Choosing the best crypto exchange in the UK can be painstaking because of the many options available. At the same time, it’s crucial that the platform you choose isn’t just useful for trading, but also secure.

At the end of the day, you want to keep your funds and private data safe. So, we’ve thoroughly tested and reviewed the best UK platforms to make your search easier.

We considered factors like trading fees, asset selection, ease of use, security, and the trading features available to point you towards the most well-rounded options.

Read on to find out why exchanges like MEXC, Margex, and Binance are among the most trusted names in the crypto exchange industry.

Best UK Crypto Exchanges – The Complete List

Before we dive into the detailed reviews, here’s a quick look at the best crypto exchanges in the UK and what makes them stand out.

- MEXC — Exchange with the Lowest Fees and Over 4,000 Crypto Pairs

- Margex — Best Place for 100x Leveraged Trading Without KYC

- BloFin — Easy-to-Use Platform with Smart Risk Management Tools

- Binance — World’s Largest Crypto Exchange with Daily Volume of $76B+

- PrimeXBT — Advanced Trading Tools with Access to 100+ CFD Markets

- OKX — Hybrid Exchange with Deep Liquidity and P2P Trading

Top UK Crypto Exchanges Reviewed – Our 2025 Picks

Time to dive into the reviews and see why these top picks make the best crypto exchanges in the UK today. We’ll give you everything you need to make an informed decision.

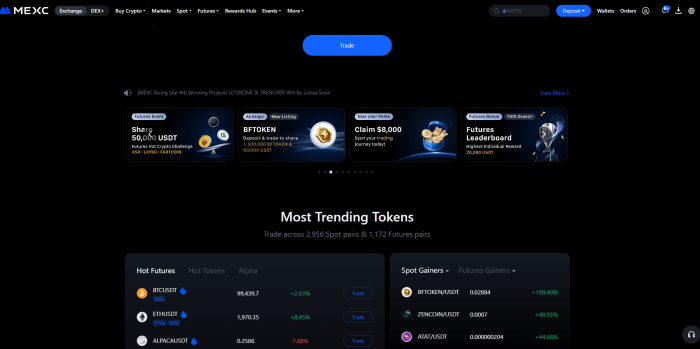

1. MEXC — Exchange with the Lowest Fees and Over 4,000 Crypto Pairs

- Listed Pairs: 4,100+

- Max Leverage: Up to 500x

- Spot Trading Fees: 0% maker & 0.05% taker (spot); 0% maker & 0.02% taker (futures).

- KYC Required: Yes

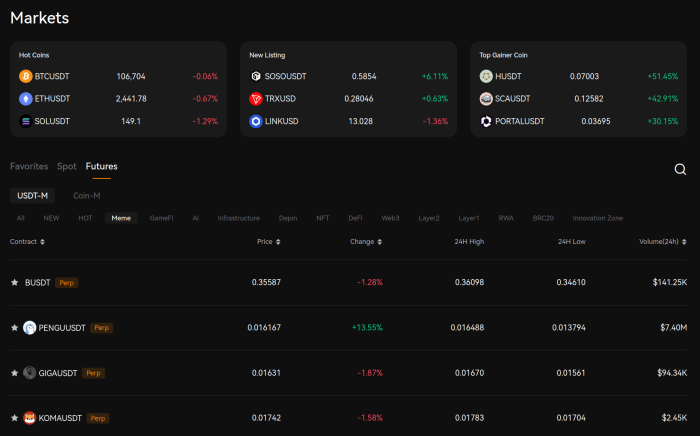

MEXC offers a huge collection of 2,879 spot pairs and 1,155 futures contracts for you to trade in, making it one of the best crypto exchange platforms to diversify your portfolio.

We were also impressed by the platform’s extremely low fees. It’s, in fact, one of the most affordable providers for trading. You won’t have to pay any spot maker fees; spot taker fees are just 0.05%.

And with MEXC futures, you’ll benefit from a 0% maker fee and only 0.020% on taker fees.

