Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

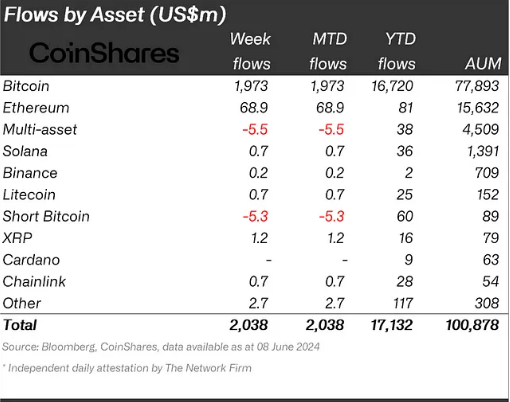

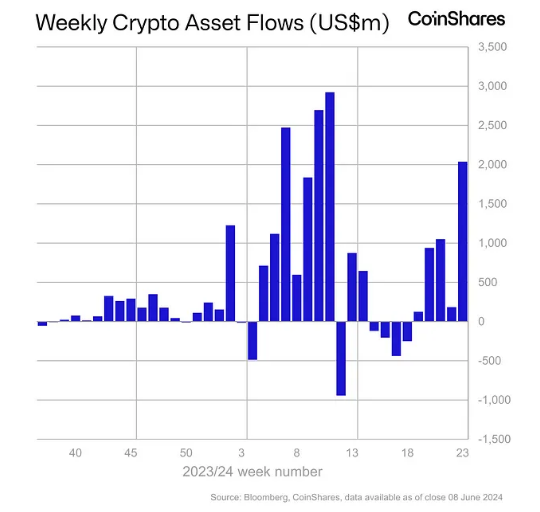

As investment money shows a historic spike, the bitcoin market is humming with fresh hope. Leading digital asset management Coin Shares revealed in only one week a record-breaking $2 billion influx into crypto funds, exceeding the nett inflows for May overall.

Now lasting five straight weeks, this favourable trend has driven total assets under management (AUM) in crypto funds back above the sought-after $100 billion threshold, a level not seen in March 2024.

Bitcoin ETFs Fueling The Fire

Unquestionably the king of cryptocurrencies, Bitcoin still attracts most investment attention. The present market mood is mostly driven by recent launch and continuous inflows into US-approved spot Bitcoin ETFs.

Their third-largest inflow day ever, these exchange-traded funds let investors hold Bitcoin without personally holding the digital commodity, seen $890 million come in on June 4th alone.

This passion for Bitcoin ETFs points to a growing demand for controlled and easily available means of engaging in the crypto market, therefore drawing a larger spectrum of investors.

Ethereum Shines Bright, Altcoins Show Promise

Although Bitcoin steals front stage, Ethereum, the second most valuable cryptocurrency, is also running really well. Last week, Ethereum funds came in around $70 million, their highest weekly since March 2024.

Coin Shares ascribes this good influx to investor expectation about the forthcoming US launch of spot Ethereum ETFs. Approval of these ETFs could provide major investment possibilities and help to further validate the Ethereum ecosystem.

With inflows of $1.4 million and $1.2 million respectively, altcoins including Fantom and XRP are also seeing a comeback in investor interest outside of the top two coins. This more general market involvement points to a possible comeback of investor confidence all throughout the crypto scene.

Along with a consistent decline in outflows from incumbents, CoinShares noted that inflows were rather common across almost all providers.

They blame weaker-than-expected macroeconomic data in the US for this change in attitude since it raises expectations for a future monetary policy rate reduction.

Total crypto market cap at $2.4 trillion on the daily chart: TradingView.com

Crypto Price Stagnation, Economic Uncertainty

Though investment inflows have surged, the price of cryptocurrencies has not shown a commensurate appreciative change. There are various reasons for this discrepancy, including residual investor doubt about the course of US economic policies going forward.

The present trend of record inflows into crypto funds presents a good future image for the market. The rising popularity of controlled investment vehicles such as spot Bitcoin ETFs points to institutional acceptability and maybe more broad investor adoption.

Featured image from Vecteezy, chart from TradingView