Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A growing chorus of Bitcoin commentators is raising the alarm over the recent boom in publicly traded companies adopting Bitcoin-centric treasury strategies. The debate ignited this week after pseudonymous investor Stack Hodler (@stackhodler) described the trend as a speculative mania disguised in corporate form, writing on X that “Bitcoin treasury companies are this cycle’s shitcoins.” His argument: these companies are “creating shares out of thin air to sell to people hoping to outperform Bitcoin,” with little more than exposure to BTC as their core product. “It’s just TradFi shitcoinery,” he warned. “And many will get rekt.”

Stack Hodler allowed that these companies are currently soaking up speculative liquidity that might otherwise chase illiquid altcoins. “But the bad news is that many of these businesses will inevitably be forced to dump their stacks one day,” he added, pointing to the moment when short-term investors realize that holding equity in a Bitcoin proxy may be less efficient than self-custody. “Fiat shenanigans with the potential to unwind” was how he framed the model. In contrast, he celebrated companies that generate real economic value and use their profits to accumulate Bitcoin—something he views as a sustainable force in Bitcoin’s monetization arc.

Bitcoin podcaster Stephan Livera entered the conversation by referencing MicroStrategy’s Q1 2025 earnings call, where Michael Saylor laid out the rationale for the company’s persistent premium to net asset value. “Saylor outlined some reasons for MSTR being at a multiple to NAV,” Livera said. While acknowledging the cyclical nature of that premium—comparing it to the GBTC discount blowout in the previous cycle—he argued there’s a broader structural context. “Bitcoin is a $2 trillion asset in a world of $1,000 trillion in assets,” Livera noted, emphasizing that many large capital allocators remain unable to directly hold Bitcoin due to regulatory, tax, or mandate-related restrictions. “There’s a case for some treasury companies to exist long-term, so long as they’re managed prudently.”

The Bitcoin Treasury Copy-Cat Surge

But Stack Hodler wasn’t referring to MicroStrategy. “I’m talking about the copycats that are popping up at an accelerating pace,” he responded. “They’re trying to draft off MSTR’s success, similar to how shitcoins drafted off of BTC’s success.” He said he doesn’t deny that regulatory arbitrage might support a few of these firms in the short to medium term, but questioned the viability of companies whose primary activity appears to be printing shares and using the proceeds to buy Bitcoin. “I love seeing companies with real profitable businesses stack BTC. Fiat engineering seems shakier to me long-term.”

Scott Melker, host of “The Wolf of All Streets” podcast, added to the discussion: “I hate to even think this, because I’m a huge fan—but Bitcoin treasury companies raising debt to buy Bitcoin could be the next bubble.” Market structure analyst Dave Weisberger agreed that risk is present, but took a more measured stance. “Sure. But bubbles have to inflate before we worry about them… spoiler, Bitcoin is NOT near bubble territory.”

Technical analyst FiboSwanny, a 25-year market veteran, focused on leverage and market structure. “If there’s a bubble forming, it’s likely in the financial instruments and leverage around Bitcoin,” he said, citing debt-funded treasury purchases, ETFs, and derivatives. “Not in actual Bitcoin itself.” Lark Davis took a more bearish tone: “This is our GBTC leverage this cycle that will have a horrific unwind with devastating consequences later. Especially the companies buying altcoins.”

Swan CEO Cory Klippsten didn’t mince words either. “Already jumped the shark,” he wrote. “Have been predicting it for a year, but it’s inevitable now.”

The current landscape includes dozens of public companies with direct Bitcoin holdings, some of which are drawing intense retail speculation. MicroStrategy remains the dominant force, with well over half a million Bitcoin on its books. Other names include Metaplanet in Japan, Semler Scientific, KULR Technology, and various new entrants who have reoriented their corporate missions entirely around Bitcoin accumulation. Many of these firms are now trading at multi-billion-dollar valuations, far above what their underlying business models would suggest.

But the sustainability of the model remains in question. Most of these companies rely on issuing new equity at inflated valuations to finance further Bitcoin purchases, creating a reflexive cycle where rising BTC prices inflate share prices, which in turn enable more buying. That dynamic works beautifully in a bull market but can reverse quickly in a downturn.

The debate over how institutional exposure is structured becomes increasingly relevant. Stack Hodler framed it simply: “Bitcoin is and always will be the best risk-return asset to hold in this space. Part of successfully holding Bitcoin is being able to resist all the ‘better Bitcoins’ that inevitably arise during your journey.” Whether the new class of treasury companies represents innovation, opportunism, or simply a bubble waiting to burst, remains one of the key questions of this cycle.

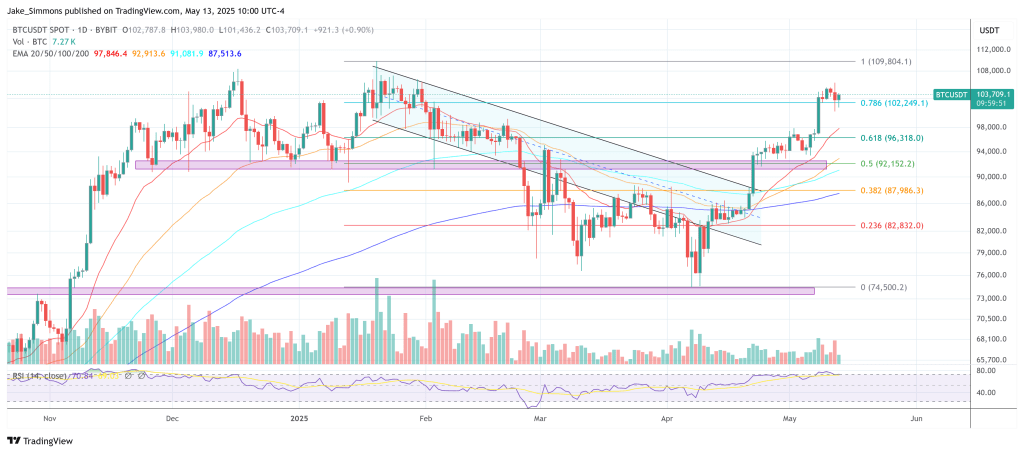

At press time, BTC traded at $103,709.