MEXC also offers one of the most comprehensive meme coin markets of all UK crypto exchanges. It has a dedicated meme coin section, where you can buy and sell all trending tokens at a single place from various chains, including Solana, Ethereum, Tron, and Base.

MEXC has something to appease traders of all kinds. The platform supports spots, futures, copy trading, and even demo trading for beginners.

If you’re a futures trader, you can choose among contracts settled in $USDT, $USDC, but also other cryptos like $BTC.

For Coin-M futures, the margin and settlement are denominated directly in the contract cryptocurrency. For instance, if you’re trading in $BTC Coin-M futures, the contract will be settled in $BTC itself.

You can also amplify your position with leverage of up to 500x on major coins like $ETH and $BTC and up to 300x on $SOL and $XRP.

The copy trading section is pretty comprehensive, too. You can choose from a list of profitable traders and replicate their trades in exchange for a small profit share (generally 10–15%). So far, MEXC has built a community of 50K+ copy traders with a combined trading volume of over $1B.

Beginner traders will also like that MEXC offers a lot of rewards to give newcomers a head start. For instance, you can get a 10 $USDT voucher for signing up on the platform and another 30 $USDT for depositing your first $100.

All in all, you can claim up to 8K worth of $USDT bonuses by completing different tasks listed on the ‘rewards hub.’

You can also redeem the staked tokens at any time, meaning there’s plenty of flexibility. If you choose to redeem early, you’ll be rewarded based on the proportion of your total staked amount.

Overall, MEXC is a popular name in the crypto exchange industry, perfect for newcomers and experienced traders alike. You can access all of its features from within the UK and trade from anywhere using its sleek and easy-to-use iOS and Android apps.

2. Margex Exchange — Best Place for 100x Leveraged Trading Without KYC

- Listed Pairs: 45+

- Max Leverage: Up to 100x

- Futures Trading Fees: 0.0.019% maker & 0.060% taker

- KYC Required: No

With more than 500K registered users, Margex is a trusted crypto exchange in the UK and worldwide. You can buy crypto on the platform using GBP through one of 150 payment options – one of the highest we’ve seen – including credit/debit cards and Google Pay.

One of the best things about Margex is that you don’t need to fill up KYC forms to start trading or even using leverage. This is great for traders who are looking for anonymity.

However, you’ll only have this no-KYC liberty if you’re depositing and withdrawing directly in crypto. If you want to make fiat deposits, you’ll still need to get verified.

Besides buying crypto, you can also use the platform to trade futures with a leverage of up to 100x. This means that, for example, if you wanted to trade $10K worth of $BTC, you’d only need $1K in your account.

And, beyond $BTC, Margex offers 45 more trading pairs, including the most liquid altcoins such as $ETH, $LTC, $XRP, $EOS, $ADA, $UNI, and $SOL.

You can also use both cross and isolated margin modes while opening trades. With isolated margin, only the funds required for a particular trade is at risk. The rest of your account balance stays untouched, which is ideal for beginners.

However, if you’re experienced, you can work with cross margins for added flexibility. With this, your whole account balance is shared across all open positions. Of course, the downside is that if one trade tanks, the rest of your account gets hit.

Overall, you’re looking at a comprehensive futures section. Unfortunately, Maregx doesn’t offer spot trading like other exchanges.

To make up for that, however, the platform has robust copy trading features with 100+ registered traders you can follow. Top accounts boast ROEs of 90% and higher on various assets like Bitcoin, Ethereum, XPR, and Tron.

We also found the platform has a rich knowledge base to help new traders get started and climb through the learning curve. You can also earn a $50 registration bonus and a $50 deposit bonus when you open your first account on Margex.

Although it’s not registered with the FCA, Margex complies with FCA rules on promoting crypto assets and provides the required disclaimer when you visit its site in the UK.

