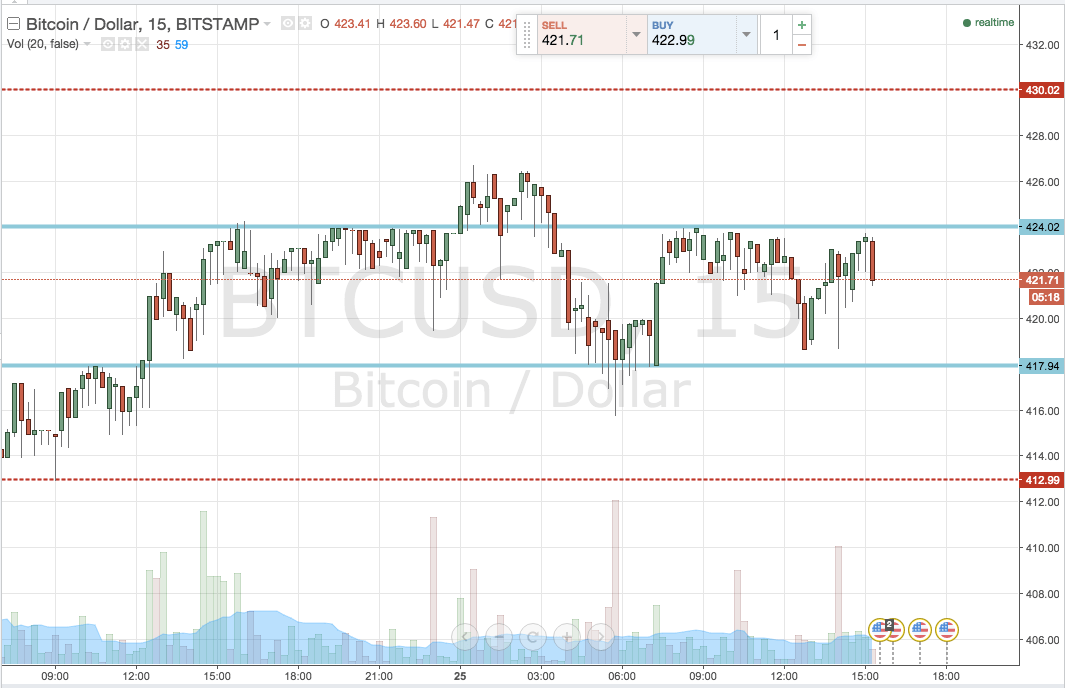

As a result, and to take into consideration the latest action, we are going to tighten things up a little bit this evening. Why? Because it increases the chance of us picking up an entry on any volatility. Why is this not the recklessness you’ve just discussed, I hear you say. Well, because we will also tighten up our risk parameters to incorporate the tightened range. Take a look at the chart below to see what we mean.

As the chart shows, this evening’s tightened range comes in at in term support to the downside of 417.94, and in term resistance to the upside at 424 flat. The more aggressive trader could bring intrarange in to play on this range (it’s borderline), but we’re going to stick with the breakout scalp for this evening.

So, let’s get to it. Downside first. A close below in term support signals a short entry towards an immediate downside target of 413 flat. A tight stop – circa 419 flat – protects the upside risk on the trade.

Looking long, a close above resistance will put us long towards the 430 flat mark, wit ha stop at 422 defining our downside.

Charts courtesy of Trading View