In this morning’s bitcoin price watch piece, we reiterated our Thursday evening comments – primarily focusing on the muted action we had seen in the bitcoin price throughout the Thursday evening session and, in turn, the Friday morning session in Europe. We were hoping that the sideways trading represented something of a consolidatory phase – one from in we would see some some pressure build and eventually break out into some decent volatility.

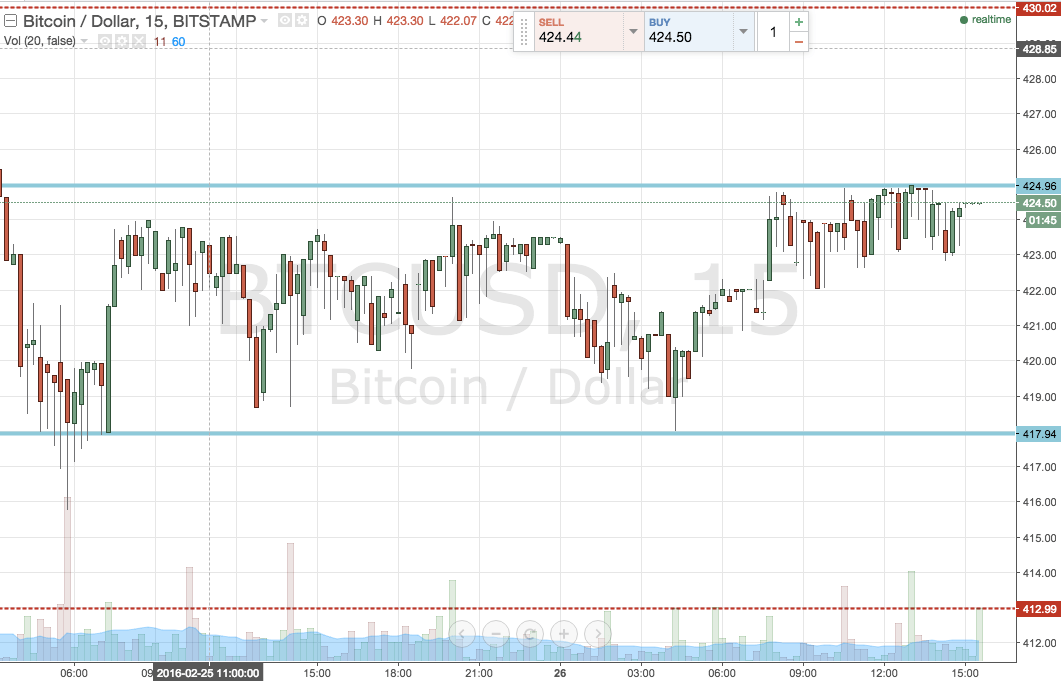

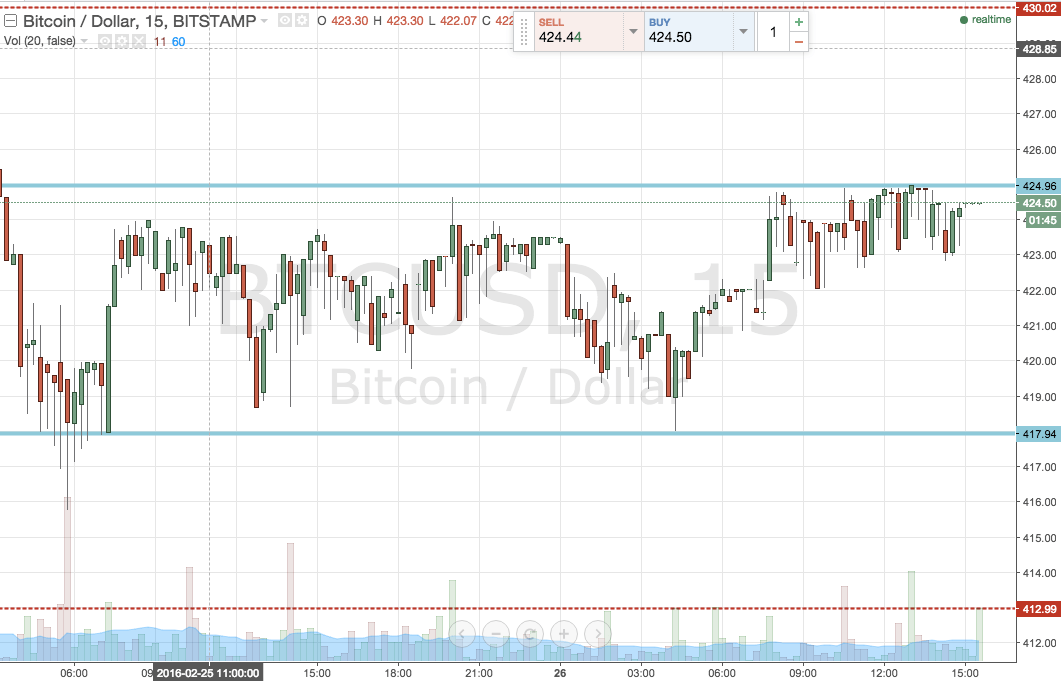

We are now drawing to a close on the Friday European session, with an afternoon left out of the US and Asia already done for the day. So, as we head into Friday evening, and beyond into the weekend, what are we looking at, and did today’s strategy reap any rewards from the relatively uninspiring action seen over the last 48 hours? Let’s take a look. First up, and as ever, take a quick look at the chart to get an idea of what happened during today’s session and to see where we are placing our key levels going forward. It’s an intraday, 15-minute chart wit ha circa 48-hour focus timeframe.

As you can see from the chart, the range we are going to be focusing on this evening, and beyond into the weekend, is defined by in term support at 418 flat and in term resistance at 425 flat.

We’re going to stick with our breakout strategy only this evening, and leave the intrarange approach to the more aggressive trader.

So, this said, we will look to enter long on a close above resistance, with an initial upside target of 430 flat. A stop loss somewhere around 423 will ensure we get taken out on a reversal and don’t get stuck on the end of an irretrievable loss.

Conversely, a close below support will signal us short towards 413. A stop on this one at 420 defines our risk nicely.

Happy Trading!

Charts courtesy of Trading View