3. BloFin — Easy-to-Use Platform with Smart Risk Management Tools

- Listed Pairs: 730+

- Max Leverage: Up to 150x

- Trading Fees: 0.1% maker & taker (spot); 0.02% maker & 0.06% taker (futures)

- KYC Required: No

BloFin offers more than 480 USDT-settled perpetual contracts and 250+ spot pairs, making it worth a serious look if you’re on the hunt for a good futures trading exchange.

Spot pairs are cryptocurrencies you can buy directly with your own funds without using any margin or leverage. This gives you the freedom of taking a long-term bet on an asset.

If you want to branch out, though, the platform’s futures section offers perpetual contracts settled in both $USDT and other cryptos.

For futures contracts settled in $UDST, you don’t have to maintain margin in the currency you’re trading. For instance, even if you’re trading in $BTC, you can maintain the required margin in $USDT.

Now, while a lot of other exchanges also offer USDT-settled contracts, BloFin’s range of 480 cryptocurrencies makes it a popular choice for traders who operate in niche assets as well.

For instance, if you’re bullish on AI-based meme coins, you can invest in coins like $TAO, $KAITO, and $ICP.

Oh, and UK traders can rest easy knowing that they can buy crypto on BloFin using GBP. The available payment options include credit or debit cards, bank transfers, Apple Pay, Neteller, or Skrill.

BloFin also comes with a lot of trading tools to help you on your journey. Its ‘Signal Bot’, for instance, lets you create customized signals on TradingView.

If you’re tracking $BTC and want an alert when the price hits $106K, you can set an alert so that TradingView will automatically notify you when the trigger is activated.

You can also use basic and advanced trade orders. Let’s say you want to place a large trade. If the market is highly volatile, a standard market or limit order might fill in chunks at different intervals. In the end, you could get an average price that’s way off from what you expected.

With BloFin, however, you can place a TWAP order instead. This will split your order into multiple small ones, each separated by a small time interval. This will minimize the impact of price fluctuations.

BloFin is also one the few exchanges that offer a Unified Trading Account (UTA). Thanks to this, you trade spot and $USDT perpetual from a single account and use cross-collateral margins to maximize your capital efficiency. You can also try this UTA via the demo trading mode first.

Like other exchanges on the list, BloFin also offers copy trading. Even better, you can get $USDT rewards for your first Futures Account Deposit, first futures trade, and first copy trade.

The platform complies with FCA requirements on risk warning for UK traders, and the exchange is also readily accessible to UK users.

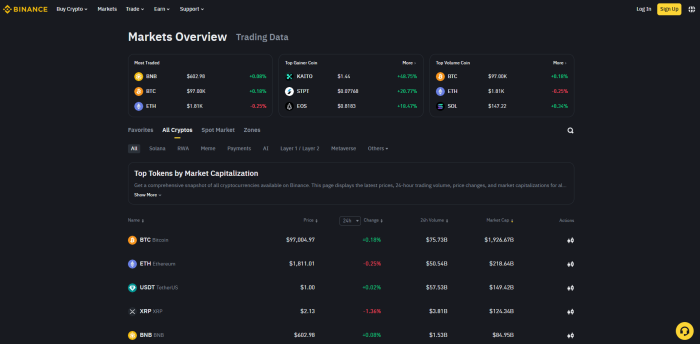

4. Binance — World’s Largest Crypto Exchange with Daily Volume of $76B+

- Listed Pairs: 2,000+

- Max Leverage: Up to 125x

- Trading Fees: 0.1% maker & taker (spot); 0.02% maker & 0.05% taker (futures)

- KYC Required: Yes

Binance is the world’s largest crypto exchange with an average daily trading volume of $76B. It’s also popular for crypto spot trading, with more than 300B spot transactions recorded in 2022 alone.

It wouldn’t be a stretch to say that a lot of Binance’s popularity comes down to its simplicity. It’s one of the most straightforward platforms to buy crypto. You can do so directly with GBP through your debit/credit card or online wallets.

