Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

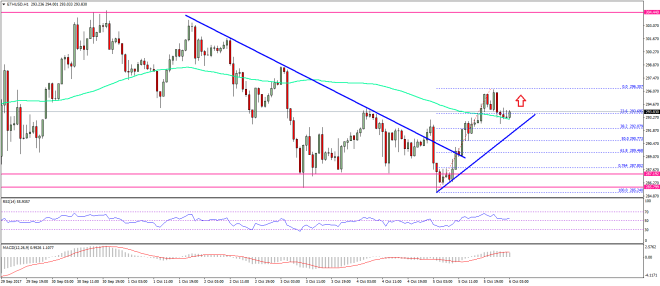

- ETH price has recovered well from the $286 low against the US Dollar.

- There was a break above a short-term bearish trend line with resistance at $289 on the hourly chart of ETH/USD (data feed via SimpleFX).

- The price is now above the 100 hourly simple moving average and $292, which is a positive sign.

Ethereum price is slowly moving higher against the US Dollar and Bitcoin. ETH/USD might soon retest the $300.00 level in the near term.

Ethereum Price Recovery

There was a recovery phase initiated in ETH price from the $286 swing low against the US Dollar. The price moved higher and was able to break the 50% Fib retracement level of the last drop from the $303.50 high to $285.60 low. It opened the doors for more gains and the price moved above $294 and the 100 hourly simple moving average. Moreover, there was a break above a short-term bearish trend line with resistance at $289 on the hourly chart of ETH/USD.

The pair traded as high as $296.30 and is currently correcting lower. It traded a few points below the 23.6% Fib retracement level of the last wave from the $285.24 low to $296.30 high. However, the downside move was prevented by $292 and the 100 hourly simple moving average. There is also a connecting bullish trend line forming with support at $292. Therefore, the price is currently supported above $292 and looks set to gain pace in the near term.

On the upside, the recent high of $296.30 is a short-term resistance. A clear break above the $296.00 level might call for a test of the $300 handle. The mentioned $300 level might once again act as a major barrier for buyers.

Hourly MACD – The MACD is currently reducing its bullish slope.

Hourly RSI – The RSI is comfortably placed above the 50 level.

Major Support Level – $292

Major Resistance Level – $300

Charts courtesy – SimpleFX