Learning to trade crypto can be overwhelming. Many beginners struggle to navigate the volatile crypto market and lack the expertise or time to devise successful strategies. That’s where the best crypto copy trading platforms can help.

Imagine being able to copy the moves of experienced traders automatically, potentially boosting your returns while learning the ropes. With a good copy trading platform, you can do just that.

Here, we review the best options to help you make your crypto journey smoother and potentially more profitable. Here’s how providers like MEXC, Binance, and Margex can help with your investment goals.

Best Crypto Copy Trading Platforms 2025 – Quick Overview

Before we get into the nitty-gritty details, here’s a quick look at the best cryptocurrency copy trading platforms for 2025.

- MEXC — Lowest Fees and Access to Top Traders with High Follower Limits

- Binance — Top Exchange for Minimal Slippage and High ROI, Low-Risk Copy Trading

- Margex — No-KYC Platform with 100x Leverage and Advanced Price Protection

- BloFin — Option to Copy Automated Bots 24/7 for Unmatched Precision and Speed

- OKX — Access to 500+ Coins and Audited Proof of Reserves for All Top Cryptos

- PrimeXBT — Unique Combination of Crypto, Forex, and Commodity Copy Trading

- CoinEx — The Most User-Friendly Exchange with Fully Transparent Profit Sharing

The Best Platforms for Crypto Copy Trading Reviewed

Now let’s talk in more detail. We’ll dive into our top choices and give you the key perks that make them the best exchanges right now.

1. MEXC — Lowest Fees and Access to Top Traders with High Follower Limits

MEXC is one of the most affordable exchanges for copy trading or otherwise. The platform boasts very low fees — 0% maker for both spot and futures. Taker fees are 0.02% for futures and 0.05% for spot trading.

The exchange also doesn’t impose account minimums for copy trading, though lead traders might set their own. The main cost to consider is the profit sharing with lead traders (usually capped at a reasonable 10–15%).

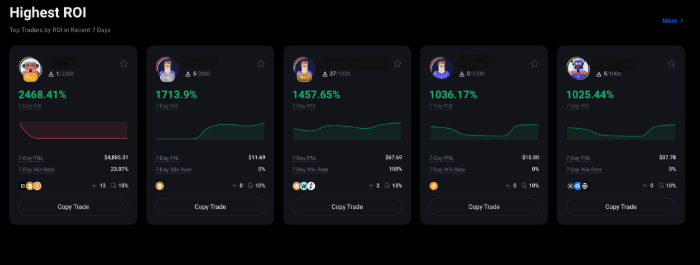

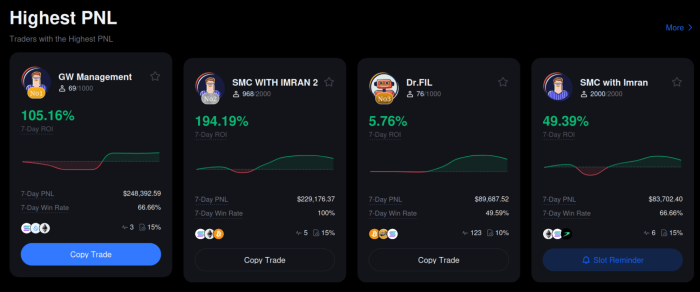

Speaking of copy trading, you can tap into a huge pool of experienced traders, which makes it easy to find someone whose strategy aligns with your comfort level and goals. MEXC has over 50K copy trade users, including over 20K traders to choose from.

Among them, you can find traders specializing only in $BTC, others trading top altcoins like $ETH and $SOL, and even many focused on meme coins and lower-cap tokens. Whatever asset or strategy you’re aiming for, there’s a high chance you’ll find a suitable trader here.

The platform also makes it easy to identify the traders to match your desired strategy and risk appetite.

All profiles display the 7-day win rate, trading frequency, and profit share ratio at a glance. These stats let you know ahead of time what the trader will take from your profit, and which traders are high vs low volume.

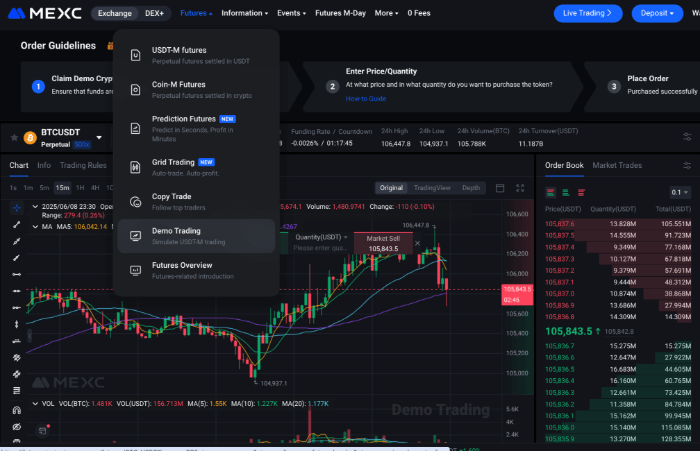

Better yet, MEXC’s copy trading is available for both spot markets and futures. For futures in particular, you can go for higher-risk, higher-reward trades with up to 200x leverage to potentially maximize your returns.

If you’d rather adopt lower-risk strategies, the platform also lets you set up stop-loss orders, tailor fund allocation per trader, and define maximum investment amounts.

You’ll also love the demo trading section. Here, you can try out strategies risk-free for some quick practice.

