It’s 2025, and the crypto market is booming, which is all the context you need if you plan to invest. So, today we will discuss how to buy crypto with a credit card and look into the most popular exchanges on the market today.

There’s a reason names like Best Wallet, MEXC, and Binance hit your feed more often than others. These platforms are easy to use, give you access to thousands of tokens, and come with friendly fees and top customer service.

But they’re not the only names on our list. So, let’s start at the beginning.

8 Places to Buy Crypto With Credit Card – Quick Overview

The following services are some of the best on the market based on ease of use and overall features.

- Best Wallet – Multi-Chain Trading and Some of the Lowest Fees on the Market

- MEXC — Trading Events with Prize Pools as High as $1M

- Binance — Native Web3 Integration with the New Alpha Trading

- Margex — Multi-Coin Staking with a 7% APY for the Top Coins

- OKX — 30% Staking APY for Newcomers for the First 3 Days

- CoinEx — Time-Sensitive Mining Pools with Airdrop Rewards

- BloFin — Up to 5,000 USDT in Rewards for Newcomers

- KCEX — 0% Newcomer Trading Fees for Futures and Spots

How to Buy Crypto With Credit Card, Step by Step

Once you’ve chosen your preferred wallet, you need to create your account and start trading.

Here’s how to buy crypto with a credit card without verification in Best Wallet. These steps generally apply to all other platforms, since the setup process is similar for most of them:

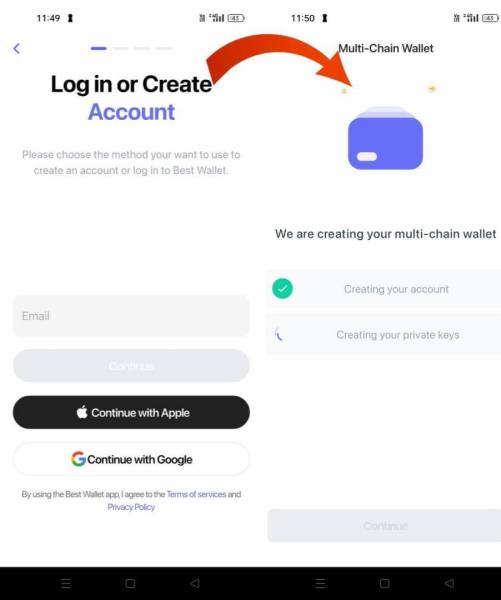

Step 1 — Download Best Wallet and Create Your Account

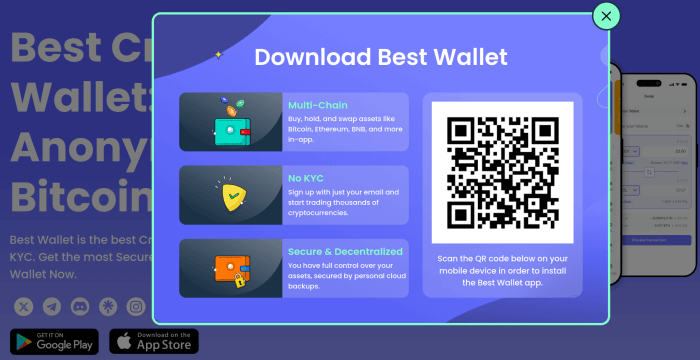

Visit the official Best Wallet website and scan the QR code to download the Android or iOS app.

Follow the on-screen steps to make your account. This includes providing an email address and verifying the code you receive.

The app will then automatically create your first wallet.

Step 2 — Set Up Your Passcode

After you receive confirmation that your account is live, you’ll be redirected to create your passcode. After that, you can choose to allow or skip push notifications.

Step 3 — Create Your Drive Backup

You now need to create your drive backup. With that complete, you will now gain access to your Best Wallet account.