Plus, the buying dashboard shows you all information about the token you’re about to buy. For example, if you’re buying $ETH with GBP, you’ll see the $ETH chart along with its market cap, volumes, and exchange rates.

For those who want to trade in derivatives, Binance offers futures settled in either stablecoins (USD-M) or other cryptos (COIN-M), as well as options.

Like USD-M futures, Binance options are priced and settled in stablecoins, but they require lesser margin than futures trading.

However, options can be a risky instrument, since they can end up worthless if the underlying asset doesn’t hit the strike price before expiry. Plus, the value keeps decreasing with time even if the market stays stagnant.

As for futures, the leverage can go as high as 125x, depending on your position size. For example, if the notional value of your position is up to $300K USDT, you can get max out at 125x leverage with a maintenance margin of 0.4% — perfect if you’re experienced with scalping.

What we also liked about Binance is that the platform offers a lot of trading bots for you to automate your trades in all kinds of market conditions, whether bullish, bearish, or sideways.

You can set up a grid bot for spot and futures, or an arbitrage bot for steady profits, for instance.

Plus, you get the freedom to choose between various instruments where to apply a given strategy – something that not many other exchanges offer. You can apply the ‘Spot grid’ bot on assets like $BTC, $ETH, $AAVE, and more.

Binance even offers a separate Non-Fungible Token (NFT) marketplace, where you can buy top and trending NFTs directly from your Binance fund. You can either buy at a fixed price instantly, place an auction bid, or simply make a price offer to the seller.

Besides all this, you can also stake various digital assets on the platform to earn a fixed APR. Currently you’ll get 5%–10.9% APR on staking $USDC and 4.95%–7.38% on $USDT.

Overall, Binance is a reputable, reliable, and FCA-compliant service in the exchange industry, offering a lot of trading solutions in a centralized place.

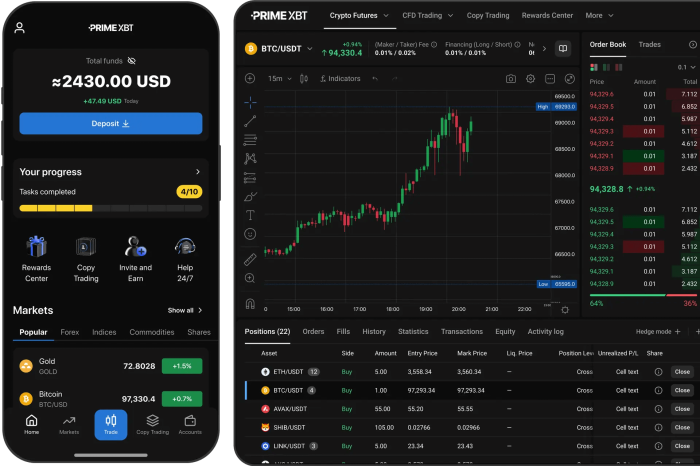

5. PrimeXBT — Advanced Trading Tools with Access to 100+ CFD Markets

- Listed Pairs: 100+

- Max Leverage: Up to 200x

- Futures Trading Fees: 0.01% maker, 0.045% taker

- KYC Required: No

PrimeXBT is among the most popular and user-friendly exchanges available. It boasts more than 1M users and has a sleek and easy-to-use interface, which makes it a very modern crypto trading platform.

As usual, you can buy, sell, or swap cryptocurrency directly from PrimeXBT. The platform also charges a maker fee of just 0.01% – the lowest we’ve seen in our testing (besides MEXC’s 0% fee).

The taker fee will depend on your average monthly trading volume and can go as low as 0.02% for monthly volumes surpassing $20M.

This means you can trade in whatever market suits your strategy from just one PrimeXBT account. You can forget having to limit yourself or switch between different providers.

The best part is that you won’t have to pay any fees for trading CFD on commodities, forex, and indices.

Another area where PrimeXBT shines is market research resources. You’ll find a lot of market information readily available on the platform, which will help you make informed decisions.

