Bitcoin price started a downside correction after rallying to a new 2020 high near $8,460 against the US Dollar. BTC corrected $500, but the price is still above many key supports.

- Bitcoin failed to continue above $8,500 and started a downside correction against the US Dollar.

- There was a significant correction below the $8,200 and $8,080 support levels.

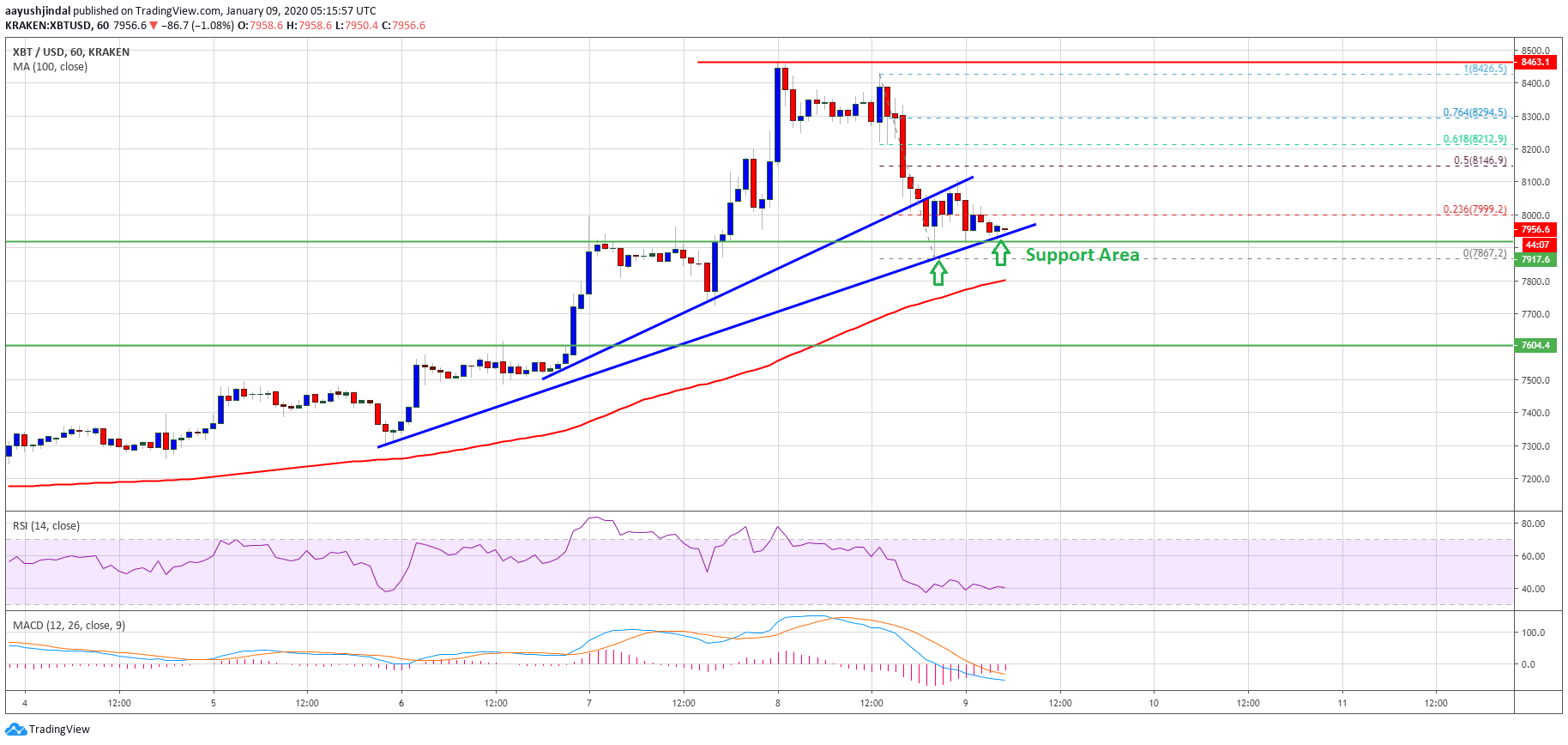

- There is a connecting bullish trend line active with support near $7,930 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is likely to bounce back as long as it is above the $7,800 support and the 100 hourly SMA.

Bitcoin Correcting Gains

This week, we saw a strong rise in bitcoin price above the $8,000 resistance against the US Dollar. BTC traded to a new 2020 high near $8,460 before it started a downside correction.

The bears were able to push the price below the $8,300 and $8,200 levels. During the decline, there was a break below a key bullish trend line with support near $8,040 on the hourly chart.

Besides, the price failed to stay above the $8,000 support area. Finally, it traded as low as $7,867 and is currently consolidating in a range. On the upside, there are initial hurdles near $8,000, and the 23.6% Fib retracement level of the recent decline from the $8,426 high to $7,867 low.

The first key resistance for bitcoin is near the $8,145 level. It represents the 50% Fib retracement level of the recent decline from the $8,426 high to $7,867 low.

If there is a clear break above the $8,145 and $8,200 levels, the price is likely to resume its upward move. The next major resistance is at $8,280, above which the bulls are likely to aim a new 2020 high.

What Could Invalidate Bullish Trend In BTC?

On the downside, there are a couple of key supports for bitcoin near the $7,800 level. More importantly, the 100 hourly simple moving average is near $7,800.

Therefore, a successful bearish close below $7,800 might invalidate the current bullish view. In the mentioned case, the price is likely to revisit the $7,500 support.

Looking at the chart, bitcoin price is clearly under stress below the $8,000 and $8,100 levels. In the short term, there could be a downside extension, but the price is likely to bounce back as long as it is above $7,800.

Technical indicators:

Hourly MACD – The MACD is slowly reducing its bearish slope.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently well below the 50 level.

Major Support Levels – $7,860 followed by $7,800.

Major Resistance Levels – $8,000, $8,145 and $8,200.