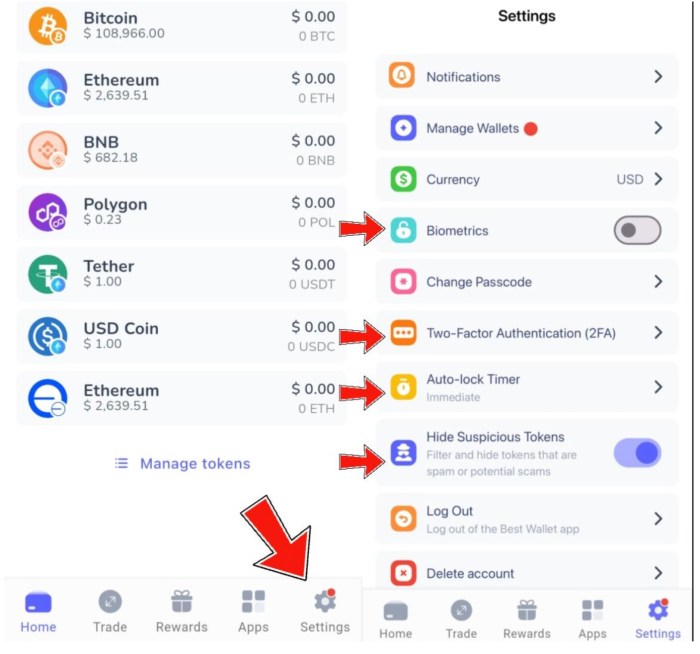

Step 4 — Set Up Additional Security Features

Once you access your account, go to Settings and enable Biometrics, 2FA, the Auto-Lock Timer, and Hide Suspicious Tokens.

That’s it, your Best Wallet account is all set up, and you’re ready to start trading.

Things to Know When Buying Crypto With A Credit Card

Many people want to learn how to buy crypto with a credit card online because it’s easy and fast. However, this payment method comes with the caveat of being risky and typically subjecting you to higher fees.

So, if you plan to buy your crypto tokens with a credit card, here’s what you should pay attention to:

The Fees

Gas fees, interest fees, platform fees, and interest charges can accumulate and eat away at your profit. You should always be aware of the costs attached to your transactions beforehand.

Also, remember that some blockchains, like Ethereum, may charge steeper gas fees during rush hours, when network congestion raises the processing cost.

The KYC (Know Your Customer) Policy

Although no-KYC crypto exchanges exist, most platforms have some form of KYC policy in place for credit card transactions, including your government-issued ID, billing address, and other information attached to your credit card.

Make sure you trust the platform before sharing your personal information.

Bank Compatibility

Not all banks are crypto-friendly, as some explicitly block crypto transactions. Bank of America, for instance, has become increasingly crypto-friendly over the years, and, starting in 2021, allows you to create and use a crypto wallet as part of its services.

However, it doesn’t allow the direct purchase of crypto with your debit or credit card, although CEO David Moynihan does see that as a viable option in the near future.

So, you should make sure that your credit card is crypto-compatible.

Regional Compatibility

If your living region has banned or restricted crypto transactions, you may be unable to do anything about it.

So, always check the platform’s list of supported countries and your card’s international transaction restrictions, if any.

Verify the Third-Party Processor

A third-party payment processor is almost always involved in your crypto transactions, with names like MoonPay, Sardine, and Simplex coming to mind.

Check the provider’s reputation and profile before agreeing to disclose your personal data.

The Trade-Off

Trading crypto with your credit card isn’t without its downsides. You could end up exposing personal information and paying higher fees than you’d like.

Still, the trade-off might be worth it if speed and convenience top your priority list, or if you’re only making a few quick transactions.

Best Platforms to Buy Crypto With Credit Card Compared

The following are the best platforms to buy crypto with a credit card today.

