So it’s time to draw our bitcoin price watch analysis to a close for the week. Things have been ok today, and we managed to get in and out of the markets on a couple of occasions for a quick profit. When we first kicked off today, we were a bit concerned about our risk management profile. So long as our risk stayed on form, things would be ok for a net profit going in to the weekend. This has been a bit tough with tight choppy action, as we try and set up a tight risk management profile but still leave a bit of space for some maneuverability.

Anyway, that’s old news now. Things worked out ok, and we’re ready to move forward into our final session. It’s the evening session out of the US, and then we’ve got a bit of Asian morning action heading into the weekend.

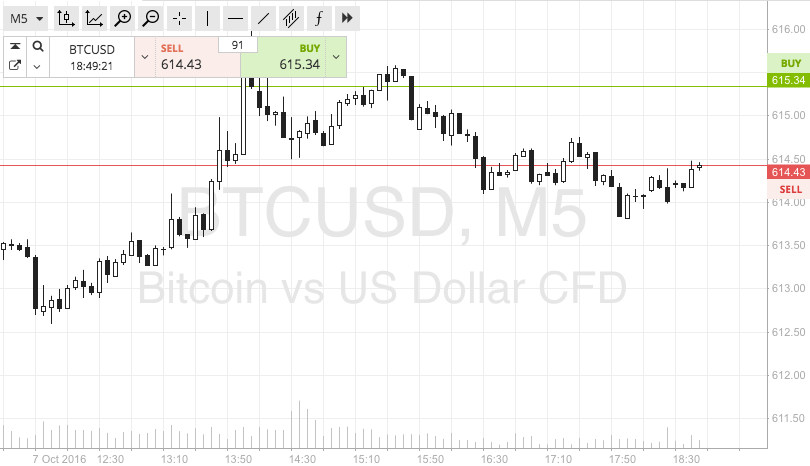

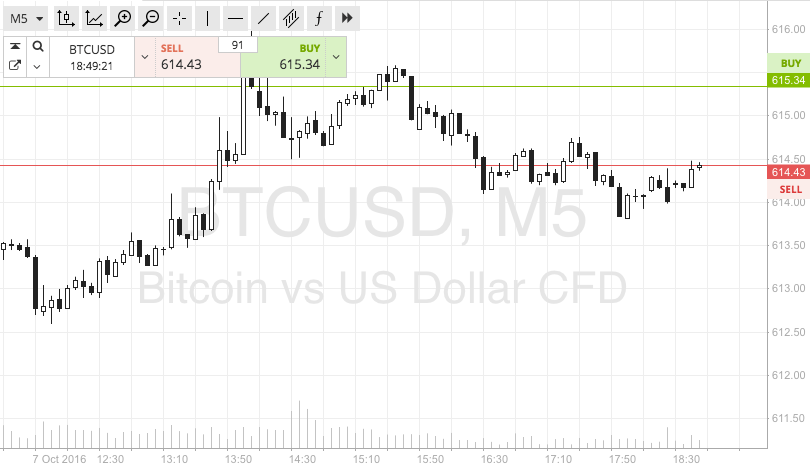

So, as ever, take a look at the chart below to get an idea of our key levels, and have a look at what happened for today’s session on the intraday charts.

As the chart shows, the range in focus is support to the downside at 610 and resistance to the upside at 618. Just as we said this morning, that width of range isn’t really wide enough for us to go at things intrarange, so we’re going to stick with a breakout strategy this evening.

Specifically, we’re going to look for a break above resistance to validate (so long as price closes above this level) an upside entry towards an immediate upside target of 625. A stop loss on this one somewhere in the region of 616 works to define risk.

Conversely, if price breaks through support, we are going to get in short towards a target of 604 flat. A stop on this one at 612 keeps risk tight.

Happy Trading!

Charts courtesy of SimpleFX