Are you looking for the best crypto to stake? While many coins offer staking, not all are great. That’s where we come in to cover some of the most profitable cryptos to stake for high APY.

We go over the most promising new coins with high rewards, including Bitcoin Hyper, Maxi Doge, and Pepenode.

Keep reading to find all the info you need to make an informed decision. Our reviews include all the numbers and facts you’ll want when choosing the best crypto to stake. Please note this article is based on independent research and doesn’t constitute financial advice.

Let’s get to it, shall we?

The Best Crypto to Stake at a Glance

Before we get down to the nitty-gritty of staking and crypto reviews, let’s take a brief look at some of the best staking coins:

- Bitcoin Hyper ($HYPER) – Bitcoin-Centered L2 Ecosystem with Its Own DAO

- Maxi Doge ($MAXI) – $DOGE-Inspired Meme Coin With High Upside Potential

- BMIC AI ($BMIC) – Future-Proof Crypto Staking Project Built Around Quantum-Safe Security

- LiquidChain ($LIQUID) – Ultra-High-APY Staking with Cross-Chain Power

- PepeNode ($PEPENODE) – The First Mine-to-Earn ERC-20 Meme Coin

- SUBBD Token ($SUBBD) – AI-Powered Social Media Platform with Extensive User Perks

- Vortex FX ($VFX) – AI-Enhanced Trading Platform Offering Staking Rewards Across Crypto, Forex, and Commodities

The Best Crypto to Stake Right Now Reviewed

We think these tokens are among the best staking cryptos right now, and the following reviews explain exactly why these coins have high potential.

1. Bitcoin Hyper ($HYPER) – Bitcoin-Centered L2 Ecosystem with Its Own DAO

Bitcoin Hyper ($HYPER) is a multi-layered project meant to upscale Bitcoin for faster execution, cheaper transactions, and broader DeFi compatibility.

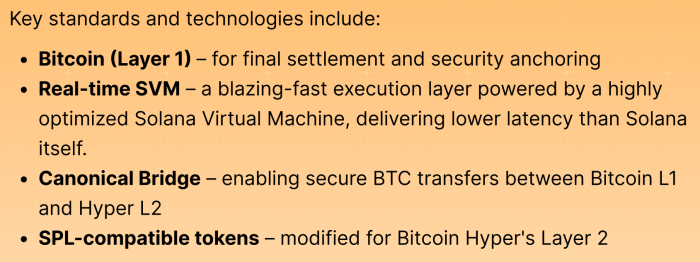

It does so using its own Layer-2 (L2), which integrates Solana Virtual Machine (SVM) to bring dApp support for $BTC users. The L2 will communicate with the Bitcoin L1 through a proprietary Canonical Bridge, which lets users transfer and use wrapped $BTC cross-chain.

Thanks to this set-up, Bitcoin Hyper provides a low-latency, high-throughput side chain where you can more efficiently use $BTC for various Web3 applications, ranging from DeFi yields, NFT trading, blockchain gaming, and more.

This is big news, considering that Bitcoin’s L1 is currently suffering from slow transactions, expensive fees, and limited scalability. Although it nails decentralization and security, Bitcoin has been slowly falling behind newer networks like Ethereum and Solana. Well, not anymore.

Overall, Bitcoin Hyper has a lot of potential. It raised over $1M in just two weeks (and this number now sits at over $25M). Need we say more?

And $HYPER has more community incentives planned to bring in investors. Staking is the main attraction throughout the presale, with an impressive ~40% APY for early buyers.

However, like most presales, the staking rewards are dynamic and fluctuate with the size of the staking pool. Right now, the pool has over 1B tokens staked.

Because the project will have its own DAO (coming out in Q2, 2026), holding more tokens will boost your voting power when it comes to ecosystem governance. So, staking for additional returns is still worth it if you plan to use the Hyper network in the future.

Related Reads:

- How to Buy Bitcoin Hyper Tokens — A Full Guide

- Bitcoin Hyper Price Potential — Full Price Prediction (2026-2030)

2. Maxi Doge ($MAXI) – $DOGE-Inspired Meme Coin With High Upside Potential

In the wild world of meme coins, Maxi Doge ($MAXI) emerges as the undisputed champ for adrenaline-fueled traders who live for the pump. Built on Ethereum, Maxi reimagines the iconic Doge as a jacked-up bodybuilder Shiba Inu, slamming 1000x leverage trades while chugging energy drinks.

