Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin prices under pressure

- Adoption on the rise as Venezuela is the poster country for crypto

- Transaction volumes drop days after Feb 24 drawdown

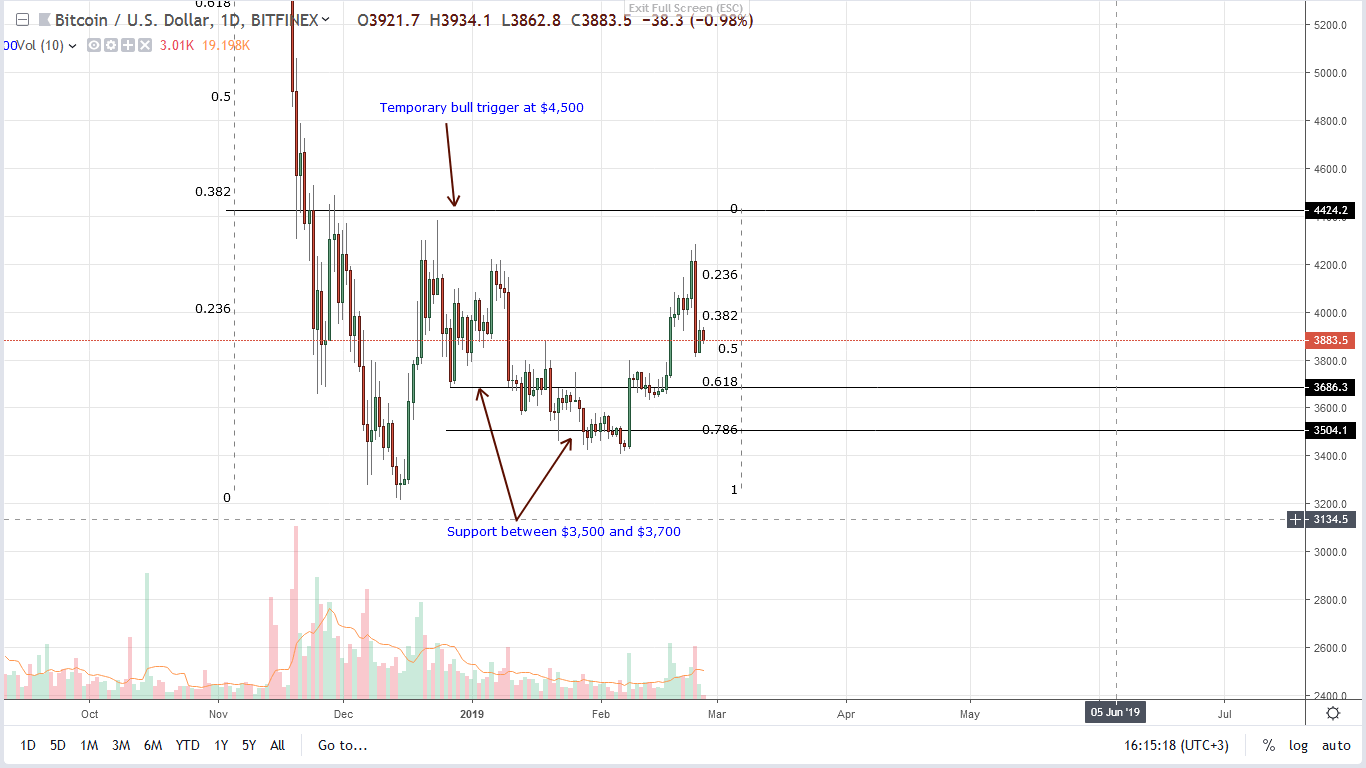

In an uptrend, Bitcoin (BTC) is under immense pressure thanks in part to sell-off of Feb 24. Moving on, we expect bulls to reject lower lows as price action snap to trend and edge above $4,500 as our previous BTC/USD trade plans are validated.

Bitcoin Price Analysis

Fundamentals

Good news is Bitcoin (BTC) learning and adoption curve over the past few years has been near perpendicular. Many people are jumping into the decentralization train, and although it may take years before Bitcoin dislodge centralized solutions from their peaks, one irrefutable fact is that the path towards complete dominance is paved by friendly regulations.

Over and above everything, Bitcoin is a duo-layer system. There is an argument over which of its function will come first—the ability to be a medium of exchange as envisioned by Satoshi or as a store of value—like we saw last year when altcoins plunged.

However, with the recent sequence of events especially in countries facing economic crises as Venezuela for example, Bitcoin is proving to be a reliable, global bank for storing value. At the same time, it is acting as a medium of exchange albeit limitations by the incumbent.

From the look of things, adoption will be the primary drive that will see the coin replace government-issued money even if it is pseudonymous and traceable. The simple fact that people will still use it thanks to its inherent properties as immutability and resistance to locally induced volatility makes it perfect for storing value.

Candlestick Arrangements

At the time of press, Bitcoin (BTC) is up but under immense pressure mainly because of Feb 24 liquidation. Prices in the last 24 hours are stable, and from the recent sequence of events, bears appear to have the upper hand.

All the same, we shall retain a bullish outlook over the short-term with the awareness that the failure of bulls to muster enough momentum and breach the $4,500 or Dec 2018 highs is bearish for the world’s most valuable coin.

Moving on, we shall advocate for a neutral stand. Despite the double bar bear reversal pattern, our bullish outlook will stand and be null once Bitcoin (BTC) prices drop below $3,500—our minor support line and Feb 18 lows.

Technical Indicators

Although there are concerns that Bitcoin (BTC) prices will drop thanks to a surge of market participation of Feb 24—36k, we must also realize that volumes of Feb 18—37k were equally high. Unless otherwise there is confirmation of Feb 24 losses complete with high volumes—above 40k—driving prices below our minor supports at $3,500, we shall maintain a bullish outlook as mentioned above.