Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

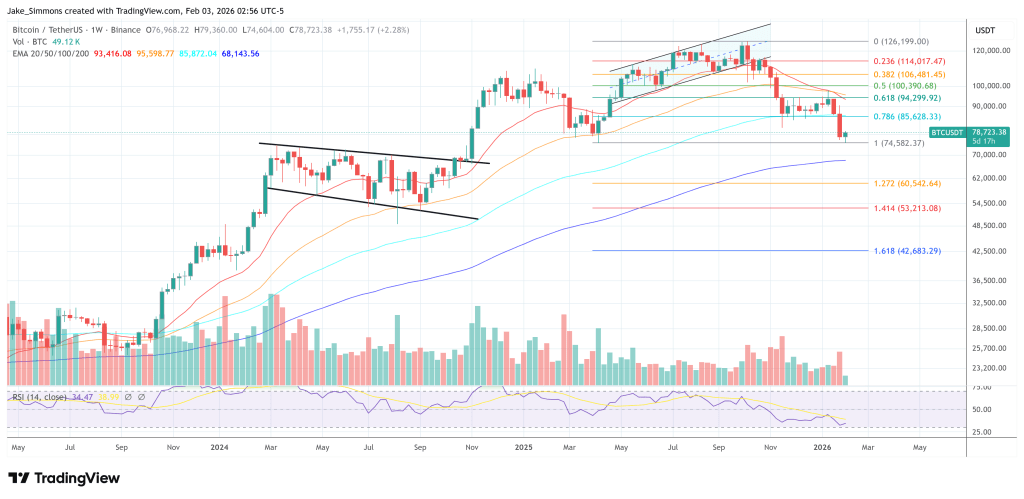

Bitcoin’s bear-market turn can be traced to Oct. 10, 2025, a session widely described as the largest crypto derivatives liquidation event on record, with roughly $19 billion in futures positions forcibly unwound as prices slid sharply off their highs.

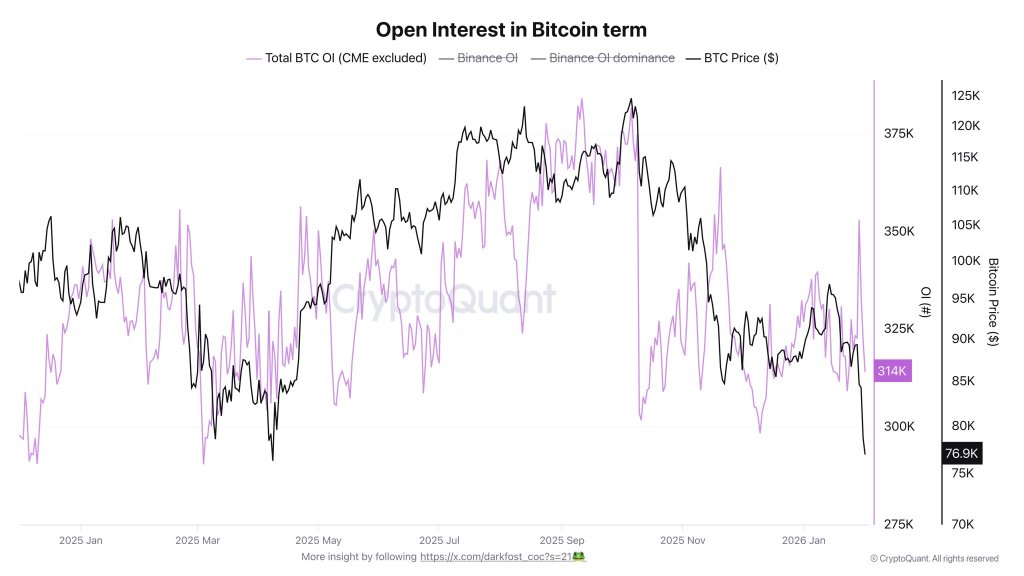

CryptoQuant contributor Darkfost argues the damage was structural as much as directional: open interest fell by about 70,000 BTC in a single day, wiping out months of leverage build-up and leaving speculation struggling to re-form. He claims that the Oct. 10 flush was “really the one that pushed BTC into a bear market” because of the speed and magnitude of liquidity destruction in futures.