Pure degen energy, and many are down for it.

In fact, despite the presale having only begun in late July this year, it’s already raised over $4M in early investor funding, with some recent purchases totaling over $314k. All of this shows strong early interest in the token, which could see it pump on launch.

The staking rewards are the cherry on top.

Those who invest in the presale can stake their tokens (currently at ~70% APY). Of course, the rate will drop as more investors stake their tokens. Over 9B tokens have already been staked.

With trading contests and futures trading platform partnerships (for high leverage trades) on the roadmap, there’s a lot to like, making $MAXI a worthy token to watch in the years to come. Could it outpump $DOGE and other dog-themed tokens? Perhaps.

The utility is certainly a plus and a good foundation for a token looking to stay relevant in the long term. With a much smaller market cap (when compared to established tokens like $DOGE), $MAXI does offer higher upside potential, not to mention a cheaper price point.

One token currently costs just $0.0002685, but this will increase as more investors join the presale. Click the button below to connect your wallet if you’re looking to buy and stake your $MAXI. If you need a detailed guide, here’s a step-by-step on how to buy Maxi Doge tokens.

3. BMIC AI ($BMIC) – Quantum-Secure Staking Built for Long-Term Web3 Protection

BMIC AI takes a very different approach to crypto staking. Instead of chasing short-term yield alone, the project is focused on protecting long-term stakers from one of the biggest future risks in crypto, quantum computing.

Most staking systems today expose public keys on-chain. That is fine for now, but it creates a serious vulnerability known as “harvest now, decrypt later.” Once quantum computers mature, long-term stakers could become prime targets. BMIC is designed to remove that risk entirely.

The project uses post-quantum cryptography, signature-hiding smart accounts under ERC-4337, and AI-assisted security layers. This means staking rewards can be earned without exposing classical keys, making BMIC one of the few projects addressing staking security at a structural level.

From a staking perspective, $BMIC is built as a core utility token. It will be required for quantum-secure staking participation, governance voting, wallet feature access, and enterprise integrations. As the ecosystem expands, staking demand is tied to real usage rather than temporary incentive farming.

BMIC’s tokenomics support a long-term staking model. Total supply is capped at 1.5B tokens, with 750M allocated to the ICO and a hard cap of $40M. Presale pricing starts at $0.048485 and increases gradually across phases, rewarding early stakers with a lower cost basis.

Unlike ultra-high-APY plays that rely on inflation, BMIC’s staking is designed to align with real service demand. Rewards are linked to platform usage across wallets, APIs, and future compute services rather than unsustainable emissions.

For investors looking to stake in 2026 with a longer horizon, BMIC represents a higher-conviction play. It combines yield potential with future-proof security, which is rare in a market still focused on short-term returns. To explore the staking design and follow ongoing development, you can review the project’s whitepaper, track updates on X, or join discussions in the official Telegram channel.

4. LiquidChain ($LIQUID) – Ultra-High-APY Staking with Cross-Chain Power

LiquidChain is a Layer-3 (L3) blockchain built to unify Bitcoin, Ethereum, and Solana liquidity. But what makes it a serious contender for the best crypto to stake today isn’t just its architecture, it’s the jaw-dropping staking rewards.

The $LIQUID token is currently on presale at a price of $0.01225, with staking yields in the five-digit range, now at ~16,000% APY. This offers one of the most aggressive reward structures in the market, and it’s tied to a high-utility ecosystem to boot.

The LiquidChain L3 protocol’s design is ambitious: it uses trust-minimized verification to validate native Bitcoin, Ethereum, and Solana holdings. That means it doesn’t rely on wrapped tokens. Real $BTC, $ETH, and $SOL liquidity flows directly through LiquidChain, enabling deep, efficient markets.

LiquidChain’s execution environment uses a Solana-class VM, tuned for low-latency, high-throughput DeFi. It isn’t just for swaps, either. This setup ensures LiquidChain will be well-equipped to onboard staking and lending protocols down the line. So, there’s room for blue-chip yield opportunities as the ecosystem expands.

