Another week complete, and unfortunately, it looks like we are going to close out the session on a bit of a damp squib. Things haven’t moved to the degree we would have liked, and we remain underneath the level I’ve been obsessing over for the past three weeks – 800 flat. The weekend is often good for big level hits, so there’s every chance we will get a run on Saturday or Sunday that takes out the level. If we do, I’m not going to complain, but I would have liked to have locked in some profits on said break before the weekend hits.

Anyway, no point in me moaning about it now.

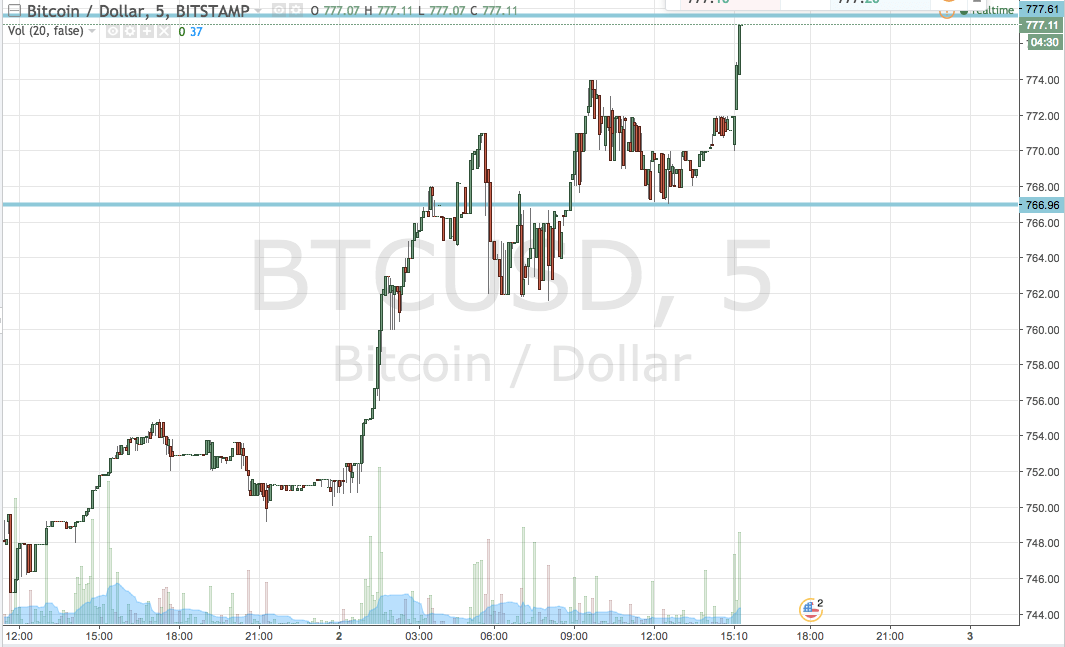

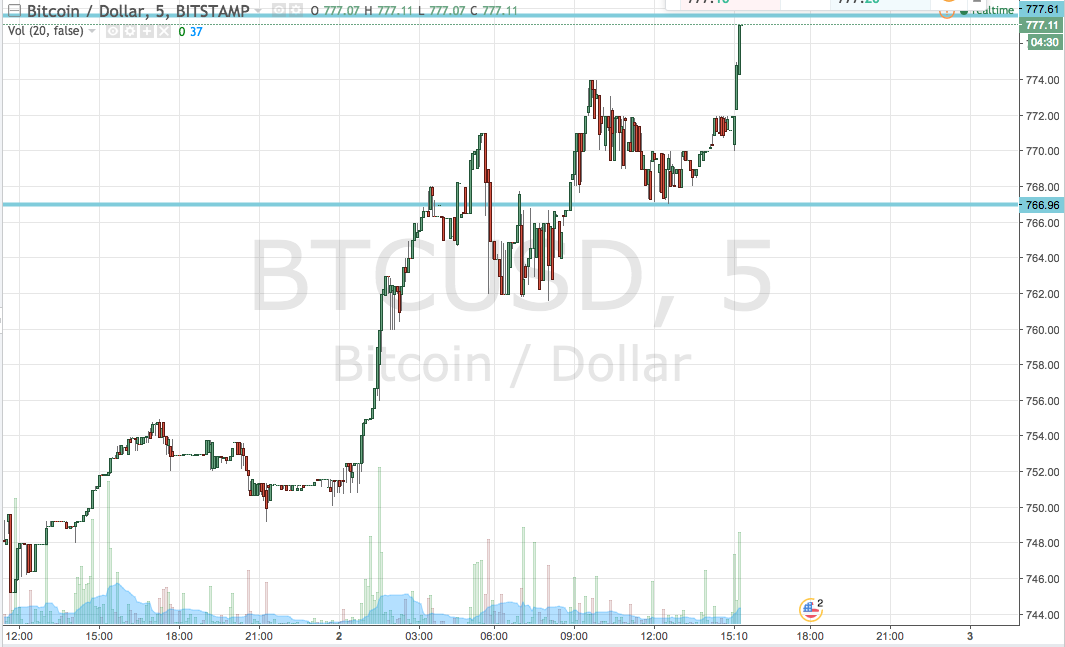

Let’s see what happened today, and try to put some key levels together for this evening’s session. As ever, take a look at the chart below to get an idea of where we are looking at this evening, as well as to get a picture of what happened during today’s European afternoon session.

So, as the chart shows, the levels we are looking at for this evening are in term support to the downside at 767 and in term resistance to the upside at 777. It’s a wide enough range for us to go at price with an intrarange strategy, so as usual, long on a bounce from support with an upside target of resistance, and short on a correction from resistance with a downside target of support.

If price closes above or below our key levels instead of reverses at them, we’ll bring breakout in to play. Specifically, a close above resistance will put us long towards 787. Conversely, a close below support will get us in short towards an immediate downside target of 757. Stops just the other side of the entries in both instances kills off risk in case price moves against us once we’re in.

Charts courtesy of Trading view