With support for 3K+ cryptos — including $BTC and top altcoins like $ETH, $SOL, and $ADA — you can test and apply your strategy for virtually any digital asset.

Note that MEXC does more than copy trading; it’s also a top P2P crypto exchange. The platform’s high liquidity and large global user base surpass competitors like Coinbase or ByBit, so you know it’s a tried and true exchange where your crypto is in safe hands.

| Copy Trading Markets | Futures and spot |

| Fees | Futures: 0% maker & 0.02% taker; Spot: 0% marker & 0.05% taker; Profit sharing with lead traders (10–15% of your profit). |

| Crypto Support | 3,000+ (including $BTC, $ETH, $SOL and meme coins) |

| Customization & Automations | Stop loss orders; Customizable fund allocation; Pre-defining maximum investment amounts. |

| Trading Bot | ✅ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

2. Binance — Top Exchange for Minimal Slippage and High ROI, Low-Risk Copy Trading

Binance shines thanks to its daily trading volume of over $13B. This is important, since you don’t just want to follow the best strategies when copy trading. You also need the liquidity to lock in fast transactions and minimal slippage.

Otherwise, your execution price might drop below what you expect, cutting into your potential profits. Well, Binance’s deep liquidity ensures the most efficient copy trades, including in fast-moving futures markets.

In fact, Binance’s copy trading focuses specifically on futures, allowing you to effectively leverage the expertise of seasoned traders in both rising and falling markets. This makes it one of the best platforms for shorting crypto, even for newcomers who are still learning the ropes.

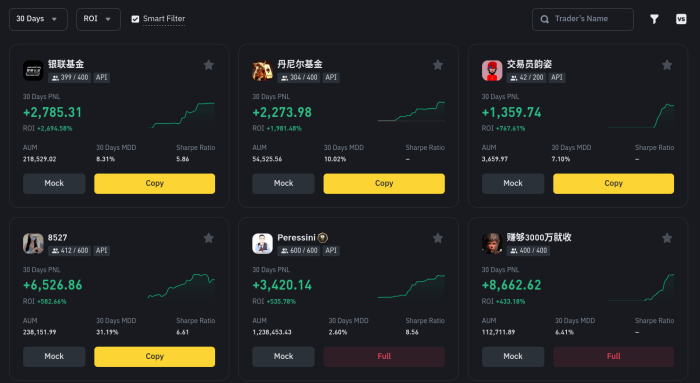

Not to mention, some of Binance’s traders have ROIs of over 500% and very low risk scores. The platform even has a ‘Smart Filter’ option that automatically picks the best traders with high profits and low drawdowns.

Beyond copy trading, Binance also offers mock copy trading. This allows you to test strategies and familiarize yourself with a trader by using virtual funds before committing real capital.

You can also trade using a combination of risk-mitigating tools, including SL orders and customizable investment allocations per trader.

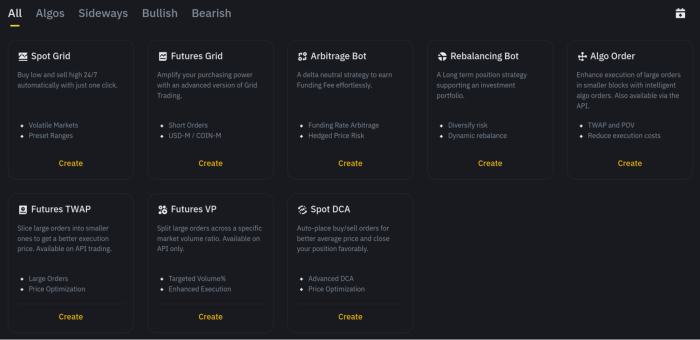

Once you learn more trading strategies and gain confidence in trading, you can branch out with trading bots. Binance has a comprehensive suite of options to automate trading in all market conditions — bullish, bearish, and sideways.

The ‘Grid bot,’ for example, is great for beginners in volatile markets. It automatically places buy and sell orders at specific price intervals, aiming to profit from small price fluctuations.

If higher-risk strategies and maximizing profits are more your thing, you can use Grid and Arbitrage bots to automate trading with 125x leverage for positions under $50K.

This leverage comes with a margin maintenance of 0.4% — perfect if you’re experienced with scalping and want more flexible capital management.

Overall, Binance has a versatile and extensive offer for all your copy trading needs and preferences.

The main cost specific to copy trading is the profit-sharing (typically around 10–20%), while funding and withdrawal fees vary by cryptocurrency.

| Copy Trading Markets | Futures and spot |

| Fees | Futures: 0.02% maker & 0.05% taker; Spot: 0.1% maker and taker; Profit sharing with lead traders (approx. 10–20%). |

| Crypto Support | 500+ cryptocurrencies (including $BTC, $ETH and other altcoins) |

| Customization & Automations | Stop-loss and take-profit orders; Customizable fund allocation; Auto-invest for spot copy trading. |

| Trading Bot | ✅ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

3. Margex — No-KYC Platform with 100x Leverage and Advanced Price Protection

Margex has carved out a niche as a versatile platform with high-leverage perpetual contracts and top price protection. All of this while also ranking as a top no-KYC crypto exchange, making it a favorite for crypto traders who prefer anonymity.

You can make an account, fund your wallet, and start trading without identity verification. Withdrawals also have zero fees and don’t require KYC. Note that this only applies to crypto deposits. If you plan to use fiat, you’ll still need to pass the identity check.

As for copy trading, the platform lets you mirror the seasoned pros and amplify potential gains with 100x leverage. This means you can control larger positions with less capital, standing to profit more from successful copied trades.

