That’s another day complete in the bitcoin price, and it’s been a pretty interesting one. In our coverage this morning, we noted that we were looking for any indication of an upside run as long term bullish, and that any such run would fall in line with what we saw overnight.

Well, we didn’t quite get what we’d hoped for, but it wasn’t all bad either. Price basically ran up and down intrarange during the session, and in response, all we’ve got to do for the evening session tonight is widen out our range and set up with a breakout strategy in pretty much exactly the way we did this morning, but with a slightly looser approach.

As we said this morning, simple.

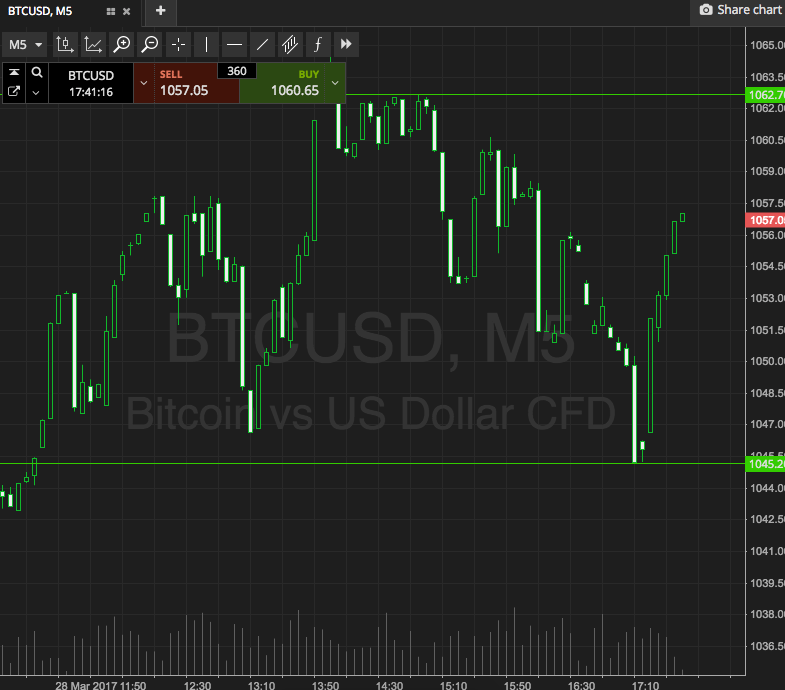

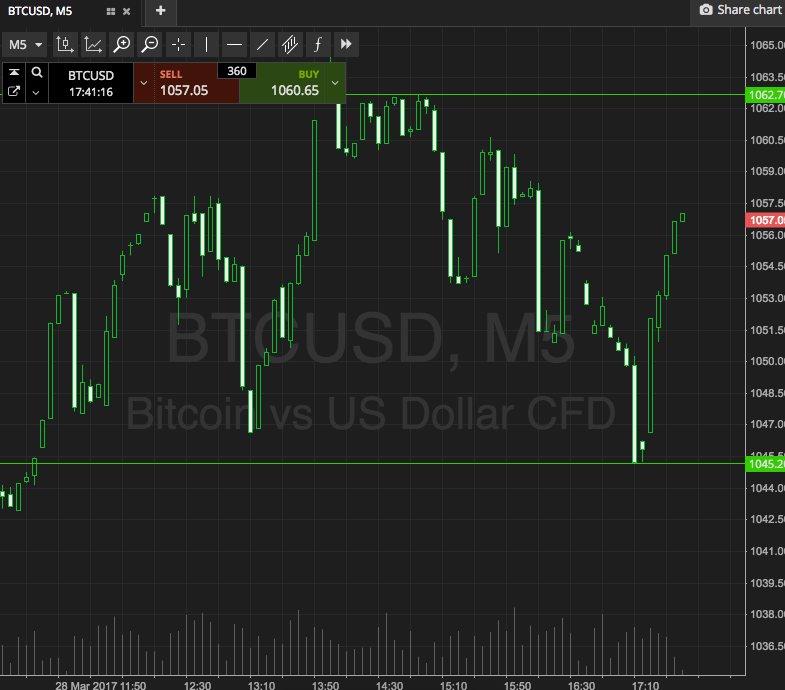

So, as we move into this evening’s session, here’s a look at what we’re going at. Take a look at the five-minute candlestick chart below to get an idea of what’s on before we get into the detail. As usual, it shows the day’s action so far (or at least, that is, the late morning and afternoon action out of Europe) and it’s got out key range overlaid in green.

As the chart illustrates, the slightly widened out range we are using as tonight’s key parameters is defined by support to the downside at 1045, and resistance to the upside at 1062. These levels represent the most recent swing low and swing high respectively, and should serve to give us something to go at if and when we see either of them break.

So, a close above resistance will get us in long towards an immediate upside target of 1075. A stop on the trade at 1057 looks good. Conversely, if we see price close below support, we’ll look to get in to a short entry towards a downside target of 1035.

Charts courtesy of SimpleFX