Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On Wednesday, US-based Grayscale Bitcoin Trust released an advertisement wherein a white-collar miner cheerfully extracts a gold rock from a cave and takes it down to his bosses on Wall Street to make a few bucks. Nevertheless, he is told that the company is investing in bitcoin instead. The poor bloke – and his shiny gold rock – is shown the door before the advertisement concludes.

In the real world, however, the narrative is very different.

Bitcoin, a supposed digital alternative to Gold, has plunged by up to 47.39 percent from its year-to-date high. The drop came after the cryptocurrency’s stunning climb from December 2018’s low of $3,120 to June’s top of $13,868. That still makes it a better performing asset than gold, which, on a year-to-date basis, is now up by 17.52 percent. Nevertheless, bitcoin’s massive drop in the last and currency quarter is alarming because it is taking place against a string of so-called favorable macroeconomic narratives.

An Unconcerned Safe-Haven

Quantitative easing programs, currency devaluation, rate cuts, Brexit, Hong Kong crisis, US-China trade war, and recession are among some global catalysts that could send bitcoin’s value higher. Maximalists on Crypto Twitter often chanted the “buy bitcoin” slogan whenever things turned sour for investors in traditional financial markets.

As a non-sovereign, non-correlated asset, bitcoin promises to offer traders an umbrella against a dwindling macroeconomic sentiment, a role otherwise performed by gold during geopolitical and economic uncertainties. But barring the second quarter’s impressive performance against the escalating trade war, further supported by the introduction of Facebook’s Libra cryptocurrency, bitcoin has failed to behave as a safe-haven. In the third quarter, the cryptocurrency plunged by 23.01 percent.

Traditional is Better

Gold, at the same time, was growing – albeit steadily. According to OANDA, the yellow metal surged by close to 4.5 percent in the third quarter as the oil crisis mounted, the Federal Reserve cut benchmark rates, inverted yield curve hinted recession, and uncertainties over Brexit and US-China trade deal remained. Gold’s performance showed that investors were trusting traditional hedging assets, also confirmed by the bond market’s roller-coaster ride – another safe-haven.

Chris Vermeulen, the author of Wealth Building Newsletter, also noted that investors might want to stay away from overly-volatile assets like bitcoin. Instead, they would go after traditional asset classes, which include stocks as well. Excerpt from his FXEmpire blog post:

“We believe Cryptos may be left on the sidelines as investors prefer more traditional assets as a measure of safety as global concerns continue to weigh on investor’s minds headed into a very contentious US presidential election. Currencies, Metals, Mature global market assets and true value stocks may become the investment of choice until we see some real clarity for the future from the global markets, global central banks, and global political leaders.”

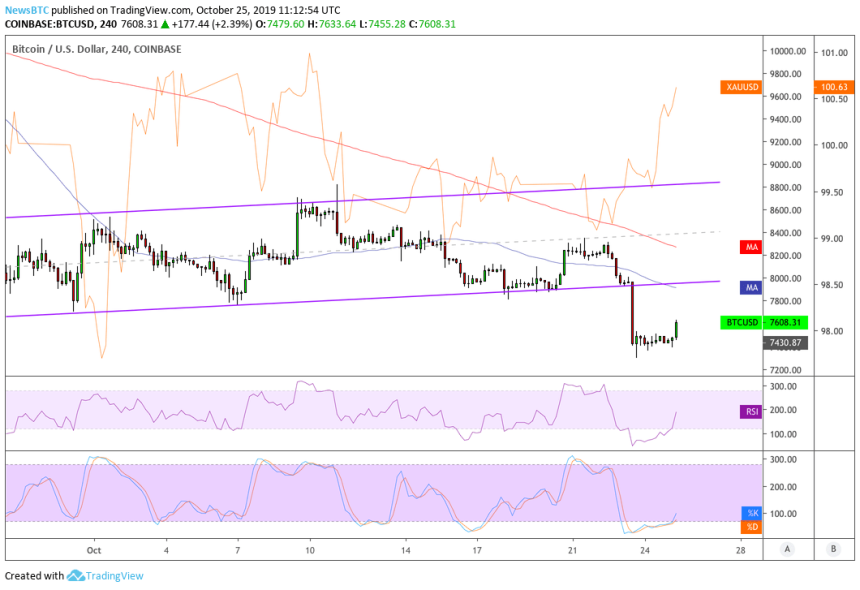

Bitcoin continues to underperform against more devastating economic data coming from the US, Germany, and China. The cryptocurrency this week plunged by more than $600 to go below a crucial support level of $7,500. Analysts believe it would continue its downtrend further toward the $5,000 level.

Unpopular opinion: The drop gold campaign is ill-informed at best. Real gold bugs appreciate Bitcoin and real Bitcoiners appreciate gold. https://t.co/QXAM9vTEqT

— Gabor Gurbacs (@gaborgurbacs) October 23, 2019