Another unique thing about Margex is that you can filter top traders by collateral, which gives you more flexibility.

Margex also prioritizes your security when trading. The platform’s ‘MP Shield’ is designed to protect against price manipulation, giving you peace of mind in high-stakes environments like futures markets, especially if you’re using leverage.

This proprietary tech uses AI algorithms to monitor price feeds across multiple liquidity pools, accounting for transaction spoofing and other suspicious market manipulation attempts.

In short, Margex ensures a stabler trading environment, protecting you from unfair liquidation in case of unforeseen price swings.

Then, there’s Margex’s multi-collateral wallets feature that lets you deposit and trade almost any crypto on the exchange and choose different collaterals for settlements.

Thanks to this, you don’t have to settle for just $USDT anymore, and you don’t need to own the underlying asset when trading new pairs, either.

Combine this level of security and convenience with Margex’s competitive fee structure, and you get a robust trading experience. The maker fee is just 0.019%, while taker fees charge 0.06%. The platform also has an estimated funding rate of 0.12% for both short and long positions.

Ease of use is another area where Margex does really well. The interface is designed for simplicity and efficiency, and you’ll find it easy to browse through a clear list of top traders ranked by ROE and equity.

Once you find your chosen trader, it only takes one click to follow. The platform’s ‘Smart Follow’ algorithm will ensure your copied positions trade under the same market conditions as the original trader. This means that if they profit, you’re guaranteed to profit as well.

| Copy Trading Markets | Futures |

| Fees | 0.019% maker & 0.06% taker; Funding rate starting at approx 0.12%; Profit sharing with lead traders (30–50%). |

| Crypto Support | 50+ cryptocurrencies including, $BTC, $ETH, and $LTC |

| Customization & Automations | Customizable leverage; Various collateral options; Stop-loss orders; Take-profit orders. |

| Trading Bot | ❌ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

4. BloFin — Option to Copy Automated Bots 24/7 for Unmatched Precision and Speed

BloFin is moving beyond the traditional leader-follower models when it comes to copy trading. The platform is pioneering a new frontier: precision copy trading driven by next-gen signals.

Sitting at the heart of this innovation is the deep integration of API-driven strategies and trading bots directly into the exchange’s copy trading framework.

Instead of just following a top trader’s manual entries, as you would on other exchanges, you can subscribe to signal providers running automated strategies, like perpetual grid trading bots and other integrated custom algorithms.

This enables you to further diversify with more sophisticated, data-driven trading. The transition to signal-based copying also offers you a more systematic and, more importantly, scalable approach to copying strategies.

So what does this mean? It means you’re getting a level of precision and speed that manual trading simply can’t match.

Trades are executed based on predefined algorithms and triggers exclusively. And although these bots are custom-made by lead traders, the algorithms are always consistent, and they reduce human error risks like bias, emotional trading decisions, or poor market timing.

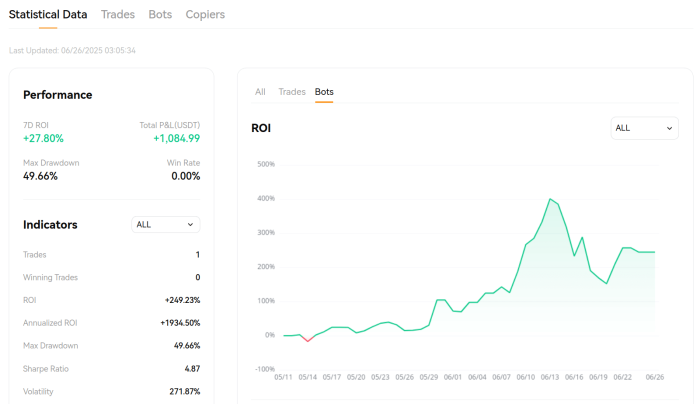

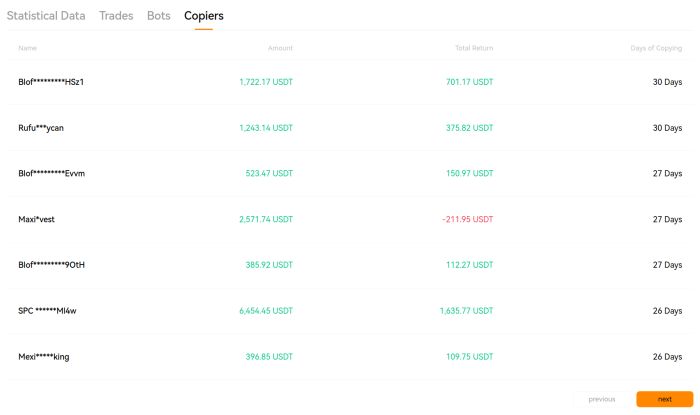

Whether you choose to copy human traders or custom bots, you can readily analyse performance metrics like the 7-day ROI, win rates, and a profile’s Sharpe ratio. This ensures you’ll find the profile best aligned with your risk appetite before committing any money.

For each trader, you can also find the ‘Copiers’ tab to see how well the strategy actually plays out for followers.

Beyond custom bots, BloFin’s copy trading offers a unique customization through ‘Fixed Amount’ and ‘Fixed Ratio’ modes, allowing you to better tailor your investment strategy.

‘Fixed Amount’ gives you precise control, allowing you to set a consistent, predetermined investment amount for each copied trade, irrespective of the lead trader’s position size. This is perfect for managing risk per trade and knowing your investment costs ahead of time.