For instance, there’s an economic calendar that lists all upcoming events such as FED announcements so that you can plan your trades accordingly. Moreover, the platform publishes a lot of market research articles daily to keep you updated.

Unlike other exchanges, PrimeXBT also hosts free trading contests with real cash rewards. You can join a weekly trading challenge, trade with virtual money, and grab a spot on the leaderboard to get real prizes.

If you’re a profitable trader, then there’s virtually nothing to lose but everything to gain with these contests. What’s more, this is also a great way to get a head start in your trading journey even if you have no money to play with.

6. OKX — Hybrid Exchange with Deep Liquidity and P2P Trading

- Listed Pairs: 45+ (CEX); 700+ (DEX)

- Max Leverage: N/A in the UK

- Trading Fees: 0.08% maker & 0.1% taker (spot); futures N/A in the UK.

- KYC Required: Yes

OKX is a very popular crypto exchange. It has 60M users in more than 100 countries, with peak daily trading volumes of more than $106B. However, much of its features are restricted in the UK due to FCA regulations.

As of now, you can buy around 45 crypto assets on OKX’s CEX, including Bitcoin, Ethereum, Solana, and Avalanche. The trading fees on OKX will depend on your 30-day trading volume. Depending on your activity, you can expect a maker fee of 0.01%–0.08% and a taker fee of 0.015%-0.1%.

Regular users with a trading volume of under $5M have maker fees of 0.08%, but VIP traders with a 30-day volume exceeding $200M get 0%. Taker fees start at 0.1% and drop to 0.05% for volumes above $5M.

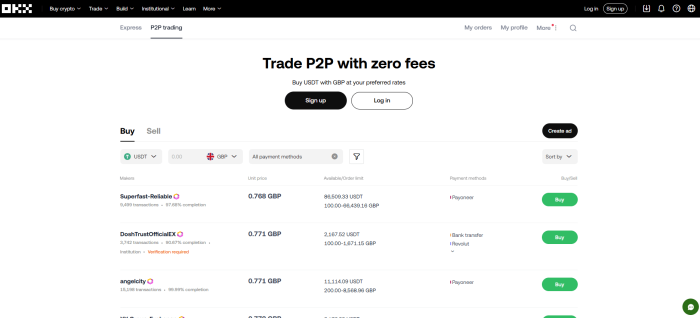

OKX is also an active P2P crypto exchange where you can buy and sell cryptocurrency directly with/from the holder without the involvement of any exchange and without any fees.

Each listing is updated with the unit price of the cryptocurrency and payment method. Bank transfer, Payeer, and Payoneer are some of the most popular options.

You will also see details like the number of transactions completed by each buyer/seller on the platform, ensuring their reliability.

Another impressive OKX feature is that it allows you to integrate its platform with TradingView — a charting platform and social network used by 100M+ traders and investors.

This will then give you access to a lot of advanced features, such as indicators and strategies through custom builders like Pine Script. For example, you could create a script that sends you buy/sell signals based on indicators like moving average crossovers, or RSI levels.

Although it’s best known as a centralized exchange, OKX also has a DEX platform. Here, you’ll find a broad range of cryptocurrencies (700+ coins), an NFT marketplace, and various airdrop events to make the best of Web3 trading.

It’s worth noting that OKX’s management is still working on complying with the required regulations to offer the full range of features in the UK. Once approved, you may see features like derivative trading and staking.

Should You Use a Crypto Exchange in the UK in 2025?

Yes, you should use a crypto exchange in the UK if you’re planning to buy or trade digital assets. While you can easily buy crypto from decentralized platforms, using a professional crypto exchange has its advantages.

The best crypto exchanges in the UK offer safer platforms, where you can buy, sell, swap, and hold various cryptocurrencies without worrying about getting scammed.

To ensure a secure trading experience, top exchanges typically employ various security measures, such as proof of reserves, cold asset storage, regular smart contract audits, and multi-factor authentication.

