Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

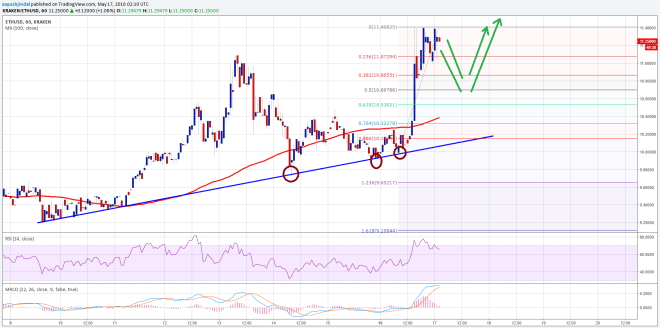

- Ethereum price spiked higher vs the US Dollar intraday and appreciated by more than 10%.

- Yesterday’s bullish trend line on the hourly chart (data feed via Kraken) of ETH/USD played well, as the price bounced perfectly after testing it.

- There is a chance of a minor correction from the current levels, which can be seen as a buying opportunity.

Ethereum price traded above the $11.00 handle vs the USD, and it looks like there are more upsides left in ETH/USD in the near term.

Ethereum Price – Buying Dips?

Ethereum price ETH as mentioned bounced during the past couple of sessions vs the US Dollar and traded above the $11.00 level. There was a lot of buying interest noted for ETH, which may continue in the near term. Yesterday, I highlighted a bullish trend line on the hourly chart (data feed via Kraken) of ETH/USD. It played well and helped the bulls to gain bids.

As soon as the price settled above the 100 hourly simple moving average, there was a sharp upside move. Moving ahead, there are many signs on the hourly MACD and RSI of a correction in the short term. So, the price may move down a few points before it can continue trading higher. On the downside, an immediate support lies at 23.6% Fib retracement level of the last wave from the $10.00 low to $11.40 high.

However, if the correction is extended, then a move towards the 50% Fib retracement level of the last wave from the $10.00 low to $11.40 high is also possible, which can act as a major support area for ETH/USD.

Hourly MACD – The MACD is in the about to change the slope to bearish, calling for a correction.

Hourly RSI – The RSI is around the overbought levels, which means there is a chance of it moving down.

Intraday Support Level – $11.00

Intraday Resistance Level – $11.40

Charts courtesy of Kraken via Trading View

Image: NewsBTC