Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

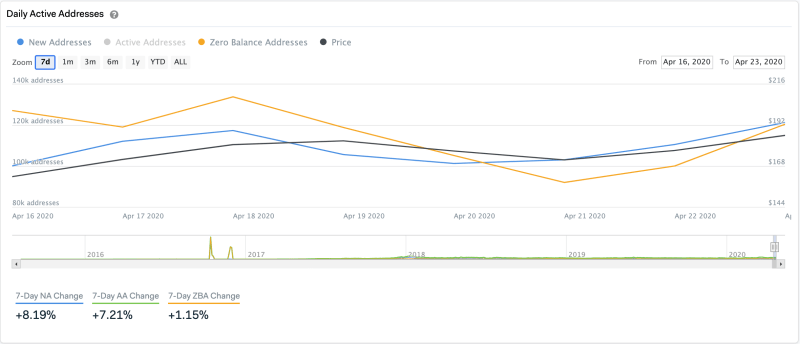

Ethereum is back in the spotlight after surging as high as $195 in the last 24 hours. The bullish impulse saw more than 220,000 addresses that had a balance in Ether go to zero, based on IntoTheBlock’s “Daily Active Addresses” model.

The selling pressure has been so significant that the drop in addresses nearly outpaced the number of new addresses being created in the network, which could spell trouble for the smart contracts giant.

Ether’s Network Growth Is Declining

Network growth is one of the most accurate price “foreshadowers,” according to Brian Quinlivan, Market and Social Media Director at Santiment. Quinlivan believes that a rising network growth usually leads to an increase in price. Meanwhile, a lack of newly created addresses indicates a future price slump.

The fact that Ether’s network is currently shrinking suggests that a correction is underway. An increase in the selling pressure behind this cryptocurrency would add credence to the bearish outlook.

Breaking below the support provided by the 100-day moving average would likely see Ethereum drop to its 200-day moving average. This support barrier is currently hovering around $172.

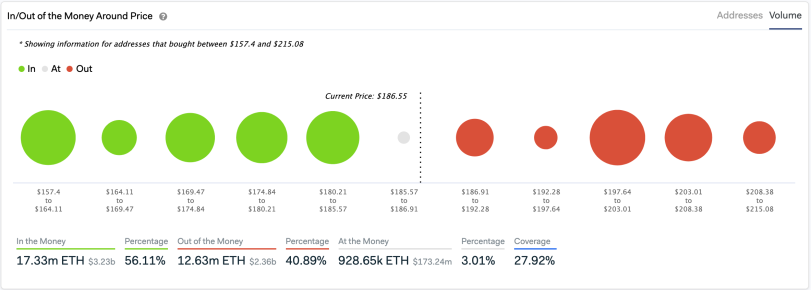

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model indicates that despite the decline in network growth, closing below the 100-day moving average will not be easy. This fundamental index estimates that over 1.5 million addresses bought nearly 5 million ETH at an average price of $185.

The massive supply wall might be able to prevent Ether from further correction and serve as a buy zone for sidelined investors.

Everything’s Not Lost

Considering that the 100-day moving average is able to hold, the IOMAP indicates that Ether can freely move towards $200. At the moment, there is not any significant supply barrier between $185 and $200 making such a bullish impulse extremely possible.

A lower time frame such as the 1-hour chart, however, suggests that the area between the lower and upper Bollinger bands is a reasonable no-trade zone. Breaking out of this trading range will determine where Ethereum is headed next.

Moving below the lower Bollinger band at $186 will signal a break of the 100-day moving average, which could be followed by a steeper correction as mentioned before. Conversely, jumping above the $190 resistance level could push Ether towards $200.

It is worth mentioning that the IOMAP reveals that approximately 1.2 million addresses bought nearly 7.8 million ETH around $200. Therefore, this price hurdle could eventually put a stop to Ether’s uprising.

Featured Image from Unsplash