Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a thread on X, business cycle analyst Tomas (@TomasOnMarkets) explains where the global economy currently stands and what that means for risk assets, including Bitcoin. Describing what he terms a “short and shallow” full business cycle that started in 2023, faded in 2024, and bottomed out in early 2025, Tomas believes this fleeting cycle was masked in part by a weak Chinese economy and a rapidly strengthening dollar.

He explains, “The general gist of the theory was that we saw an abnormal, ‘short and shallow’ full business cycle over recent years that suppressed traditional PMI measures both in the US and globally.”

According to Tomas, his analysis relies on four real-time measures of the global economy, which he tracked in inverted trade-weighted dollar index, Baltic Dry Index, 10-year Chinese Government bond yields, and the copper/gold ratio. By converting these individual data points into rolling yearly z-scores, he created an “equal-weighted composite z-score” he calls the Global Economy Index (GEI).

He notes, “You can see clearly here that the GEI was underwhelming to the upside in 2023 and 2024 (didn’t reach the ‘business cycle peaking zone’). And then fell to levels typically correlated with the end of a business cycle in late 2024/early 2025 (‘business cycle troughing zone’).”

This composite measure appeared to lead US Manufacturing PMI data prior to the disruptive events of 2020, and Tomas highlights that relationship by shifting the GEI forward by six months. He observes a break in the pattern around the 2020 pandemic and the following large-scale central bank interventions, yet still sees the possibility that GEI’s recent rebound indicates a new “fresh” business cycle taking hold, potentially peaking around late 2026 or 2027. “Based on historical precedent,” he writes, “this new business cycle could reasonably be expected to peak around late 2026/2027.”

He also addresses the interplay between GEI, equities, and PMIs, remarking that the stock market usually leads business survey measures but tends to lag the GEI. “If we peel back the layers of the onion, we find the stock market generally leads PMI measures but generally lags the GEI, so it lives somewhere in the middle, most of the time,” he says. He points out that the S&P 500 recently slipped into negative year-over-year territory, which he sees as typical of end-of-cycle price behavior. “The S&P 500 has now hit what would historically be an acceptable ‘end of business cycle bottoming level.’”

The Implications For Bitcoin

Bitcoin, however, remains the wildcard. Tomas acknowledges that the leading-lag relationship of the GEI, stock market, and PMIs might normally apply to most risk assets, yet this time around, Bitcoin appears to be deviating from its usual volatility in relation to the macro environment. “The piece of the jigsaw that doesn’t seem to fit at all (by historical precedent) is Bitcoin,” he writes.

He acknowledges that it has so far resisted typical “end of business cycle” drawdowns, and he speculates on whether “Bitcoin has just grown up and become less volatile and less sensitive to business cycle swings — potentially due to ETFs and higher institutional interest.” Yet he also entertains the possibility that Bitcoin might simply be lagging the stock market. Regardless, “if Bitcoin continues its historical relationship with the business cycle,” Tomas warns, “this would probably obliterate the ‘four year halving cycle’ theory for Bitcoin price action.”

Tomas concludes by cautioning that if the global economy index fails to maintain its recent bounce and instead rolls over to a new low, the outlook could turn more bearish, especially if so-called tariff headwinds worsen. He speculates that part of the rebound seen in copper/gold and shipping rates in early 2025 may have been frontloaded by tariff announcements, hinting that the recovery in those metrics might not be as robust as it appears on the surface.

Still, the key takeaway from his perspective is that equities and the broader business cycle appear to be in late-stage territory, and if his assessment holds, a new cycle could begin soon — one that runs long enough to postpone any meaningful Bitcoin peak until late 2026 or even 2027, calling into question any assumptions about the enduring validity of Bitcoin’s four-year halving cycle.

“Another point to note is that the GEI is currently signaling the start of a new business cycle, which could reasonably be expected to peak in late 2026/2027. If Bitcoin continues its historical relationship with the business cycle, this would probably obliterate the ‘four year halving cycle’ theory for Bitcoin price action,” Tomas concludes.

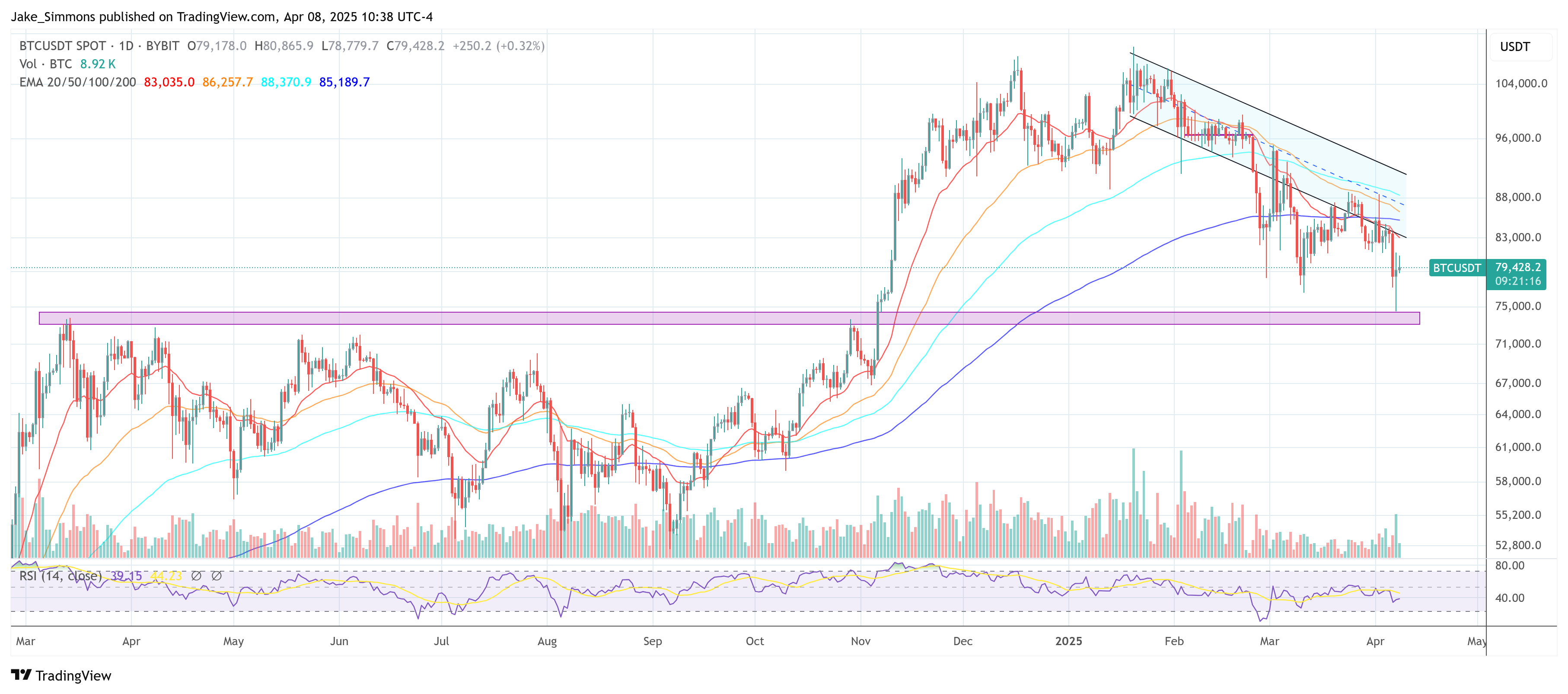

At press time, BTC traded at $79,428.