Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

One of 2020’s most profitable DeFi tokens, LEND, proved that the rising buying pressure behind is not only speculative. Recently, it was revealed that Aave Limited, Aave’s UK business entity, earned itself an Electronic Money Institution license in July.

Aave Granted Financial License in the UK

The authorization enabled the grantee to offer services that include digital asset issuance and payments. The FCA-approval validated the Aave protocol as a contender in the lending space.

Michaël van de Poppe, a prominent market analyst, braved Aave and its investors for their patience, recalling days when the market had rubbished the DeFi project as dead.

“In the accumulation zone; everybody calls the coin dead. But now, everybody wants to have it. Literally, how the market psychology works – and I believe a substantial amount of coins will follow LEND,” said van de Poppe.

Indeed, it seems like speculators rushed to buy LEND following the announcement. The spike in the buying pressure behind this token pushed its price up by nearly 39% in the past 24 hours. The upswing allowed it to reach a new all-time high of over $0.786.

LEND Surges to New All-Time Highs As Buy Orders Skyrocket. (Source: TradingView)

Now, multiple indexes suggest that Aave may have more room to go up.

On-Chain Metrics Flash Bullish Signals

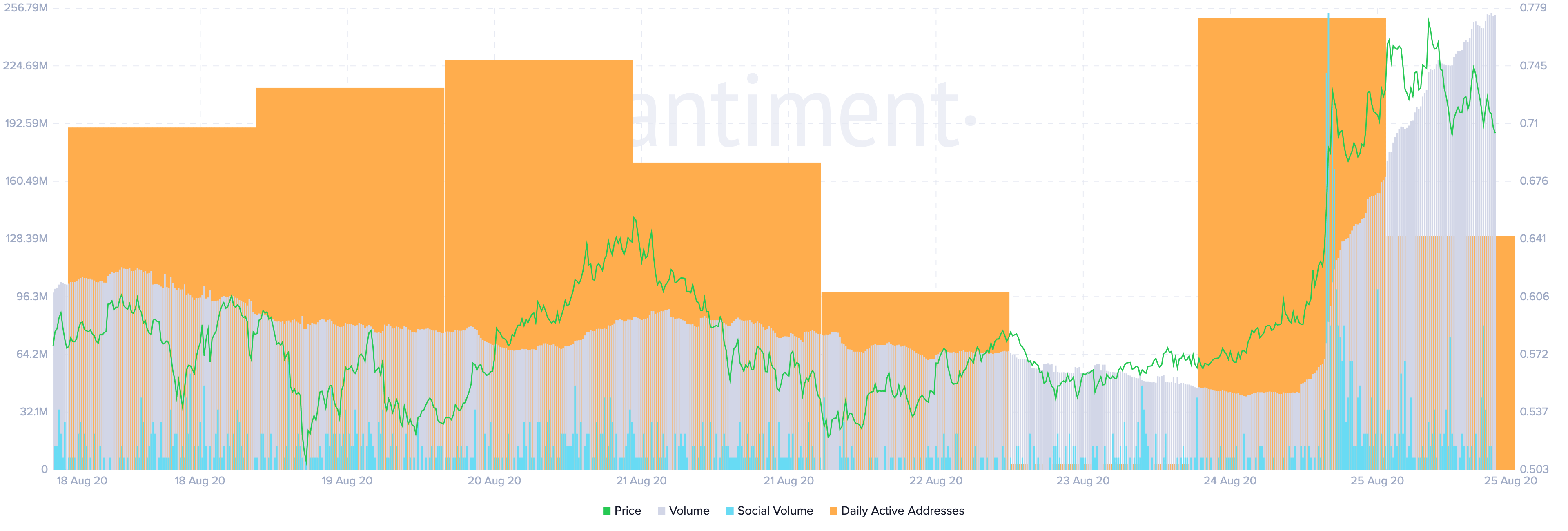

Data from Santiment reveals that alongside prices, on-chain volume, daily active addresses, and social volume also surged. When taken together, these are positive signs that can help determine whether Aave is poised to advance further.