Why October 10 Was The Bitcoin Bear Market Beginning

Darkfost pointed to a collapse in open interest measured in BTC terms. “In a single day, around 70,000 BTC were wiped out from Open Interest, bringing it back to its April 2025 levels,” he wrote. “That’s the equivalent of more than six months of Open Interest accumulation erased in one session. Since then, Open Interest has been stagnating and struggling to rebuild.”

The implication is less about the specific catalyst for the selloff and more about market structure after it. In Darkfost’s telling, the Oct. 10 event wasn’t just a price move; it was a sudden reduction in the market’s capacity to carry leverage, which tends to compress speculative activity across the complex.

“Liquidity destruction in an already uncertain crypto market environment is not conducive to a return of speculation, which is nonetheless a key component of the crypto market,” he added.

That view resonated with Bitcoin Capital, which replied that “nothing has been the same after 10/10,” adding that “it actually feels like something broke.” Darkfost’s response was blunt about the path back: “It needs to be rebuilt and it can takes months …”

In a follow-up post, Darkfost widened the lens beyond derivatives, describing an environment where spot participation has also cooled. He said Bitcoin is entering a fifth consecutive month of correction, with the October 10 event as a major driver due to its impact on futures liquidity, but “not the only factor at play.”

He flagged broader liquidity pressure via stablecoin flows and supply. According to his figures, stablecoin outflows from exchanges have coincided with an approximate $10 billion decline in aggregate stablecoin market capitalization over the same period, an additional headwind for risk-taking, particularly when leverage is already being de-risked.

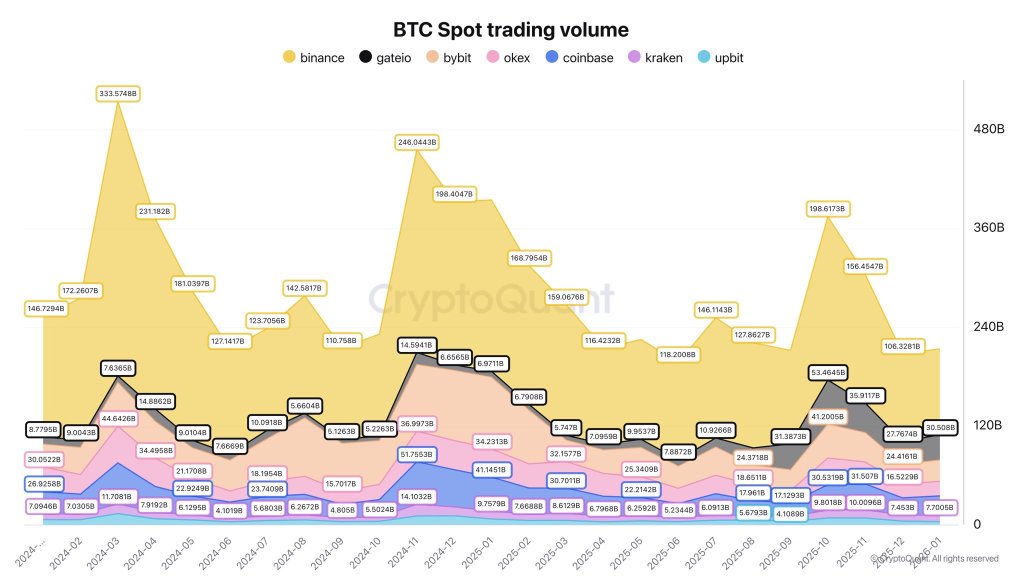

Spot volumes, he argued, tell a similar story of disengagement. Since October, BTC spot volumes have been cut roughly in half, with Binance still holding the largest share at $104 billion. He contrasted that with October levels when Binance volume “had nearly reached $200B,” alongside $53 billion on Gate.io and $47 billion on Bybit.

Darkfost characterized the contraction as a return to “levels among the lowest observed since 2024,” and read it as weaker demand rather than simply a lull in activity. The current setup, he wrote, “remains uncertain and does not encourage risk-taking,” arguing that a durable recovery would require monitoring liquidity conditions and, “above all,” seeing spot trading volumes return.

At press time, Bitcoin traded at $78,723.