Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

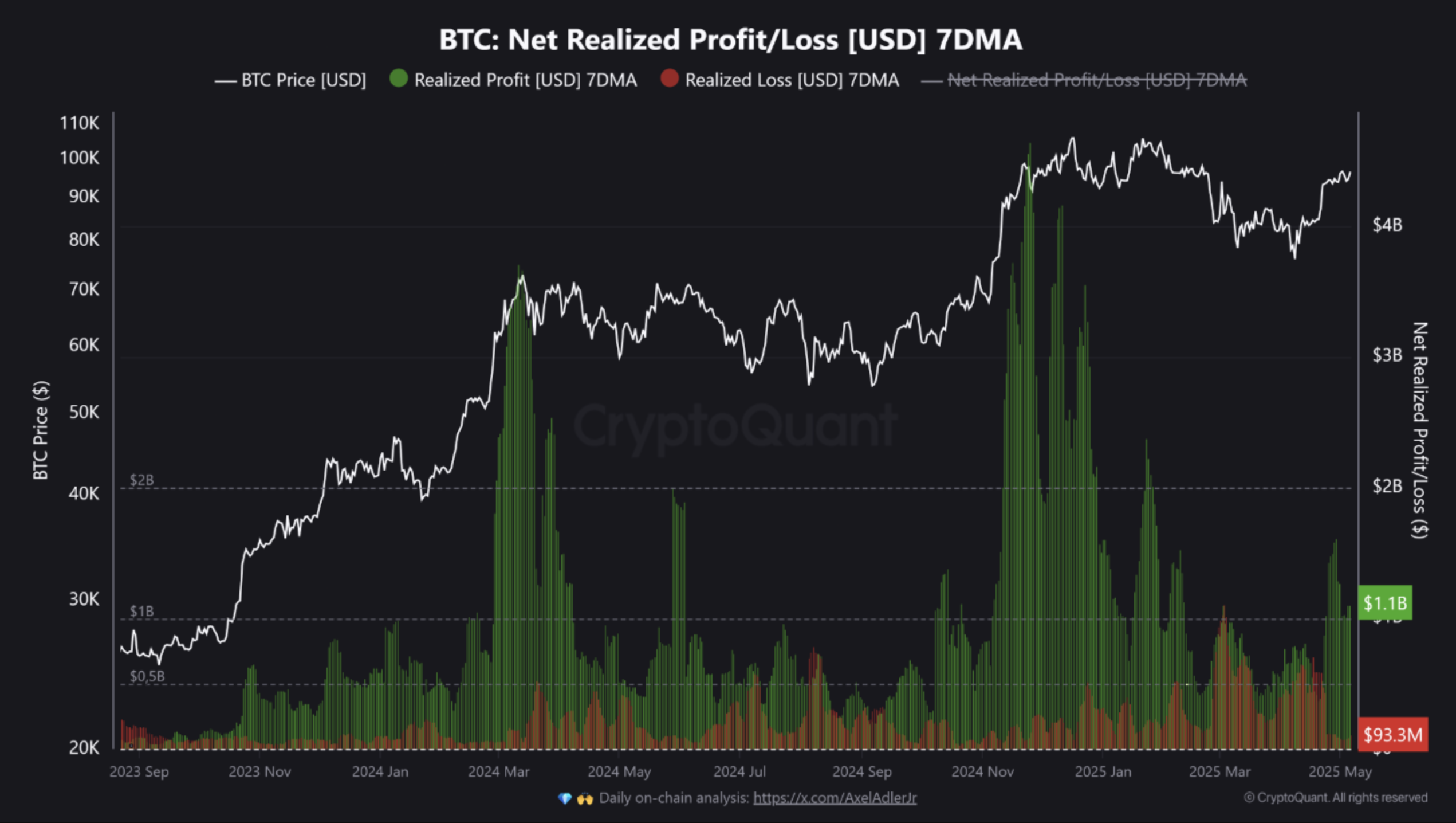

According to a recent CryptoQuant Quicktake post, Bitcoin (BTC) investors are aggressively taking profits following the latest surge in the digital asset’s price. This uptick in profit-taking mirrors investor behavior typically seen during the late stages of a bull market.

Bitcoin Profit-Taking Rises – A Cause For Worry?

Bitcoin’s 7-day moving average (MA) net realized profit/loss has mostly remained positive since early 2024. The metric surged as high as $1 billion a day as the flagship cryptocurrency pushed towards new all-time highs (ATH) last year.

Although BTC experienced a sharp downturn between March and April 2025, profit-taking remained robust as Bitcoin recovered most of its losses. The asset is currently trading in the mid-$90,000 range.

CryptoQuant contributor Kripto Mevsimi noted that such strong realized profits – even as prices rise – typically signal a late-stage bull market. Drawing comparisons to the 2021 market cycle, Mevsimi pointed out that similar patterns preceded a local top.

However, the launch of spot Bitcoin exchange-traded funds (ETFs) in January 2024 has altered the market structure to a great extent. That said, investor psychology has remained the same in that profit-taking patterns still align with historical patterns, though now with greater speed and volume.

Mevsimi shared several possible scenarios that may play out in the market. First, If realized profits remain high, the likelihood of a sharp correction increases. This may push BTC back toward $90,000.

On the contrary, if profit-taking declines, it could indicate the start of a market cycle transition. Either way, short-term volatility is expected to rise. The post adds:

The signal is not calling a full macro top, but it’s flashing a local caution zone. As always: zoom out, and follow behavior — not just price.

BTC Could See A Temporary Pullback

Meanwhile, seasoned crypto analyst Ali Martinez warned that BTC may retest the $97,700 resistance ahead of today’s Federal Open Market Committee (FOMC) meeting, which could trigger another short-term pullback.

Additionally, Bitcoin’s supply scarcity narrative is being questioned. While exchange reserves continue to dwindle, recent on-chain data suggests a supply squeeze is unlikely in the near term.

In similar news, Bitcoin’s demand momentum is yet to recover from negative territory. Recent data shows that market participants are still favoring short-term speculation over holding BTC for the long-term.

That said, momentum indicators like the Bitcoin Stochastic RSI are showing renewed strength, bolstering the case for BTC to reach a new ATH. At press time, BTC trades at $97,248, up 3.4% in the past 24 hours.