A comprehensive crypto exchange, like the ones in this guide, also allows you access to more varied market products, including futures, options, copy trading, and demo trading, which you’d have no way to access otherwise – certainly not all in one place.

Last but not least, you also get an exhaustive set of trading tools, bots, and learning resources to improve your trading game over time.

It’s not all perfect, though. Crypto exchanges also have their drawbacks to consider, so it’s worth weighing both the pros and the cons.

| ✅ Pros | ❌ Cons |

|

|

However, bear in mind that crypto investments are subject to market risks and high volatility, no matter where you trade.

As such, the information provided here is not financial advice. We recommend you do your own research before entering the crypto market.

How to Choose the Best UK Crypto Exchange

Picking the best UK crypto exchange can be an uphill task if you don’t know what to look for. Here are a few guidelines to help you out.

Supported Coins

Check if the exchange offers the coins you want to trade, especially if you’re looking for lower-cap assets.

Most exchanges will offer popular cryptos like Bitcoin, Ethereum and XRP. But, depending on your requirement, it could also be worth seeing if they have niche meme coins, such as $POPCAT or $DOGE.

Low Fees

Crypto exchanges charge various fees, such as maker and taker fees, deposit and withdrawal fees, and account maintenance charges.

Make sure that the fees you’re shelling out are par with industry standards and there are no hidden charges.Generally, the most competitive platforms like BloFin and Binance offer trading fees ranging from 0.01% to 0.06% or lower.

Plus, check the spreads offered on various instruments. Higher spreads can lead to costly entries and eat into your profits.

Ease of Use

Most top exchanges offer a demo trading mode, where you can check the platforms’ ease of use, interface, and design. Try placing a couple of mock trades to see how you like the exchange.

Beyond intuitive platforms, look for easy-to-use mobile apps if you like to trade on the go.

Security Features

The crypto exchange you pick should employ the latest security measures, such as cold asset storage and advanced data encryption. This way, you know your crypto and personal data are protected.

Also look for providers that undergo regular third-party audits to prove their privacy claims.

Step-by-Step Guide to Buying Crypto on an Exchange

If you’re wondering how to go about buying crypto on the best exchange in the UK, here’s a step-by-step breakdown of the process.

We’ve taken MEXC as an example. However, the process remains by-and-large the same for other exchanges as well.

Step 1: Choose a Trusted Exchange

First things first, you need to find a trusted crypto exchange in the UK where you can buy crypto. We suggest MEXC as our top pick due to deep liquidity and availability of 2,800+ spot pairs.

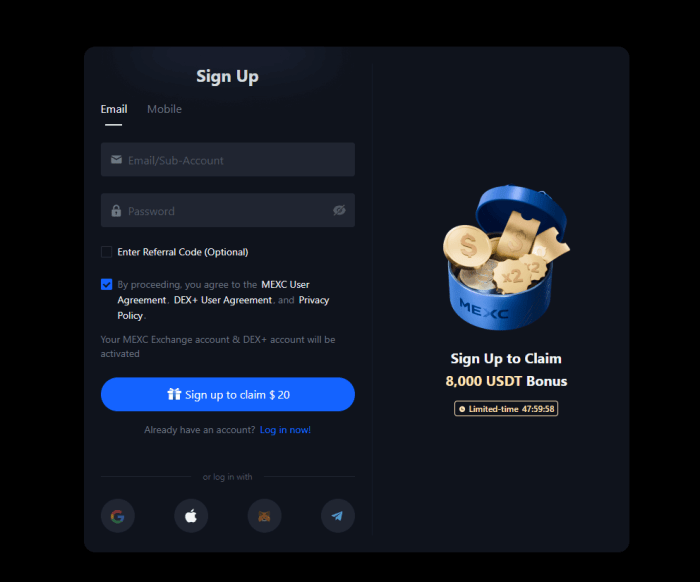

Step 2: Register and Verify

Next, you need to register on the platform, which is pretty easy and only requires an email address.

Alternatively, you can also use a Google, Apple, or Telegram account to sign up hassle-free.