Alternatively, the ‘Fixed Ratio’ mode allows for proportional scaling. You define a multiplier, ensuring your copied trades adjust in size relative to the lead trader’s positions.

This works for mirroring the lead trader’s strategy more closely, with position sizes adapting to their investments.

Both options give you flexibility in managing your investment, margin, leverage, and profit/loss settings, making BloFin a viable option for deep customization and risk management.

| Copy Trading Markets | Futures and spot |

| Fees | Futures: 0.02% maker & 0.06% taker; Spot: 0.1% maker and taker; Profit sharing with lead traders (capped at 20%). |

| Crypto Support | 480+ perpetual futures pairs; 400+ for spot trading (including $BTC, $ETH, and $SOL). |

| Customization & Automations | Three copy trading fund allocation options; Stop-loss orders; Take-profit orders. |

| Trading Bot | ✅ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

5. OKX — Access to 500+ Coins and Audited Proof of Reserves for All Top Cryptos

OKX gives you hundreds of trading pairs across both spot and futures markets (300+ in each). The selection includes major cryptos like $BTC, $ETH, $USDT, $SOL, and $XRP, alongside a variety of niche altcoins, giving you a diverse portfolio.

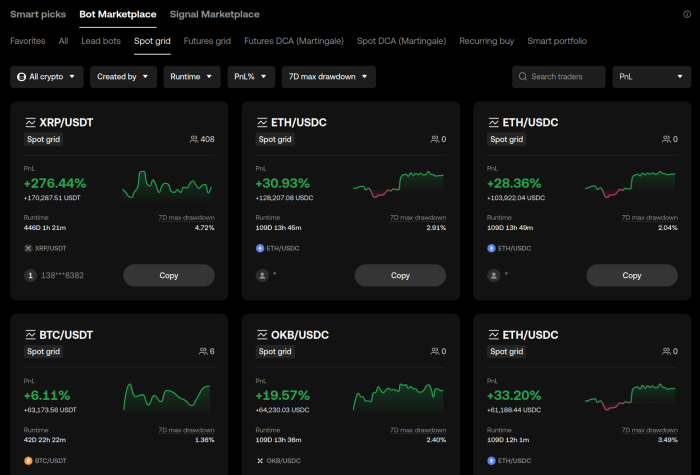

Whether you’re a long-term HODLer looking to hedge against a falling market or you’re an aggressive, high-frequency futures scalper interested in automated bot strategies, OKX has you covered.

The platform’s trading bots boast $500M+ trading earnings to date, and you get various offers for all market conditions.

A notable example is the Grid Trading Bot, which excels in sideways markets by placing buy/sell orders at set intervals to profit from minor price fluctuations.

Then there’s the DCA (Dollar-Cost Averaging) Bot, designed for trending markets to average position costs by strategically buying or selling more assets as prices move against its entry.

Other options include Recurring Buy Bots, Arbitrage Bots, and Smart Portfolio Rebalancing Bots. With the wide options at hand, your automated trades can help you stay ahead of the game.

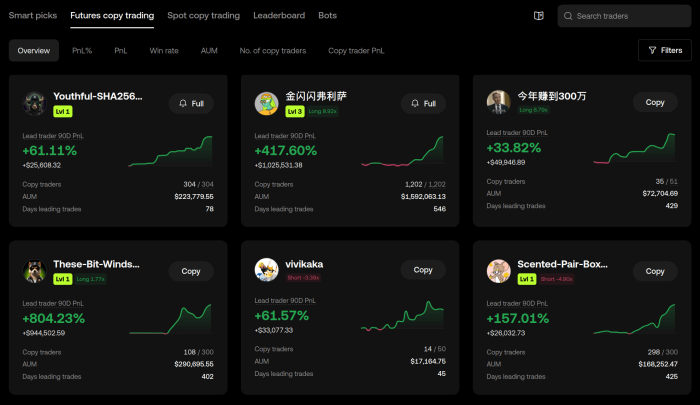

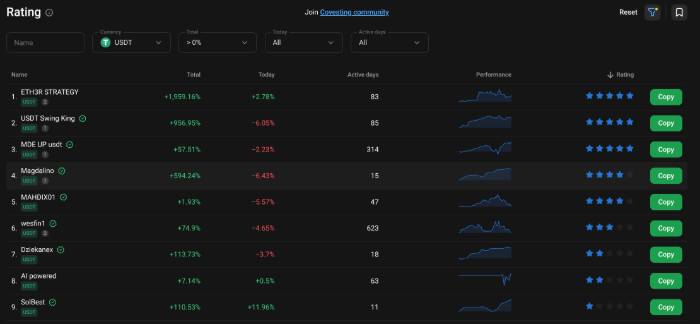

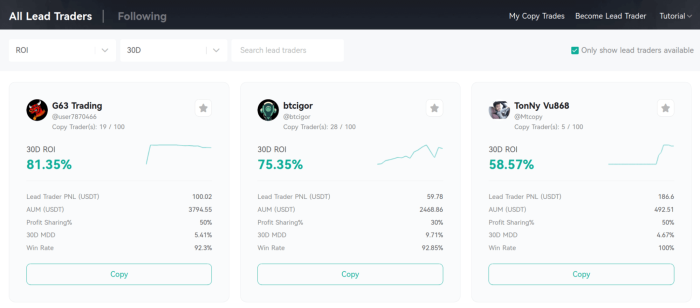

Beyond bots, the platform also has a leaderboard of copy crypto traders, showcasing vital metrics, such as PnL (Profit and Loss) and max drawdowns.

