Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

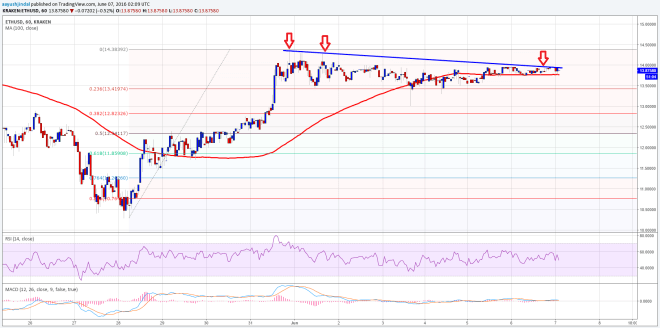

- Ethereum price continued to trade in a very tiny range vs the US Dollar, as there was no real move in ETH/USD.

- Yesterday’s highlighted bearish trend line on the hourly chart (data feed via Kraken) of ETH/USD is still intact and acting as a resistance for the buyers.

- On the downside, the 100 hourly simple moving average is acting as a support and preventing losses.

Ethereum price is still in wait and watch mode. No doubt, there is a major break forming on the hourly chart, which traders must consider before trading.

Ethereum Price Break

Ethereum price ETH may be annoying to many traders, as it traded in a tiny range during the past 24 hours vs the US Dollar. There was hardly any major move, and as a result the price was stuck in a range. On the upside, yesterday’s highlighted bearish trend line on the hourly chart (data feed via Kraken) of ETH/USD is acting as a hurdle for the bulls and preventing gains.

Similarly, on the downside, the 100 hourly simple moving average is acting as a barrier for sellers, and stalling losses. In short, the price is stuck between a major resistance area and an important support zone. Even most technical indicators are flat, and pointing towards a consolidating in the short term.

If the price moves below the 100 hourly SMA, then the38.2% Fib retracement level of the last wave from the $10.28 low to $14.38 high may be tested. One may even consider selling in the mentioned scenario with a stop above the trend line and resistance area.

Hourly MACD – The MACD is almost flat, suggesting that the price is ranging before the next move.

Hourly RSI – The RSI just dipped below the 50 level, which can be considered as a negative sign for the bulls.

Intraday Support Level – $13.60

Intraday Resistance Level – $14.00

Charts courtesy of Kraken via Trading View