Things have been a little dull on the bitcoin price intraday charts over the last week or so, and we’ve had to reiterate a number of our levels across some pretty insignificant movements in these twice daily bitcoin price watch pieces as a result. This morning we covered a pretty solid range, and things remain well within that range as I write this, so as to avoid repeating our positions, this evening’s price watch piece will be something a little different. Specifically, we’re going to leave the narrow timeframe charts alone, and zoom out to get a look at the bigger picture. A wider timeframe can be useful for picking up a feel of what the market is doing overall, and this can help us to form a bias (and often more importantly, a risk tolerance) as we zoom in to trade the narrower frames.

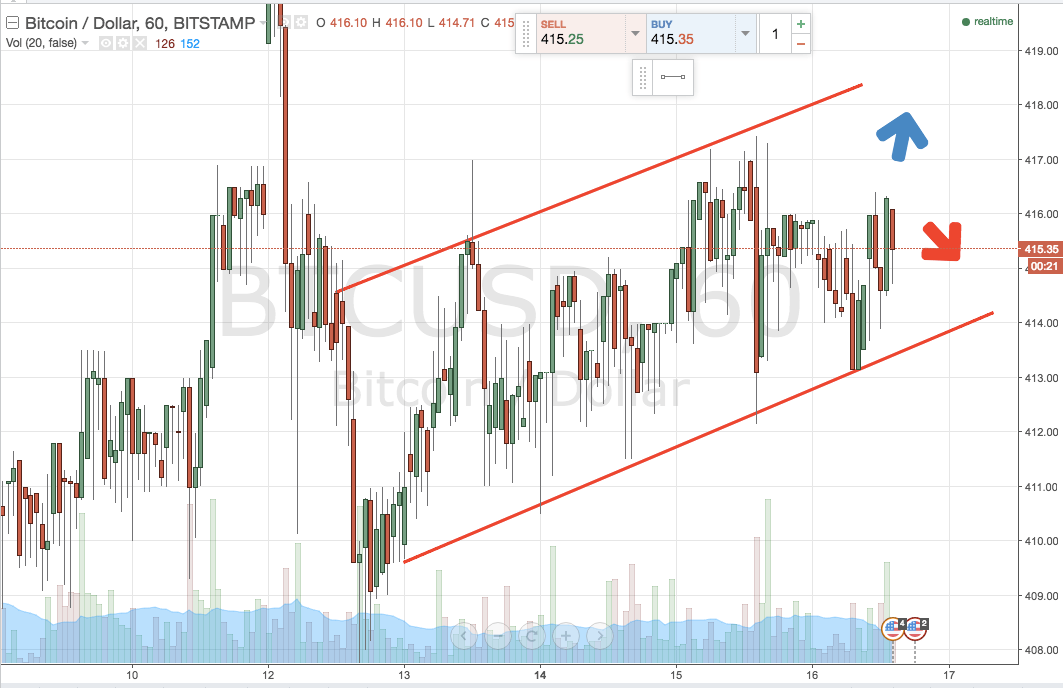

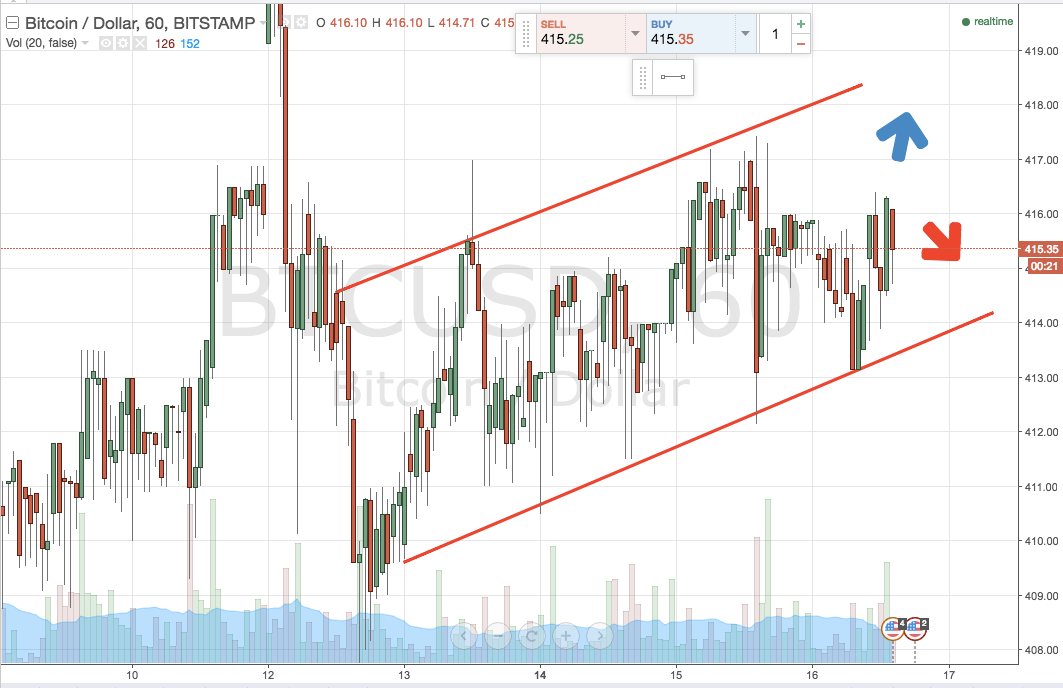

In traditional asset markets, we’d call it multi time frame analysis, so why not carry that term over to this market. Take a quick look at the chart to get an idea of what we are talking about. It’s a 60-minute chart, highlighting the action in the bitcoin price across the last eight to ten days.

As the chart shows, while action on the narrower time frames has seemed pretty flat, we’ve actually been trending to the upside between two upward sloping channel lines, which are highlighted in red. Our wider timeframe analysts might look at trading these, just as we would attempt to scalp them on a narrower timeframe breakout strategy. This said, what does it suggest about action over the coming few days?

Well, we are mid range, which suggests we could be in for a sustained move before we get a reversal in either direction. This bodes well for our breakout strategy. In other words, if we see price break to the downside on one of our predefined ranges, we should see a run in that direction, and so we can be reasonably aggressive with our targets.

Tomorrow morning, when we return to our intraday strategy, we’ll use this knowledge to set a framework for the day’s session. Until then, stick with this morning’s range and see what turns up.

Happy Trading!

Charts courtesy of Trading View