This well-organized, transparent dashboard makes it easy to get a clear insight into the follower’s actual revenue and the trader’s largest historical losses, letting you assess the risk profile.

Note that lead traders on OKX also earn a profit-sharing margin, which typically varies based on their rank, with rates often around 10–15% of followers’ net profits.

Beyond its diverse crypto support and trading automations, OKX focuses on ease of use. The entire process, from finding a lead trader to allocating funds and initiating the copy, is intuitive and can be completed in just a few clicks.

And if you’re after more control, OKX has advanced settings, allowing you to customize your risk management with specific stop-loss or take-profit orders. You can also control copied trade sizes through either fixed or proportional allocations, much like on BloFin.

You can also selectively copy specific trading pairs, meaning your copied portfolio aligns with your preferred assets.

Another noteworthy thing about the provider is its commitment to transparency and security. In an industry where trust is paramount, OKX provides peace of mind through its monthly, independently audited and thoroughly verifiable Proof of Reserves reports for over 20 top cryptos.

This, along with the majority of user funds being held in offline cold storage, creates a securely fortified environment where you can deposit and trade confidently.

| Copy Trading Markets | Futures, spot, and options |

| Fees | Futures: 0.02% maker & 0.05% taker; Spot: 0.08% maker and 0.1% taker; Profit sharing with lead traders (capped at 13%); Subscription fees (optional and set by the lead trader). |

| Crypto Support | 300+ cryptocurrencies (including $BTC, $ETH, and $OKB) |

| Customization & Automations | Fixed/proportional allocations for copying; Stop-loss orders; Bot marketplace for countless custom solutions. |

| Trading Bot | ✅ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

6. PrimeXBT — Unique Combination of Crypto, Forex, and Commodity Copy Trading

PrimeXBT has established itself as the premier destination for traders seeking genuine portfolio diversification. That’s because this exchange goes beyond just crypto, adding other assets like forex currencies and commodities into the mix.

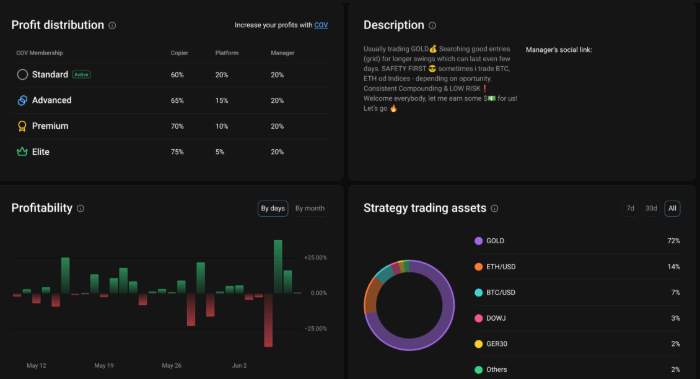

Its Covesting module lets you seamlessly copy strategies across a broad spectrum of global markets. This unique, multi-asset approach is a powerful tool if you’re looking to combine crypto with less volatile instruments.

Thanks to this, you can browse and replicate the performance of top-ranking strategy members who aren’t just trading $BTC and $ETH, but also fiat, and even gold.

Imagine having one single portfolio encompassing top cryptocurrencies, major forex pairs like EUR/USD, essential commodities such as gold and oil, and global stock indices like the S&P 500. PrimeXBT makes it happen, and it looks something like this.

For you, this means you can copy trade and manage the broadest range of asset classes, all from a single account. You’ll get a better balance between high-risk, high-reward crypto trades and more steady forex strategies for balanced risk-managed.

The Covesting module is also designed for transparency and ease of use. A detailed leaderboard system ranks strategy managers based on verifiable metrics, allowing you to make informed decisions.

These metrics include not just ROI and daily profit, but also more in-depth data for added transparency, like equity and win rates.

Top traders often stand out for their consistent gains over extended periods, disciplined risk management shown by lower margin usage, and proven longevity on the platform, meaning you can identify truly skilled professionals without much guesswork needed.

Profit-sharing is also transparent and clearly explained upfront: 20% goes to the strategy manager and 20% to the platform, so your share is 60% every time.

While the profit-sharing ratio for you might seem lower initially compared to some other platforms (where shares can range from 70–85%), Covesting offers unique redeeming qualities thanks to its broad asset selection and through its native $COV utility token.

By holding $COV, you can improve your profit share by reducing the portion going to the platform. This promotes engagement with the Covesting ecosystem and can offset the initial lower percentage, offering benefits if you’re a committed user.

| Copy Trading Markets | Futures and spot |

| Fees | Futures: 0.01% maker & 0.02% taker; Profit sharing (20% to the trader, 20% to the platform). |

| Crypto Support | 40+ |

| Customization & Automations | Customizable strategy allocations; Stop-loss orders. |

| Trading Bot | ❌ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

7. CoinEx — The Most User-Friendly Exchange with Fully Transparent Profit Sharing

CoinEx focuses on two core principles: simplification and transparency.

If you’re looking for a copy trading service that’s both powerful and intuitive, CoinEx has refined its copy trading service to appeal to both novices and seasoned professionals. And this is all underpinned by a clear and equitable profit-sharing model.

The emphasis on a simplified user experience is immediately apparent. The interface is clean and uncluttered, a welcome departure from the often overwhelming dashboards of some exchanges.

Finding and selecting a lead trader is a straightforward process, with a comprehensive yet easy-to-navigate list of top accounts.

