Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

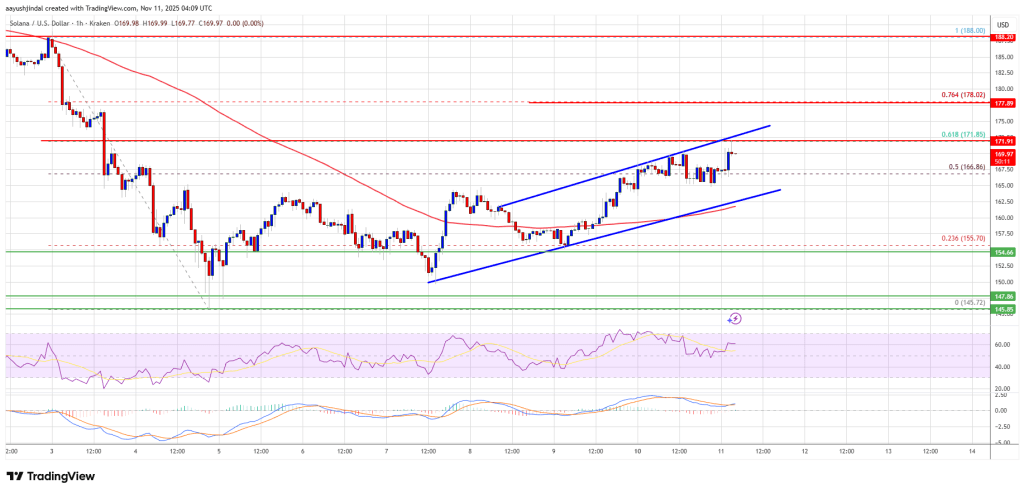

Solana started a decent upward move above the $165 zone. SOL price is now consolidating and faces hurdles near the $172 zone.

- SOL price started a decent upward move above $162 and $165 against the US Dollar.

- The price is now trading above $165 and the 100-hourly simple moving average.

- There is a rising channel forming with resistance at $175 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The price could continue to move up if it clears $172 and $175.

Solana Price Eyes Upside Break

Solana price remained stable and started a decent recovery wave above $155, like Bitcoin and Ethereum. SOL was able to climb above the $162 pivot level.

There was a move above the 50% Fib retracement level of the downward move from the $188 swing high to the $145 low. However, the bears are now active near the $172 resistance zone. There is also a rising channel forming with resistance at $175 on the hourly chart of the SOL/USD pair.

Solana is now trading above $162 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $172 level and the 61.8% Fib retracement level of the downward move from the $188 swing high to the $145 low.

The next major resistance is near the $175 level. The main resistance could be $188. A successful close above the $188 resistance zone could set the pace for another steady increase. The next key resistance is $202. Any more gains might send the price toward the $220 level.

Another Decline In SOL?

If SOL fails to rise above the $172 resistance, it could continue to move down. Initial support on the downside is near the $165 zone. The first major support is near the $162 level.

A break below the $162 level might send the price toward the $155 support zone. If there is a close below the $155 support, the price could decline toward the $150 zone in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $165 and $162.

Major Resistance Levels – $172 and $175.