Key Highlights

- There were decent moves in ETH price, as it remained elevated above the $360 level against the US Dollar.

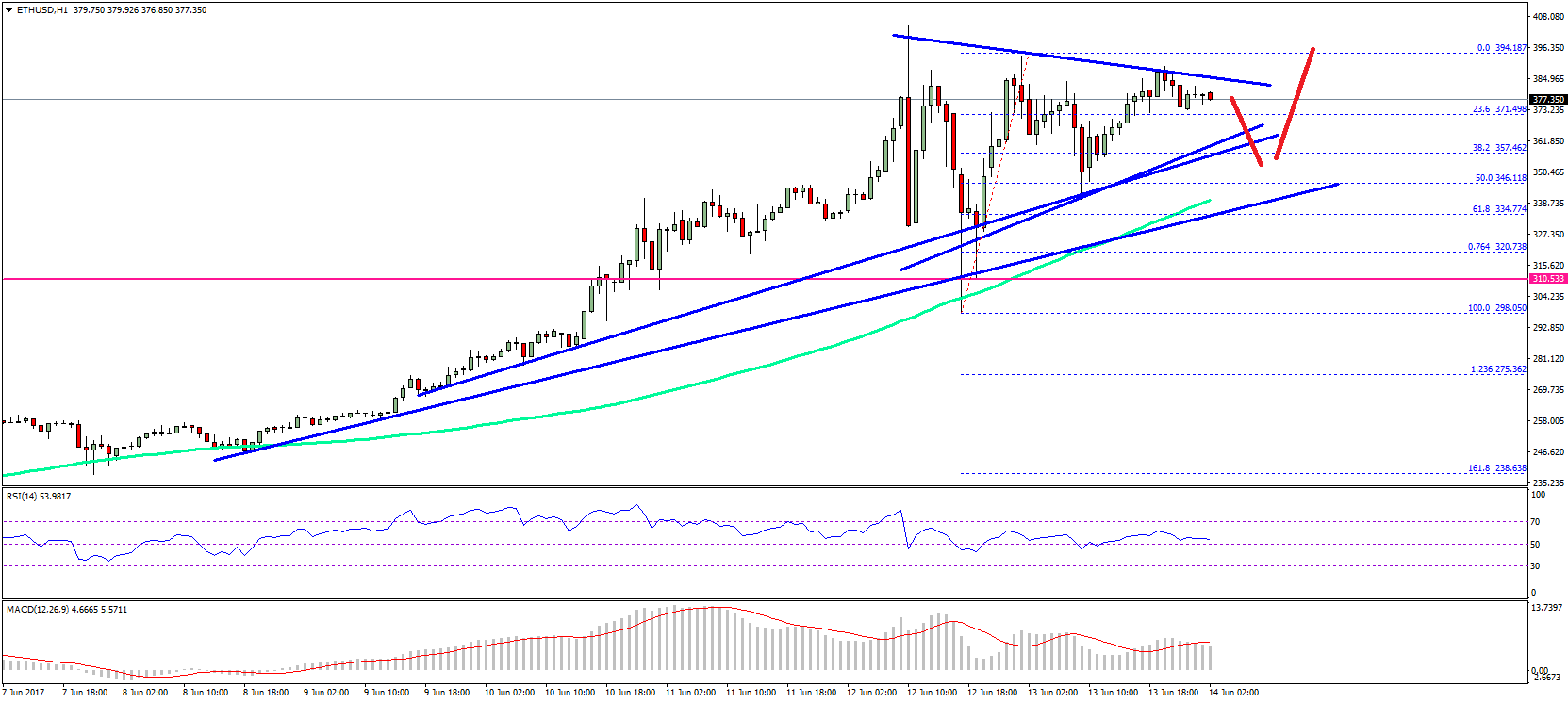

- There is a cluster of bullish trend lines with supports such as $360, $350 and $345 on the hourly chart of ETH/USD (data feed via SimpleFX).

- The pair remains a good buy on dips as long as there is no daily close below $335.

Ethereum price is preparing for the next break against the US Dollar and Bitcoin, and ETH/USD can be seen as a good buy on dips.

Ethereum Price Resistance

There was mostly a consolidation in ETH price above $360 against the US Dollar during the past few hours. The price looks stable and may be preparing for the next move above $380. If we look at the hourly chart of ETH/USD, there is a connecting bearish trend line at $380, which is acting as a resistance. The pair is trading below it, and slowly moving lower.

On the downside, there are many supports like $360 and $350. We can also see a cluster of bullish trend lines with supports such as $360, $350 and $345 on the same chart of ETH/USD. One of the trend lines is positioned with the 100 hourly simple moving average at $335. I think it can be considered as a strong support, and sellers may find it tough to close the price below $335. Moreover, the 38.2% Fib retracement level of the last wave from the $298 low to $394 high can also act as a support.

If the price dips from the current levels these trend lines between $345-360 may provide support. One can consider buying with a stop of a daily close below $335.

Hourly MACD – The MACD is positioned well and moving nicely in the bullish slope.

Hourly RSI – The RSI is flat and positioned just above the 50 level.

Major Support Level – $335

Major Resistance Level – $380-390

Charts courtesy – SimpleFX