Plus, you’ll find a diverse range of strategies among top profiles. Some specialize in high-frequency futures scalping on major pairs like BTC/USDT and ETH/USDT.

Others employ swing trading tactics or deep technical analysis for medium-term positions across various altcoins. Whatever your preference, there’s someone to follow.

Key performance metrics like ROI, daily profits, win rate, and maximum drawdown are also presented clearly, allowing you to draw informed conclusions without being bogged down by data overload.

A key feature of CoinEx’s approach is its straightforward profit-sharing mechanism. It’s built on a 30-day settlement cycle, providing regular and predictable periods for profit distribution.

Before committing to a copy trader, you should check the proposed profit-sharing ratio to avoid surprise fees. This information is readily available on each profile, right under the account name. You’ll also be able to mirror your chosen lead trader’s leverage and margin.

Overall, while CoinEx isn’t without its learning curves, particularly for those entirely new to trading, it does lower the barrier to entry for copy trading.

Not to mention, recent user reviews on Trustpilot have been lauding CoinEx’s user-friendly design that makes for seamless trade monitoring and management, especially on mobile.

Finally, CoinEx operates with a tiered verification system regarding KYC. Many positive reviews highlight a ‘no KYC’ experience, especially for crypto-only deposits and withdrawals.

Still, it’s important to note that unverified accounts typically have withdrawal limits (e.g., up to $10K USD per day and $50K USD per month).

For higher limits or in certain jurisdictions, ID verification may still be required, and CoinEx reserves the right to request it at any time, especially for legal compliance.

| Copy Trading Markets | Futures |

| Fees | 0.03% maker & 0.05% taker; Profit sharing with lead traders (10–50%, set by the lead trader). |

| Crypto Support | 1.3K+ (including $BTC, $ETH, and $CET) |

| Customization & Automations | Option to mirror the lead trader’s leverage and margin; Stop-loss and take-profit orders. |

| Trading Bot | ✅ |

| Demo Trading | ✅ |

| Mobile App | ✅ (Android and iOS) |

What Is Crypto Copy Trading and How Does It Work?

Copy trading is a feature offered by crypto exchanges that lets you automatically copy the strategies of experienced traders. Think of it like having a skilled co-pilot for your crypto journey.

Before selecting a lead trader, you can browse through profiles and look at important statistics like performance history, preferred assets, and risk indicators.

Once you find someone who aligns with your goals, you can assign a portion of your funds to automatically mirror their trading in real-time.

The platform then acts like a bridge between the lead trader and you, while also providing the crypto assets, instruments, and liquidity for the trades.

Whenever the account you follow buys/sells, you do too, proportionally to your allocation.

It’s a hands-off way for newcomers to potentially benefit from the expertise of others, while successful traders can earn a share of the profits generated for their copiers.

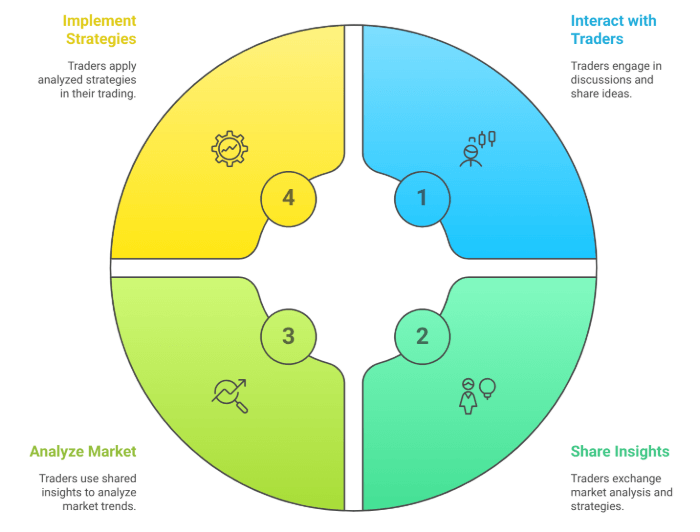

Crypto Copy Trading vs Social Trading

Social trading is a little different from copy trading, but related. Social trading is a broader concept where traders interact, share insights, strategies, and market analysis within a community, a bit like a social network for investors.

Crypto copy trading usually falls under the social trading umbrella. While social trading encompasses discussion and information sharing, copy trading is the direct action of automatically replicating another user’s trades.

So, you could be a part of a social trading platform to learn and discuss, and then use its copy trading feature to mirror when a lead trader acts on newly shared information.

They’re similar in that both leverage community wisdom, but copy trading provides a more direct, fully automated execution of strategies.

Copy Trading vs Crypto Trading Bots

Crypto trading bots are software programs designed to automatically execute trades based on pre-set algorithms or rules. You might set up a bot to buy $BTC when it hits a certain price or sell $ETH if a particular technical indicator is met.

Source: Original creation using Napkin.ai

So, how do bots and copy trading cross over or differ? They both offer automation, which is a key similarity.

The core difference lies in the source of the strategy: with copy trading, it’s another trader’s expertise you’re leveraging directly; with bots, it’s pre-programmed logic.

When using a bot, you or the developer can also pre-define the parameters and rules. In copy trading, you’re choosing to follow the strategy of a human trader, which can sometimes be unpredictable.

Is Crypto Copy Trading Profitable?

Copy trading can be profitable; however, it’s not a magic money-making machine. Like any crypto venture, potential profits come hand-in-hand with potential losses. Your profitability hinges on a few key factors:

- The skill and consistency of the trader you choose,

- The market conditions,

- The platform fees and the profit-sharing margin are taken by the lead trader.

