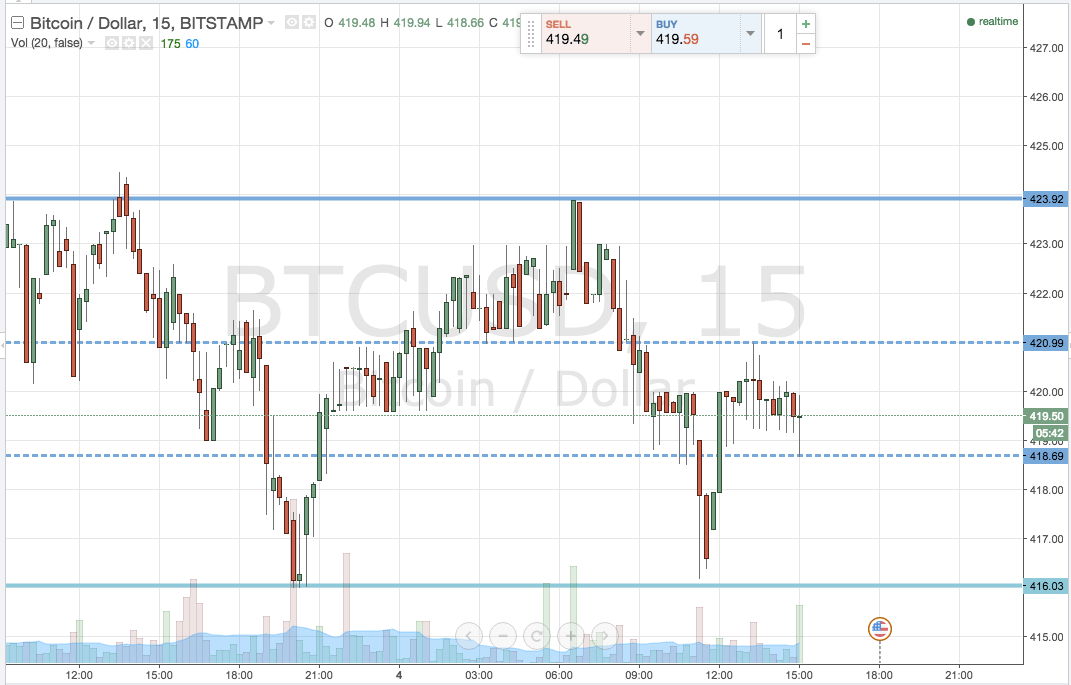

For our final analysis of the week, we’re going to mix things up and make this evening’s trading a little more interesting. This morning we noted that the likely best approach was going to be an intrarange one, based on the sideways trading we’ve seen in the bitcoin price since Wednesday evening’s decline. Action today, has vindicated this suggestion, by remaining well encased between the two parameters (support and resistance) that define today’s range. We got into a trade on a bounce from support a little earlier on today, and remain solidly in that trade (currently the bitcoin price sits mid range, and we are targeting support) so we’re going to hold off from entering any fresh trades until this one resolves itself – be that by a target or a stop hit). However, for those not in a trade, or for those looking to run a concurrent strategy, we’ve introduced some mid range parameters to aid the intrarange trader. With this said, let’s get to the details. The chart below highlights what’s important.

As you can see, we’ve got two primary ranges to focus on this evening. The first is the same one we outlined this morning, with in term support at 416 flat and in term resistance at 424 flat. This is the one that we are currently trading intrarange. The second (highlighted by the dotted lines) is defined by mid term support at 418.69 and mid term resistance at 421 flat.

This mid range range gives us a secondary way to play the wider range, through a sort of scalp intrarange breakout approach.

Specifically, if we get a break to the upside through 421 it will signal a long entry towards 424 flat. A tight stop is required on these trades, and somewhere around 419.5 works perfectly.

To the downside, a close below support will put us short towards 416 flat. A stop on this one around current levels – circa 419.5 – defines risk.

Charts courtesy of Trading View.