Once done, we recommend opening your account section and completing advanced KYC for unrestricted access to deposits and withdrawals.

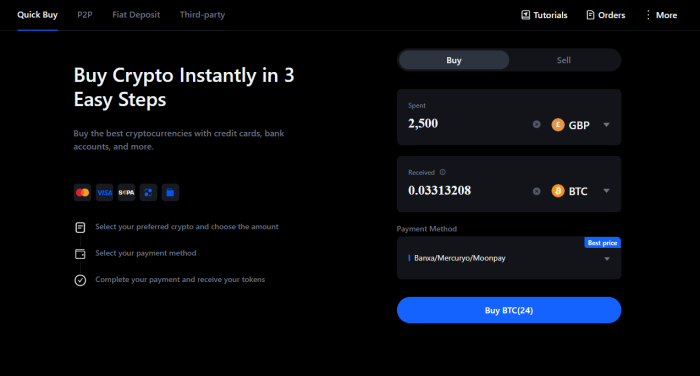

Step 3: Buy Crypto

Now that you’re ready, click the ‘Buy Crypto’ menu on the top left side and choose the ‘quick buy’ option.

You’ll see a window where you’ll need to enter transaction details (such as the amount of GBP you want to spend and the cryptocurrency you want to buy). Set up the transaction and click ‘Buy.’

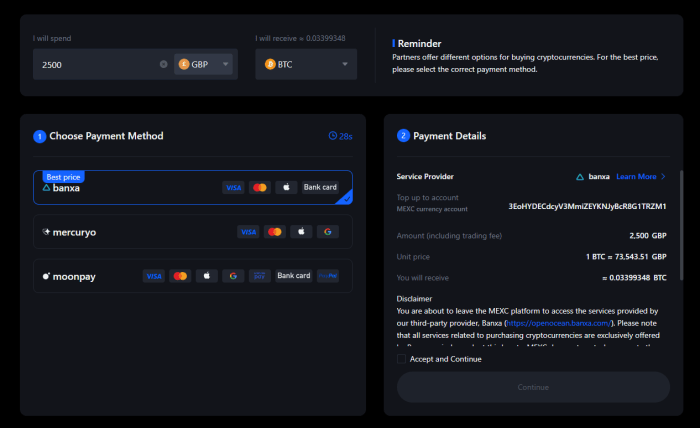

Step 4: Complete the Payment

Next up, you’ll see a payment menu, where you can choose the desired payment method (like bank cards or digital wallets). You’ll also see the ‘best price’ payment method at the top.

Don’t forget to review the transaction before confirming the payment.

Step 5: Transfer to a Wallet or Hold On-Platform

After you complete the payment, you’ll see your purchased crypto asset in your MEXC wallet.

From here, you can keep your crypto on the platform for further trading, or withdraw to a non-custodial wallet for safe holding.

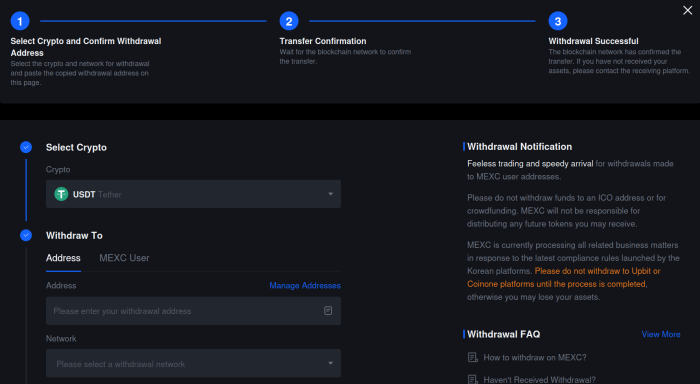

Making a withdrawal is pretty easy on MEXC. Click on ‘Wallets’ on the top-right corner of the dashboard and select ‘Withdrawal.’

You’ll see a new window, where you’ll need to add your wallet address, network name, and withdrawal amount.