Overall, copy trading offers an exciting way to grow your crypto assets by leveraging the expertise of others. It’s a tool that, when used wisely, can be a valuable addition to your investment strategy.

However, nothing’s guaranteed. Even top ROI traders have weeks or months where they don’t turn a profit.

Thus, copy trading still requires careful due diligence, ongoing monitoring, and a clear understanding that a trader’s past performance doesn’t promise future success.

Beyond profit potential, it’s also worth considering other pros and cons before you decide whether copy trading is for you. Here’s a balanced rundown.

| Crypto Copy Trading Pros | Crypto Copy Trading Cons |

|

|

How to Choose the Best Platform for Copy Trading Crypto

Picking the right platform is crucial for a successful copy trading experience. To help you slim down the options, here’s a handy checklist of the top considerations to keep in mind.

- Trust and Reputation: Opt for platforms with long-standing, positive reputations in the industry. See if they are regulated and if they provide proof of reserves and other audits to ensure your assets are in safe hands.

- Security: Look for platforms that use robust protection measures like 2FA and email confirmation for withdrawals. Beyond account security, see if the provider uses cold storage — this keeps assets on the platform safe even in the event of a hack.

- Cost: Understand the fee structure, including trading fees, profit-sharing percentages, and any potential subscription or withdrawal fees. The lower they are, the more you keep from your profits.

- Copy Trading Markets: A wider range of markets means more opportunities. For more advanced strategies, check if the platform offers copy trading on not just major spot pairs, but also derivatives like futures.

- Trader Pool: A deep and high-quality pool of experienced traders is the heart of any copy trading platform. Look for platforms that provide detailed metrics and a transparent history for each trader.

- Cryptocurrency Support: Make sure the platform supports a wide range of crypto that you’re interested in trading. This gives you more flexibility in the strategies and traders you can choose to copy.

- Customization: The ability to tailor your copy trading is paramount. Good platforms allow you to set your own investment amount per trade and customize other parameters to align with your strategy.

- Risk Management and Demo Trading: Effective risk-management tools are non-negotiable. Look for stop-loss orders and the ability to test strategies on a demo account before committing real funds.

- Automation and Bots: If you want more automation, check the availability of trading bots. These can execute trades 24/7 based on the parameters you set.

We meticulously apply these same stringent metrics when evaluating platforms, so you know you can trust our reviews and recommendations.

Our top picks are chosen based on a comprehensive analysis of cost-effectiveness, trader quality, and risk management features, ensuring you have the most reliable and user-friendly options available.

How to Start Copy Trading

Planning to get started with copy trading? Here’s a step-by-step guide to setting up and using copy trading on MEXC, our top choice for the lowest fees, a wide trader pool, and high follower limits.

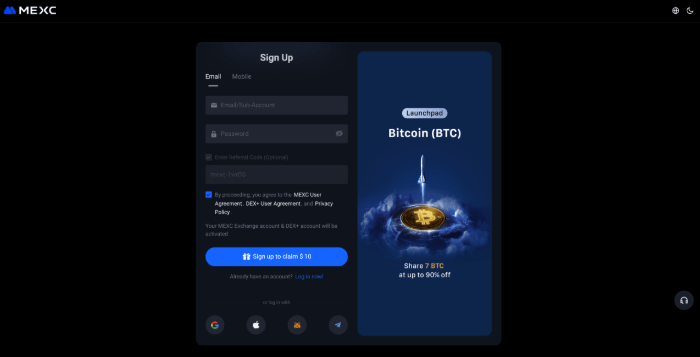

Step 1: Create and Verify Your MEXC Account

First, register on the official MEXC website. You’ll need to provide an email or phone number, set up a password, and complete the sign-up process.

If you want to access all features and ensure security, you’ll also need to complete KYC.

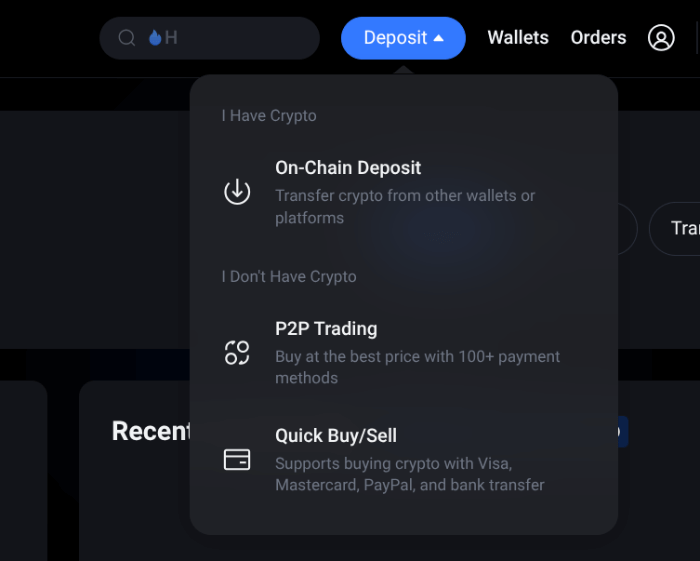

Step 2: Deposit and Transfer Funds to Your Futures Account

Once registered, deposit funds into your MEXC account. This can be with direct crypto deposits or buying crypto with fiat currency.

Click on the ‘Deposit’ tab and select the option you prefer. Next, follow the simple on-screen prompts.

