Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

- Ethereum price showed no mercy to the sellers’ vs the US Dollar, as it continued to rocket higher.

- A new high was formed in ETH/USD, as the price surged above the $17.00 level.

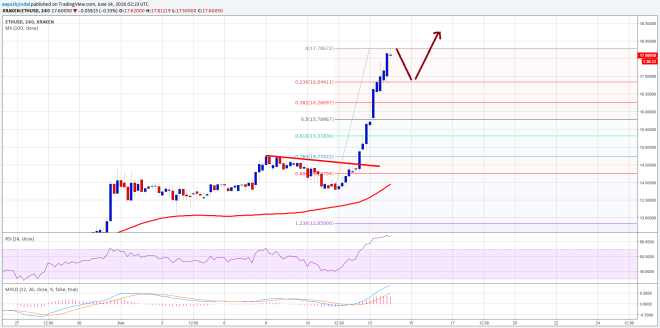

- Looking at 4-hours chart (data feed via Kraken) of ETH/USD, the technical indicators are around overbought levels, which is a warning sign.

Ethereum price surge continued intraday vs the US Dollar. It looks like ETH/USD may be boosted further, but I suggest trading with caution.

Ethereum Price Overbought?

Ethereum price ETH made a new high against the US dollar for the second time in a new this week, as ETH/USD traded as high as $17.78. There was an upside thrust taking the price higher. Furthermore, there was a lot of buying interest noted recently for crypto currencies, as BTC and ETH both were seen moving higher.

If we look at the 4-hours chart (data feed via Kraken) of ETH/USD, then there was a break above a bearish trend line. The highlighted break opened the doors for sharp gains in ETH, taking it above the $17.00 level. More importantly, as mentioned yesterday, the price moved above the $15.00 level, which was a crucial resistance and may now act as a support zone.

Currently, the technical indicators are in the overbought levels, which is a warning sign for the bulls. There can be a correction anytime in ETH/USD. So, I suggest trading with caution in the short term, as there is a chance of a down move. Only consider buying if you are placing a tight stop for your trade, or better wait for a major correction to enter into a trade.

Hourly MACD – The MACD is strongly placed in the bullish zone, pointing towards the buyer’s strength.

Hourly RSI – The RSI is around the overbought levels, calling for a correction in ETH.

Major Support Level – $16.80

Major Resistance Level – $17.75

Charts courtesy of Kraken via Trading View