That’s another day pretty much complete in our bitcoin price trading efforts and it’s been another interesting one. After the revelations of yesterday (that the bitcoin hard fork is now not going to take place, or at least that seems to be the case) price ran up considerably before dipping and correcting as people took profits out of the market.

The hope now is that the volatility is somewhat out of the way. If this is the case, we should see a degree of overarching momentum return to price and – in turn – we should see things start to creep to the upside once more.

We’ll be looking for signals that imply some upside as we go and we’ll be ready and waiting with our short-term strategy to make sure that we don’t miss out on any opportunities to jump in and out as things mature.

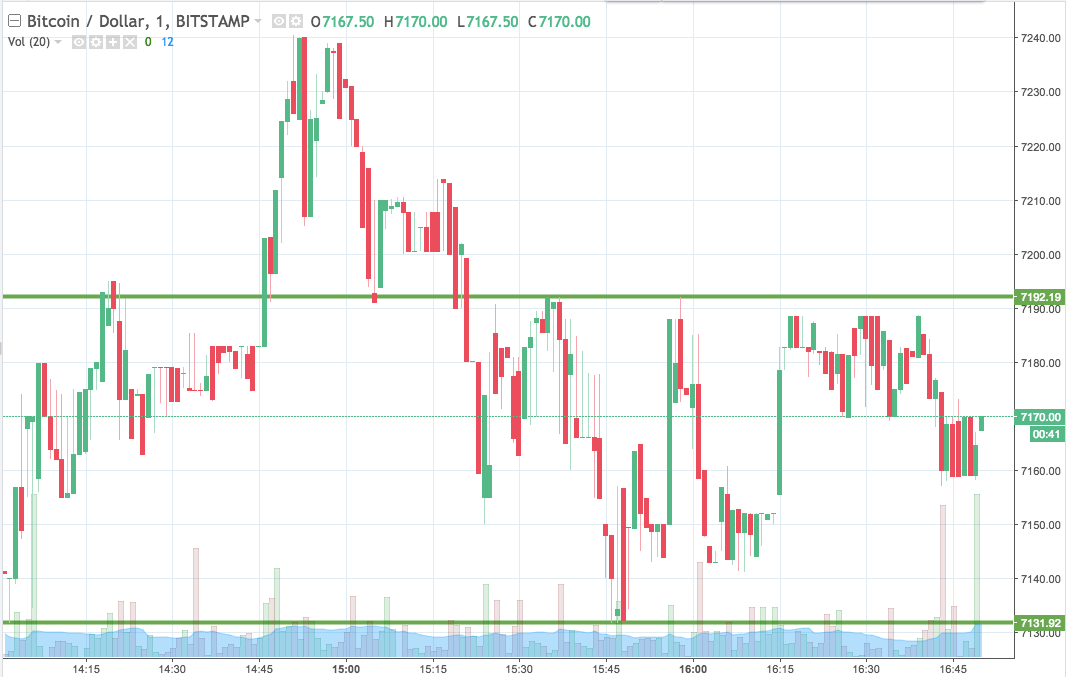

So, with that said, let’s take a look at what’s going on and see if we can set up a strategy that we can use to draw a profit from the market on any further movement in line with our thesis. As ever, take a quick look at the chart below before we get started so as to get an idea where things stand right now. It’s a one-minute candlestick chart and it’s got our range overlaid in green.

As the chart shows, the range we are looking at for the session this evening comes in as defined by support to the downside at 7131 and resistance to the upside at 7192. If we get a close above resistance, we’ll jump in long towards an upside target of 7260. Looking the other way, a close below support will have us in short towards an immediate downside target of 7090.

Let’s see how things play out this evening and we will shuffle things about later to reflect any changes in approach.

Charts courtesy of Trading View