Right now, the project has live staking for its $LIQUID token. Out of a total supply of 11.8B $LIQUID, 15% is reserved for staking and community rewards. That allocation ensures ongoing incentives for early backers.

If you’re stacking for yield in 2026, LiquidChain offers a high-risk, high-reward play: you’re backing a cross-chain infrastructure vision with promising fundamentals and wildly generous early staking incentives.

5. PepeNode ($PEPENODE) – The First Mine-to-Earn ERC-20 Meme Coin

PepeNode ($PEPENODE) is making serious waves, despite being in the early stages of its presale (which only began in August this year). What’s the attraction? For starters, it’ll be the first mine-to-earn meme coin.

And no, no expensive equipment will be needed. Anyone can play the virtual game and earn more $PEPENODE (and later other popular meme coins, such as $PEPE and $FARTCOIN). Interactive and unique. This is the main USP, but there’s more…

Staking rewards are still high compared to most presales we’ve seen. We’re talking ~500% APY. The opportunity here goes far beyond just having more $PEPENODE, though. That’s because the more tokens you have, the more mining nodes you’ll be able to get for your server room.

More nodes = higher mining power = more meme coins!

Holders will also be able to combine certain nodes for more mining oomph, so it’ll be fairly strategic. To add to this, leaderboards and additional rewards are teased in PepeNode’s roadmap.

Utility like this, paired with the growing community and rewards system, positions PepeNode as a token that could light the charts green on launch and maintain momentum in the years following.

If you’re interested in learning more about or investing in this project, click the button below to visit the official website. For more on its potential, here’s a full $PEPENODE price prediction for 2026-2030 (we predict it could jump 700+% up from its current price by 2030).

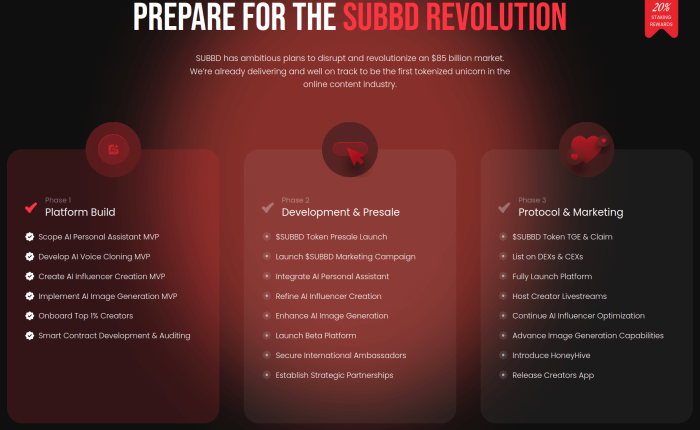

6. SUBBD Token ($SUBBD) – AI-Powered Social Media Platform with Extensive User Perks

SUBBD Token ($SUBBD) is a utility token made to fuel the SUBBD app, an AI-powered social media platform made with creators and fans in mind.

Unlike traditional social media platforms and subscription models, SUBBD lets users support and interact with their favorite creators in several ways. Holding the $SUBBD token, for example, ensures access to exclusive content and even platform discounts.

Creators on the platform will also get AI-powered automation tools to upscale their content quickly and easily, freeing up more time to build their community. Simply put, this cryptocurrency has strong utility and potential, which makes it a great coin to stake right now.

Note that, unlike other presale cryptocurrencies, $SUBBD has a fixed 20% staking reward. This means you don’t have to worry about the APY going down. Still, getting in early will help you make the best of this staking opportunity.

Note that, unlike other presale cryptocurrencies, $SUBBD has a fixed 20% staking reward. This means you don’t have to worry about the APY going down. Still, getting in early will help you make the best of this staking opportunity.

Currently, the token costs only $0.056975, a great entry point for potentially massive returns once the presale ends. Moreover, according to the project’s whitepaper, the SUBBD platform’s beta release will happen during the presale, not after the coin lists on exchanges.

This is quite rare for new crypto projects and a good sign that the development team is set on delivering on its promises.

Combine this level of trust with the platform’s huge media following, and things are looking pretty good for $SUBBD.