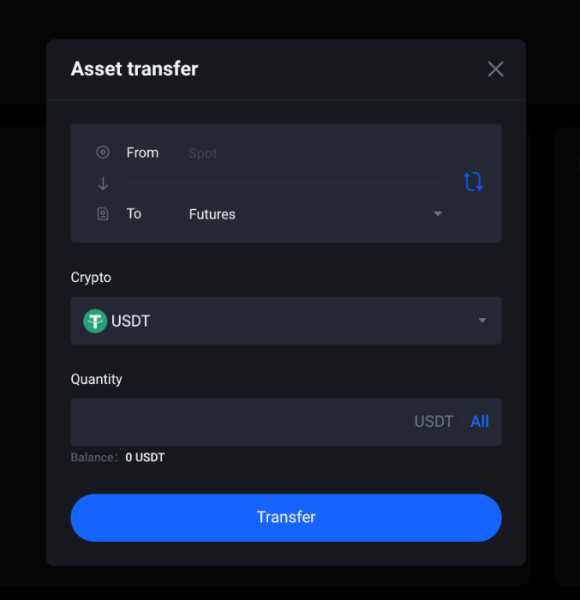

Since most copy trading operates on the futures market, you’ll then need to transfer your funds from your spot wallet to your futures wallet.

To do this, head to your ‘Wallet’ section and look for the transfer option.

Select ‘Spot Account’ as the ‘From’ wallet and ‘Futures Account’ as the ‘To’ wallet, then enter the amount you wish to transfer.

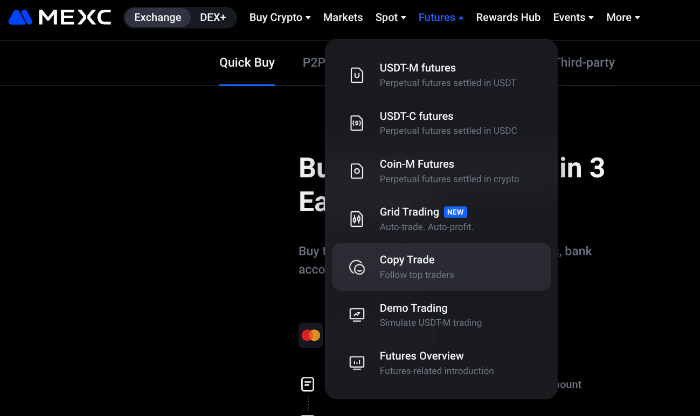

Step 3: Navigate to the Copy Trading Section

From the main dashboard, find the ‘Futures’ tab in the top navigation menu. Click and select ‘Copy Trade’ in the dropdown menu.

Step 4: Select a Trader and Configure Settings

Browse the leaderboard of master traders. Remember to analyse their performance statistics before making your selection.

Scrolling down, you’ll see top traders ranked by ROI and, most importantly, PNL — a metric showing the actual profits resulting from the traders’ and followers’ activity.

Once you’ve chosen a trader, click ‘Copy Trade’ and configure your settings, including the investment amount per trade and your take-profit or stop-loss limits.

Step 5: Monitor Your Copy Trading Activity

After you begin copying, you can track all open positions and monitor your performance from your personal copy trading dashboard.

You can check ongoing results, manage your settings, and stop copying a trader at any time.

Crypto Copy Trading Takeaways

Crypto copy trading offers a dynamic way to engage with the digital asset market by mirroring the strategies of successful, experienced traders.

The key lies in choosing a reputable provider with transparent fees, a deep pool of skilled traders, and risk management tools like stop-loss orders and demo trading for beginners.

Platforms like MEXC, Binance, and Margex provide these features and other reliable tools to automate your trading, saving you time and helping you learn as you go.

These exchanges also let you select from a diverse range of strategies, from leveraged futures trading to multi-asset collateral management.

But remember, a lead trader’s past performance is not indicative of future success. Always do your own research about the traders and their preferred assets before committing your funds.

This article is for informational purposes and not intended as financial advice.

FAQs

1. What’s the best crypto copy trading platform?

MEXC is among the best crypto copy trading platforms thanks to its extensive range of master traders and low fees. The platform has over 20K traders to choose from, and even top accounts by PNL accept 1,000–2,000 followers.

Profit sharing is capped at 15%, and the maker fee is 0%. Taker fees range between 0.02%–0.05% across futures and spot markets.

2. How much does it cost to start copy trading crypto?

The initial cost for crypto copy trading can vary. Some platforms require an initial minimum deposit, which can start at $10. But this isn’t common.

For the most part, costs only involve profit-sharing fees paid to the traders you copy (typically 10–30% of your profits). The exchanges themselves also have small transaction fees, usually around or below 0.1%.

3. Is copy trading crypto really profitable?

Copy trading can be profitable if you carefully select skilled traders and manage your risk effectively. However, profits aren’t guaranteed due to how volatile the crypto market can be. So, a trader’s past performance doesn’t promise future success.

It’s still important to diversify and understand the strategies you’re copying, the broader market trends, and the assets you’re trading.

4. Should I use a crypto trading bot?

Crypto copy trading bots can make effective tools, especially if you prefer algorithmic strategies and have a technical understanding of the market.

Because bots automate based on preset rules and indicators, they can be faster and more efficient than copy trading alone. Some platforms, like Binance and BloFin, offer both and allow for greater diversification.

5. Can I copy trade crypto in the US?

Copy trading is challenging in the US due to stringent regulations. Availability varies significantly between platforms, with many restricting American users from accessing derivatives or full copy trading features. It’s crucial to verify a platform’s terms and compliance with local laws before attempting to copy trade in the US.