Platform |

Supported Cryptos |

Supported Cards/Banks |

Trading Fees |

KYC |

Geographic Availability |

Best For |

Best Wallet |

50+ tokens natively + million others via third-party wallets | Revolut, Visa, Mastercard, Skrill, Paypal, SEPA, Google Pay | Varies by third-party platform | Depends on the payment processor | 149 | User-friendly interface + no-KYC policy |

MEXC |

2K+ | SEPA, Visa, Mastercard, Banxa, MoonPay, Mercuryo, PayPal, Google Pay, Apple Pay | Spot: 0% maker and 0.05% taker

Futures: 0% maker and 0.02% taker |

Not mandatory, but KYC verification is necessary to lift withdrawal limits | 170+ | Some of the lowest fees (0% maker fees for spot and futures trading) |

Binance |

400+ | Visa, Mastercard, Revolut Pay, SEPA, ZEN, Paymonade, SWIFT | Spot: 0.1% maker and taker

Futures: 0.02% maker and 0.05% taker |

Yes | 100+ | Wide variety of trading bots + passive income on 300+ coins |

Margex |

40+ | Visa, Mastercard, Revolut Pay, SEPA, Neteller, AstroPay | Spot & futures: 0.019% maker and 0.06% taker | Only required for fiat deposits | 150+ | Up to $10K in rewards upon sign-up + risk-free live demo trading |

OKX |

300+ | Wire transfer, ACH transfers (Automatic Clearing House), SEPA, iDEAL, Bancontact | Spot: 0.08% maker and 0.1% taker

Futures: 0.02% maker and 0.05% taker |

Yes | 100+ | Customizable trading bots + access to pre-market futures before listing |

CoinEx |

1394 | Simplex, Guardian, Mercuryo, AlchemyPay, MoonPay, Volet, Banxa | Spot: 0.2% maker and taker

Futures: 0.03% maker and 0.05% taker |

Yes | 200+ | Tradeboard rewarding trading performance + learning hub with airdrops as rewards |

BloFin |

400+ | Visa, Mastercard, Google Pay, Simplex, Alchemy Pay | Spot: 0.1% maker and taker

Futures: 0.02% maker and 0.06% taker |

Not mandatory, but KYC verification is necessary to lift withdrawal limits | 150+ | Vast rewards hub based on trading performance + the option to become a Master Trader |

KCEX |

800+ | Doesn’t support fiat transfers | Spot: 0% maker and taker

Futures: 0% maker and 0.02% taker |

Not mandatory, but KYC verification is necessary to lift withdrawal limits | 180+ | The Futures Trading Competition with a prize pool of 20K USD |

We recommend Best Wallet as the most user-friendly option, with multi-chain support and non-custodial storage. It’s also free to use and one of the best no-KYC crypto wallets.

You should also check our other recommendations if you find another that fits your needs.

How to Buy Crypto With Credit Card: Takeaways

Now that you know how to buy crypto with a credit card, no verification, you should take your time to research some of the best platforms available before deciding on the right one.

Aspects like coin support, fees, ease of use, bank and regional compatibility, and reputation can distinguish between a trustworthy provider and one you’d better skip.

More importantly, you shouldn’t take this as financial advice. Always DYOR (Do Your Own Research) before entering the crypto market and invest wisely.

FAQs

1. Can you buy crypto with credit cards?

Yes, you can, but it depends on the type of platform you’re using and its compatibility with your bank or region.

Read the section ‘Things to Know When Buying Crypto with a Credit Card’ to learn what to consider before signing up on your chosen platform.

2. Why is it so hard to buy crypto with a credit card?

Buying crypto with a credit card is typically harder because of the different regulations between regions, crypto platforms, and banks. The worldwide crypto market is, at best, semi-regulated, so many banks and jurisdictions may avoid it.

KYC (Know Your Customer) policies also play a role here, given that, especially for first-time buyers, the verification process may last several days.

3. Can you buy crypto with a credit card without verification?

No, you can’t buy crypto without verification. While wallets like Best Wallet have no KYC policy for account creation, you must get verified if you plan to buy crypto with your credit card.

That’s because, when completing the payment, all platforms, Best Wallet included, will redirect you to a payment processor like PayPal, Simplex, or MoonPay, which require KYC.

4. Can you buy crypto with a credit card without fees?

No, you cannot buy crypto without paying some types of fees; usually, several of them. In most cases, you will pay platform fees, 3rd-party processor fees, credit card fees, and gas fees.

So, before you learn how to buy Bitcoin with a credit card, ensure you understand a platform’s fee system.