Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) seems to lose further ground, as bears relentlessly drive its price downward. The focus has now shifted to a crucial support level at $25.2K, a critical juncture that could potentially dictate Bitcoin’s trajectory in the near term.

The persistent selling pressure has resulted in Bitcoin struggling to maintain its position above key support levels, leaving traders anxious and speculators on edge.

The prolonged bearish trend has dampened the optimism that once surrounded Bitcoin’s meteoric rise, leaving many to question whether the cryptocurrency’s bullish run has come to an abrupt halt.

BTC Rejected At $30K Resistance, Prompting Altcoin Sell-off

Bitcoin experienced a significant setback in mid-April when it failed to break through the $30K resistance level. This failure resulted in losses that were mirrored across the altcoin market as investors fled to stablecoins.

The trend was unsurprising given the interconnectedness of the cryptocurrency ecosystem, where Bitcoin tends to lead the way in determining the market’s overall direction.

Despite the bearish market conditions, some short-term BTC holders found themselves in a profitable position after the digital currency moved above the critical $25.2K support level.

However, as BTC prices surged, many late bulls were caught off guard and ended up selling their Bitcoin holdings at a loss.

Based on latest data, the Spent Output Profit Ratio (SOPR) fell below 1, indicating that numerous addresses were liquidating their holdings at a lower price than their purchase price.

The cascading effect of Bitcoin’s rejection at $30K and subsequent downward spiral was felt throughout the crypto market, leading to a massive sell-off of altcoins. Investors, spooked by Bitcoin’s losses, sought refuge in stablecoins, leading to a significant drop in altcoin prices.

The situation was a reminder of the volatility of the cryptocurrency market, which is highly susceptible to changes in Bitcoin’s price movements.

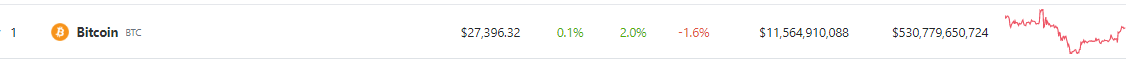

Source: Coingecko

Bitcoin Attempts To Recover From Recent Slump

CoinGecko data indicates that BTC is currently priced at $27,396, representing a 2% surge in the last 24 hours. This uptick comes as Bitcoin tries to shake off the seven-day slump of 1.6%, a trend that has left traders and investors cautiously optimistic about the digital currency’s future prospects.

However, the market sentiment remains uncertain, as recent Open Interest data shows a significant rise in short positions for BTC futures. On both May 8 and May 11, the Open Interest increased significantly, even as the prices fell lower, indicating that futures traders shorted BTC en masse.

BTCUSD slightly past the $27K region on the daily chart at TradingView.com

This extreme bearish sentiment on the lower timeframes has given sellers enormous confidence, leading to a 2.5% drop in BTC’s value on both days.

The bearish structure on higher timeframes and the lower timeframe sentiment signal potential further losses for BTC in the near term.

-Featured image from Haibike