Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Data shows that Bitcoin investors may be close to embracing greed as market sentiment has surged into neutral territory.

Bitcoin Fear & Greed Index Points At Neutral Trader Sentiment

The “Fear & Greed Index” is an indicator that tells us about the general sentiment among the investors in the Bitcoin and wider cryptocurrency sector. According to the index’s creator, Alternative, the metric takes into account multiple factors for calculating this sentiment.

The five factors it currently uses in the indicator’s value are namely: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends data. Earlier, the index also made use of surveys, but for now, they are on pause.

To represent the market sentiment, the fear and greed index uses a numeric scale that runs from 0-100. All values above the 54 mark suggest greed among the traders, while values below 46 imply fear. The in-between region means the presence of a neutral mentality.

Besides these three basic sentiments, there are also two extreme sentiments, called “extreme fear” (taking place below 25) and “extreme greed” (occurring above 75). Historically, these two regions have been quite significant for Bitcoin, as cyclical bottoms and tops have usually formed in the respective zones.

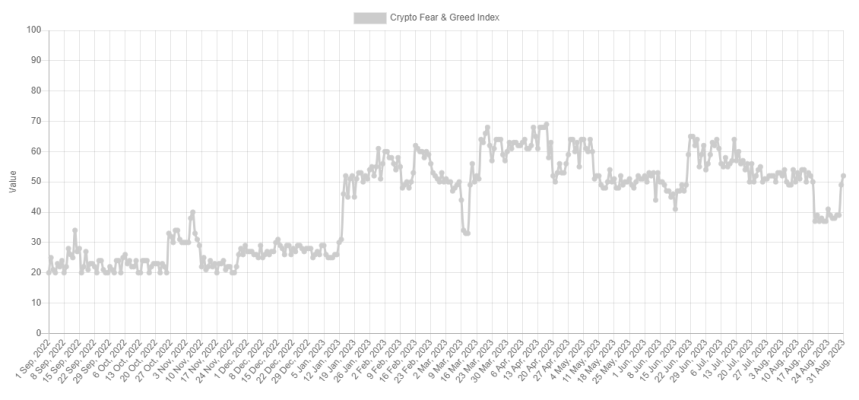

Now, here is what the Fear & Greed Index looks like for the market right now:

The value of the metric appears to be 52 at the moment | Source: Alternative

According to the index, the investors as a whole are sharing a neutral sentiment, meaning that they aren’t leaning one way or the other. Although, at the current 52 value, the metric is certainly closer to the greed territory than the fear one.

Earlier in the month, when BTC witnessed a crash from the $29,000 level to below the $26,000 mark, the sentiment in the market naturally plummeted. Investors had become fearful and had remained so for the duration that the asset consolidated around these lows.

After the rally spurred by Grayscale’s lawsuit victory, though, the sentiment rapidly registered an improvement and surged toward the current neutral values.

The below chart represents how the Fear & Greed Index’s value has changed recently:

Looks like the indicator's value has observed a sharp uplift in recent days | Source: Alternative

While the sentiment in the market has seen a rapid improvement with the latest rally, the investors haven’t quite yet made up their minds if they want to give in to greed or not.

It’s possible that more positive price action would need to happen before the investors are able to fully embrace the bullish momentum.

Nevertheless, a break into the greed territory would naturally be a green signal for any surge’s sustainability, as it would mean that the majority of the investors are ready to support the move.

BTC Price

After observing a pullback since the rally high, Bitcoin is currently trading around the $27,200 level, with investors still enjoying profits of about 3% over the past week.

The BTC price surge has slowed down | Source: BTCUSD on TradingView