Key Highlights

- ETH price traded higher recently and managed to move above $326 against the US Dollar.

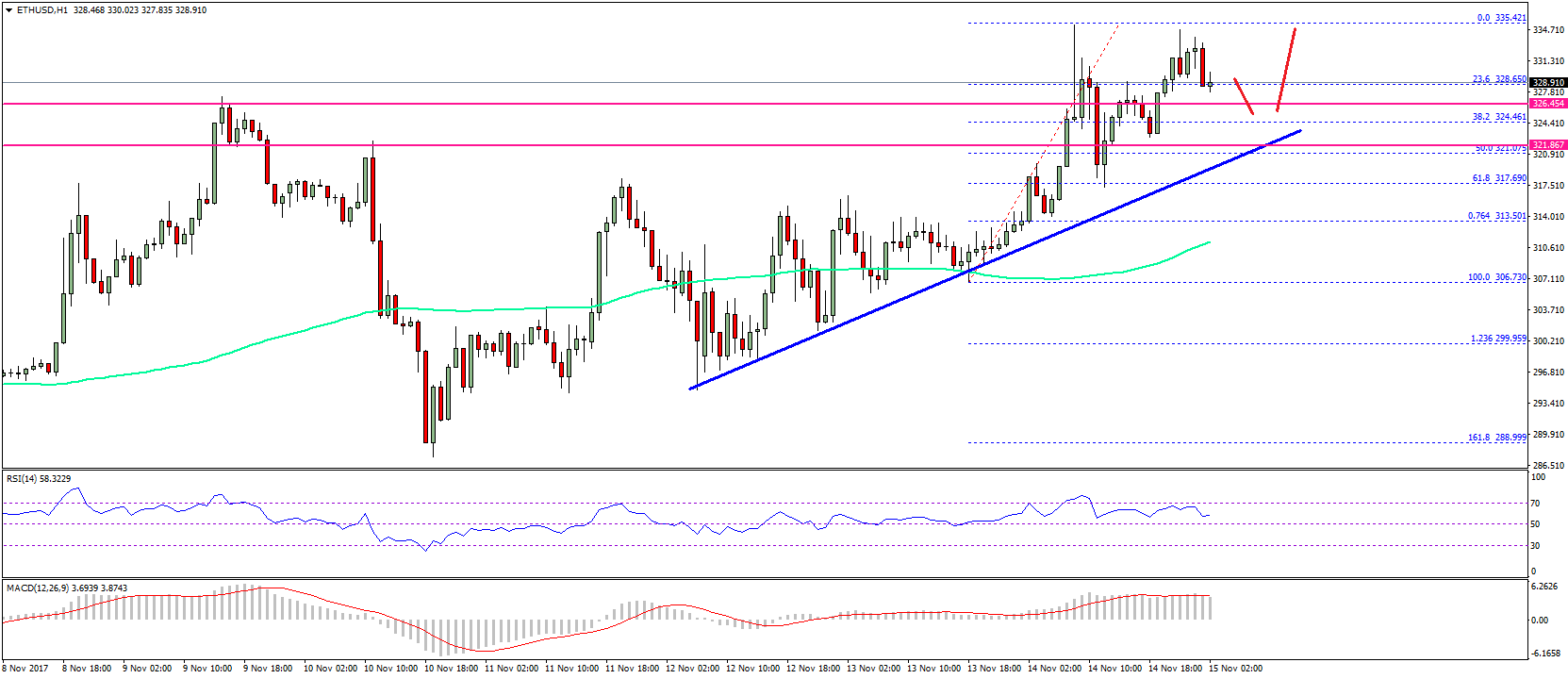

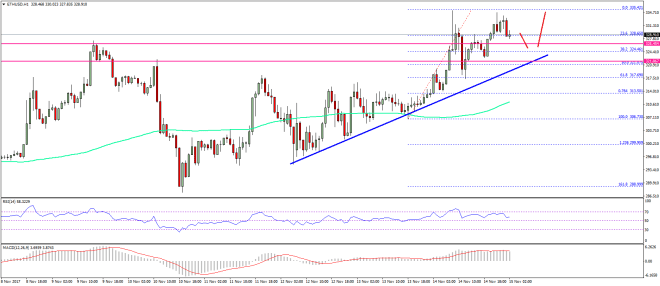

- There is a major bullish trend line forming with support at $322 on the hourly chart of ETH/USD (data feed via SimpleFX).

- The price might continue to gain bullish momentum and it could even break $335 for more gains.

Ethereum price is eyeing more gains against the US Dollar and Bitcoin. ETH/USD remains buy on dips near the $322 and $320 levels.

Ethereum Price Trend

There was a decent start of an uptrend in ETH price as it managed to break the $320 level against the US Dollar. The upside move gained traction and the price was able to break the $326 resistance as well. A new weekly high was formed near $335.42 from where a minor correction is initiated. The price is currently trading near the 23.6% Fib retracement level of the last wave from the $306.73 low to $335.42 high.

However, there are many supports on the downside near $320. An initial support is around the 38.2% Fib retracement level of the last wave from the $306.73 low to $335.42 high at $324.46. Below this last, there is a major bullish trend line forming with support at $322 on the hourly chart of ETH/USD. The trend line support is near the 50% Fib retracement level of the last wave from the $306.73 low to $335.42 high. As long as the price is above $320, it remains in an uptrend.

There are chances of ETH retesting the $335 level. If buyers remain in control, it could even break the $340 level in the near term. On the downside, the $322 and $320 levels are decent supports and buy zones.

Hourly MACD – The MACD is placed well in the bullish slope.

Hourly RSI – The RSI is currently well above the 50 level.

Major Support Level – $320

Major Resistance Level – $335

Charts courtesy – SimpleFX