Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the continuous downward trend in the global crypto market, leading on-chain analytics firm Glassnode yesterday reported some significant movement recorded in the Bitcoin (BTC) and Stablecoin markets. According to Glassnode, the dominance of Bitcoin and stablecoin flows have seen “dramatic shifts” over the years.

Changes In Bitcoin Supply Ownership

In a series of tweets posted earlier today, Glassnode released a recent report shedding light on the evolving landscape of Bitcoin supply ownership and the dynamics surrounding stablecoins.

The findings reveal significant shifts in the dominance of Bitcoin supply and the distribution of stablecoin holdings, indicating changing investor behaviors and potential migration of liquidity towards lower-risk digital assets.

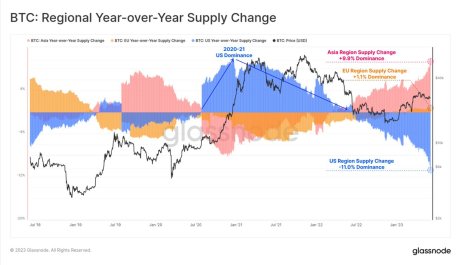

According to Glassnode’s report, the dominance of BTC supply has witnessed a noteworthy transformation over the past two years. US entities now hold 11% less Bitcoin than in June 2022, while investors active during Asian trading hours have increased their holdings by 9.9%.

This reversal of fortunes represents a distinct departure from the trends observed during the 2020-2021 bull cycle, signifying a shift in market dynamics and investor preferences.

Stablecoin Dynamics And Changing Market Sentiment

Glassnode’s report also highlights significant developments in the stablecoin space. The supply of USDT (Tether) has reached all-time highs, indicating a surge in demand for this popular stablecoin. In contrast, the supplies of USDC (USD Coin) and BUSD (Binance USD) have declined to multi-year lows.

This divergence suggests that non-interest-bearing stablecoins, such as USDT, are attracting more attention and capital, potentially due to their utility in trading and liquidity provision.

Furthermore, Glassnode’s analysis of on-chain flows reveals a decline in demand since April. While stablecoin inflows had significantly outweighed Bitcoin and Ethereum inflows in the first quarter, the market correction has led to a reversal in this trend.

Glassnode now observes larger BTC and Ethereum inflows, possibly indicating sell-side activities as market participants adjust their positions in response to the evolving landscape.

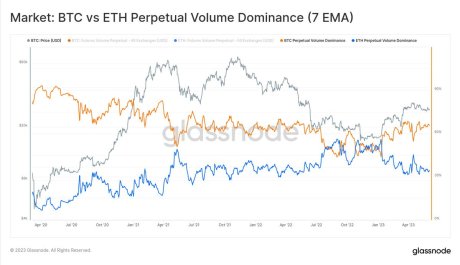

These findings collectively suggest a net capital rotation and the migration of liquidity towards lower-risk digital assets. Glassnode’s data aligns with the observation that BTC futures trade volumes are increasingly dominating the market, surpassing Ethereum and other digital assets in 2023.

The recent increase in Bitcoin’s volume dominance, surpassing 65%, supports the notion that Bitcoin is perceived as a relatively lower-risk digital asset within the digital asset realm.

Meanwhile, Bitcoin has witnessed a dramatic plunge in the past week and in the past 24 hours. The largest crypto asset by market capitalization has recorded a bearish movement down by 8.8% in the past 7 days. Over the past 24 hours, BTC has seen a 4.2% loss.

At the time of writing, BTC currently trades below $26,000. This plummet follows the ongoing negativity in the crypto market including the lawsuit from the US regulator, the Securities and Exchange Commission (SEC) which has now affected the world’s largest crypto exchange Binance.

~ Featured image from iStock, Chart from TradingView