Once you’ve filled this, you’ll get an email confirmation code – enter it to initiate the withdrawal process.

Related Reading ➡️ Best Non-Custodial Wallets in 2025

Why You Can Trust Our Reviews on the Best UK Crypto Exchanges

Gauging the reliability of a given crypto exchange isn’t always easy. Older platforms are already established and have built trust among the investor community. But new crypto exchanges entering the UK market often have a smaller user base and lack the same solid proof of work.

Fortunately, our team at NewsBTC have vast experience testing and reviewing crypto platforms. We know what to look for in terms of features, security, and trust factors, ensuring our top picks offer the best trading experience.

For starters, we review every feature such as spot and future trading, trade orders, copy trading, and staking to check if they work as advertised.

During our time testing an exchange, we also pay attention to other must-know factors such as market spread, liquidity, and leverage.

Needless to say, we also test the platforms on every supported operating system – Windows, Mac, iOS, and Android. This allows us to check out the user interface across various platforms.

Lastly, the security measures employed by the exchange are also of utmost importance. We check whether the exchanges offer proof of reserve, undergo regular audits with public reports, and offer device security such as multi-factor authentication.

Final Thoughts: Best Crypto Platforms to Use in 2025

MEXC is one of the best crypto platforms you can use in the UK. For starters, you can directly buy crypto using GBP through various payment methods, including debit and credit cards, Apple Pay and Google pay.

Moreover, it has a huge spot market with more than 2,800+ listed pairs with deep liquidity and low spreads.

And for experienced traders, MEXC offers 1,100+ futures contracts, with leverage going as high as 500x on certain pairs. For niche asset hunters, MEXC even has a dedicated meme coin market, where you can buy all the latest and trending coins.

Beginners can also benefit from the copy trading feature that helps you replicate the moves of successful traders on the platform in exchange for a profit share – perfect for getting started and gaining trading experience.

Last but not least, MEXC offers handy iOS and Android apps and a 20 $USDT bonus upon signup.

Frequently Asked Questions About the Top Trending Crypto

1. What Is the Best Crypto Exchange in the UK?

MEXC is the best crypto exchange in the UK offering up to 4,100+ crypto trading pairs across spot and futures markets. It charges no maker fees and a low taker fee of just 0.05%.

Besides this, you can get up to 500x leverage on major assets like $ETH and $BTC. You can also access copy trading features and stake your tokens for additional rewards.

2. Are UK Crypto Exchanges Safe?

Crypto exchanges should be registered with the FCA to operate in the UK. However, there are several offshore crypto exchanges that accept UK citizens along with proper risk disclaimer as required by the FCA.

Exchanges that do this, such as MEXC and Binance, are reputable and have a positive track record regarding safety protocols. They have cold asset storage, proof of reserves, and undergo regular safety and compliance audits.

3. Can I Buy Bitcoin With GBP?

Yes, you can go on any exchange such as MEXC and Margex to buy crypto directly with GBP. You can use payment methods like debit or credit cards and online wallets like Apple Pay and Google pay.

Simply enter the amount of GBP you want to spend, and you’ll see the amount of Bitcoin you’ll get. Once you set up and confirm the transaction, the Bitcoin will enter your exchange wallet.

4. Do I Need KYC to Use a Crypto Exchange?

Not all crypto exchanges require you to undergo KYC before starting to trade. For instance, if you’ve not completed KYC on MEXC, you can still trade and even withdraw up to 10 $BTC daily.

Primary KYC increases this limit to 80 $BTC. Completing KYC typically grants you higher withdrawal and deposit limits along with the full range of products the exchange has to offer.

5. Which Crypto Exchange Has the Lowest Fees?

MEXC has the lowest spot fees – it charges 0% maker fees and only 0.05% taker fees. You can also trade more than 4,000 pairs listed on the exchange.

If you’re trading in crypto futures, you can pick PrimeXBT, as they offer a low 0.01% maker fee and 0.045% taker fee.