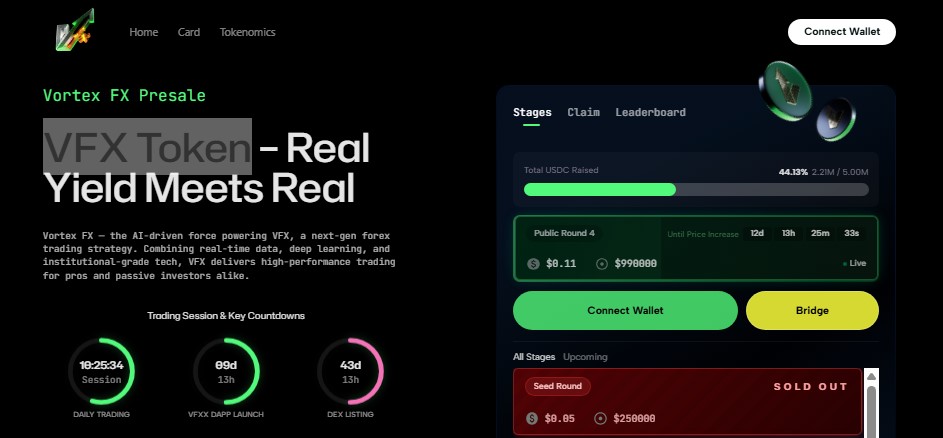

7. Vortex FX ($VFX) – AI-Powered Trading Platform Bridging Crypto, Forex, and Commodities

$VFX is tied to a next-generation trading ecosystem designed to unify multiple asset classes under one platform. Vortex FX (currently live in public presale) allows traders to access crypto, forex, commodities, and other assets seamlessly, all through a single, AI-enhanced interface.

This is a game-changer for traders, as most platforms require juggling separate accounts and tools to manage diverse portfolios. Vortex FX solves this by providing fast cross-asset execution, real-time analytics, and smart AI-driven insights, making portfolio management simple and efficient.

Utility is clear from day one. $VFX holders benefit from daily staking rewards in $VFX or USDC, governance rights through DAO participation, and referral incentives. Up to 70% of platform fees are distributed back to token holders, creating a strong incentive to participate early.

Exclusive perks include VFX Cards for worldwide spending, leaderboard competitions, and bonus rewards tied to presale contributions. The presale has already attracted strong interest, and with the platform’s roadmap progressing, now is an ideal opportunity to get in early.

What is Staking in Crypto?

When you stake your cryptocurrency, you essentially commit to locking your tokens up for a certain period of time. Staked tokens help validate transactions and keep the network secure. In return, you receive free additional crypto as a reward.

You can think of it like putting money into a fixed deposit account. While you can’t use this money for a certain period, the bank incentivizes you to keep your money ‘locked up’ by rewarding you with interest.

The staking reward is represented as the Annual Percentage Yield (APY), and it shows you the total amount of interest earned on staked crypto over one year.

For example, let’s say a project offers an APY of 293%. This means that, assuming the APY stays the same, your staked balance has the potential to grow by 293% throughout the following 12 months.

An important note here is that the APY drops as more tokens are being staked. The earlier you stake your tokens, the better the return’s potential could be. This mechanism incentivizes early adoption and long-term staking.

Now, not all cryptocurrencies can be staked. Only tokens that use a staking-based algorithm—like Proof of Stake (PoS) or Delegated Proof of Stake (DPoS)—allow it. Solana and Ethereum are such examples.

On the other hand, non-staking tokens, like Bitcoin, use something called a Proof of Work (PoW) system. In place of staking, these tokens are mined and therefore rely on computational power to secure their network.

Where and How Do You Stake Crypto?

If you want to stake your crypto, you have a few options. The most common way is through centralized exchanges (CEX) like Margex or Binance, which are among the best crypto exchange platforms at the moment.

These platforms make it easy to stake crypto as they offer built-in staking services and, not to mention, are designed to be easy to navigate, even for beginners.

Simply deposit your crypto into your exchange account, head over to the staking section, and opt into a staking program. Once your tokens are staked, these platforms usually manage the lock-up periods and will also automatically calculate any rewards.

Another way you can stake your crypto is through non-custodial crypto wallets like Best Wallet. Non-custodial simply means you have control over your private keys, unlike centralized exchanges that own your private keys and therefore manage your crypto assets on your behalf.