Usually, when these three on-chain metrics rise together, a positive and sustained upward price movement tends to follow.

Aave’s On-Chain Metrics Explode. (Source: Santiment)

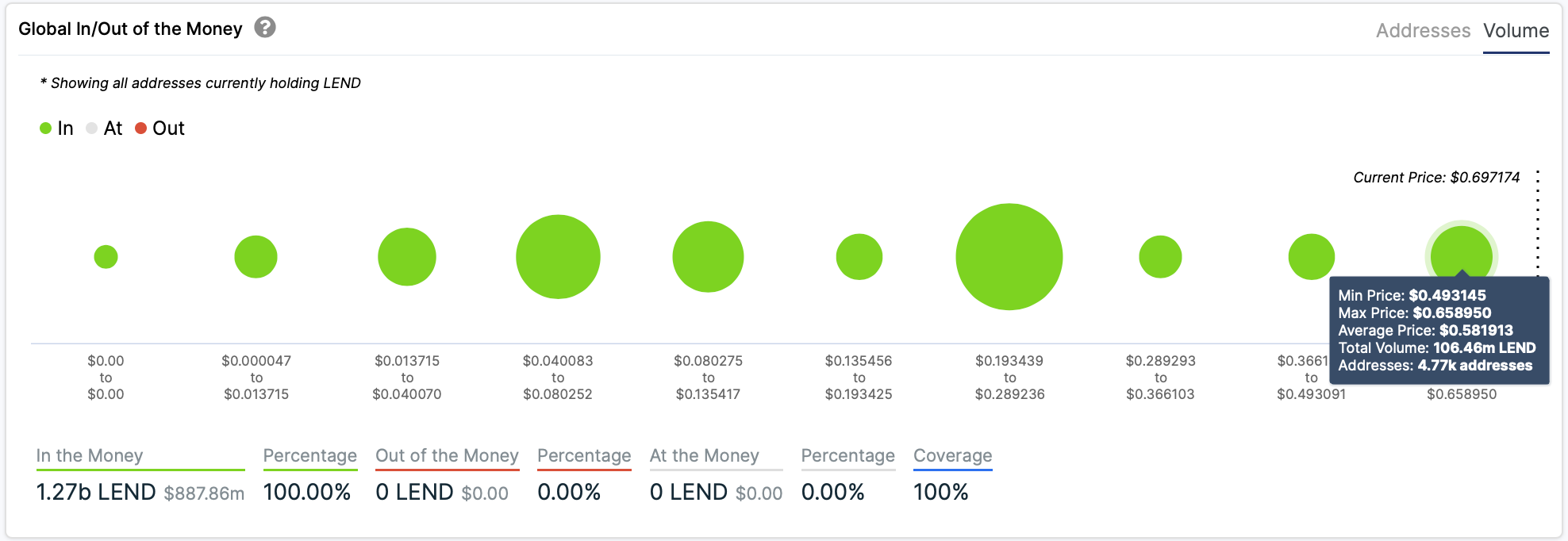

Since LEND has entered price discovery mode given the recent bullish impulse, all the addresses on the network are in-the-money, according to IntoTheBlock. These figures indicate that the investor base behind the non-custodial lending and borrowing token expects further upwards price action. As a result, any downswing may be taken by sidelined investors as an opportunity to get back into the market.

In the event of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) model shows that there is a crucial supply wall underneath Aave that could hold falling prices at bay. Based on this on-chain metric, roughly 4,800 addresses had previously purchased 106.5 million LEND between $0.49 and $0.66.

This supply barrier forms the basis of the nearest support level and may have the ability to abosrb any potential selling pressure.

Aave Shows Significant Support Barriers Underneath it. (Source: IntoTheBlock)

It is worth mentioning that Aave does not face any significant supply barriers ahead, so the sky is the limit for this cryptocurrency, at least in the short-term. Nonetheless, due to the speculative nature of DeFi tokens, traders should proceed with caution to avoid getting caught on the wrong side of the trend.

Featured Image by Unsplash Price tags: lendusd, lendusdt, lendbtc Chart from TradingView.com