Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

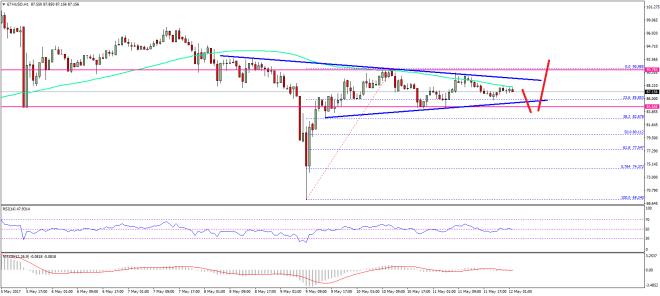

- There was no break above $90.98-91.00 in ETH price against the US Dollar, as the upside move was contained.

- There is a clear range pattern formed with support at $84.60 and resistance near $91 on the hourly chart (ETH/USD, data feed via SimpleFX).

- The 100 hourly simple moving average is acting as a strong resistance near $88.20, and preventing gains.

Ethereum price did not move much against the US Dollar and Bitcoin, and ETH/USD is currently forming a range with resistance near $91.

Ethereum Price Upside Hurdle

Yesterday, we saw an upside break in ETH price above $88 against the US Dollar. However, the price was contained near $91, which acted as a strong resistance and prevented gains. The same level was also near the 76.4% Fib retracement level of the last decline from the $98 swing high to $70 low. Later, the price started trading in a range with resistance just below $91.

If we look closely, then it’s the 100 hourly simple moving average which is acting as a strong hurdle and currently near $88.20. It may continue to act as a barrier for gains above $90. Looking at the hourly chart of ETH/USD, there is a clear range pattern formed with support at $84.60 and resistance near $91. On the downside, the range support is near the 23.6% Fib retracement level of the last wave from the $70 swing low to $90.98 high.

As long as the price is below the 100 hourly simple moving average and $91, there is a chance of a dip towards $84. However, any downside move should limited, considering the current market sentiment. Finally, when buyers gain traction, ETH price may look to break $91 for further gains in the near term.

Hourly MACD – The MACD is mostly flat.

Hourly RSI – The RSI is just around the 50 level.

Major Support Level – $84

Major Resistance Level – $91

Charts courtesy – SimpleFX