Either way, both methods are very much the same. Simply fund your crypto wallet with the tokens you’d like to stake, navigate to the staking section, and opt to lock your tokens for APY returns.

How We Picked the Best Crypto for Staking

This article covers a small handful of cryptocurrencies, though there are thousands of coins in the market today. With a market cap exceeding $3T, there has never been more potential to make money from crypto.

The only question is where to find the next big token. That’s where we come in. We’ve done extensive research to bring you a list of the best crypto to buy and stake, basing our top picks on key aspects like:

- Project Functionality – A coin’s roadmap shows us how well the project is thought out and if it offers any long-term utility. If a crypto project has a unique proposition and can offer something that not many other projects offer, it could have the potential to go far and gain value over time.

- Tokenomics – We analyze the project’s token distribution, taking note of how the project plans to support its ecosystem and whether the community receives fair rewards and incentives. For example, $HYPER allocates 15% of the total supply for rewards, while a larger 30% has been reserved for the development of the project, indicating plans to maintain Bitcoin Hyper into the future.

- Staking Rewards – We look into projects with good APY but also long-term stability. A high APY might be attractive at first. However, if the rewards are driven by inflationary mechanisms (the project mints too many new tokens to pay rewards), the token could suffer in the long term.

- Presale Performance – Looking at the presale allows us to gauge the hype around a coin, which is generally a good indication of what the project could achieve in the future. Bitcoin Hyper’s explosive early presale momentum, for example, indicates significant interest and rapid adoption.

- Community – A growing and active community indicates strong trust and support for a project. This helps the reputation of a coin in the short and long term and encourages users to invest and stake that crypto. This translates into wider adoption and could result in less volatility.

However, even with all the coins we already vetted and reviewed, it’s still important that you do your own research and fully understand a crypto project before investing. This article is not financial advice but merely an opinion.

Is Staking Crypto Worth it?

Staking crypto really depends on your financial goals and expectations. Overall, staking crypto is a good way to make passive income and, in many cases, earn yields higher than a typical bank would offer. However, your assets will also be locked and, therefore, illiquid for a period of time.

As for staking new coins with very high APY, you should also consider the level of risk you’re willing to withstand, as the market is extremely volatile and new tokens fluctuate wildly.

Without proper research and a good understanding of a potential investment, it’s very tough to determine if investing in and staking crypto is worth it, particularly for new and upcoming tokens.

Should I Stake Crypto?

While we’ll never tell you what to do when it comes to investing in crypto, staking your assets does bring benefits. However, as with all things in life, there are also some risks to be aware of. Let’s take a deeper look:

Benefits of Staking Crypto

- Opportunity to earn passive income

- Your staked crypto could potentially appreciate in price

- Helps to stabilize the token’s price

- Helps to secure the network by validating transactions

- Governance rights or active participation in the blockchain network

Risks of Staking Crypto

- Staked tokens can’t be claimed until the staking period ends.

- Changes in protocols could negatively impact your rewards over time.

- Tokens can be ‘slashed’ or partially confiscated if network protocols are violated.

Summary of the Best Crypto to Stake in 2026

Staking crypto can be potentially rewarding and is a popular strategy for earning passive returns. However, it does have its own risks, and understanding these risks empowers you to make informed decisions.

The coins we covered all provide great staking APY right now, though if you want to succeed in the crypto market, it’s important to choose tokens that align with your long-term investment goals. New coins are, above everything, highly volatile and speculative.

A good rule of thumb is to diversify your portfolio to mitigate some of the losses you might experience. Remember, this article is not for financial advice, and you should always DYOR before putting money into crypto.

FAQs

1. Is staking crypto safe?

Yes, staking crypto is safe, provided you stake your coins through a secure platform and vetted smart contracts. The crypto you stake can also impact your investment’s potential, with volatile tokens potentially depreciating in value throughout the lockup period.

2. What crypto has the highest stake APY?

Of all the cryptos we covered, $PEPENODE has the highest staking APY of around ~550+%. Keep in mind that as more tokens are staked, the APY tends to drop, so early participation is incentivized with better rewards.

3. What is the best crypto to stake right now?

The best crypto to stake right now depends on your investment goals and strategy. For stability, established coins like $ETH and $ADA are best. If you like a bit of risk, new coins like $HYPER have great potential. As always, it’s important to do your own research before investing.