Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

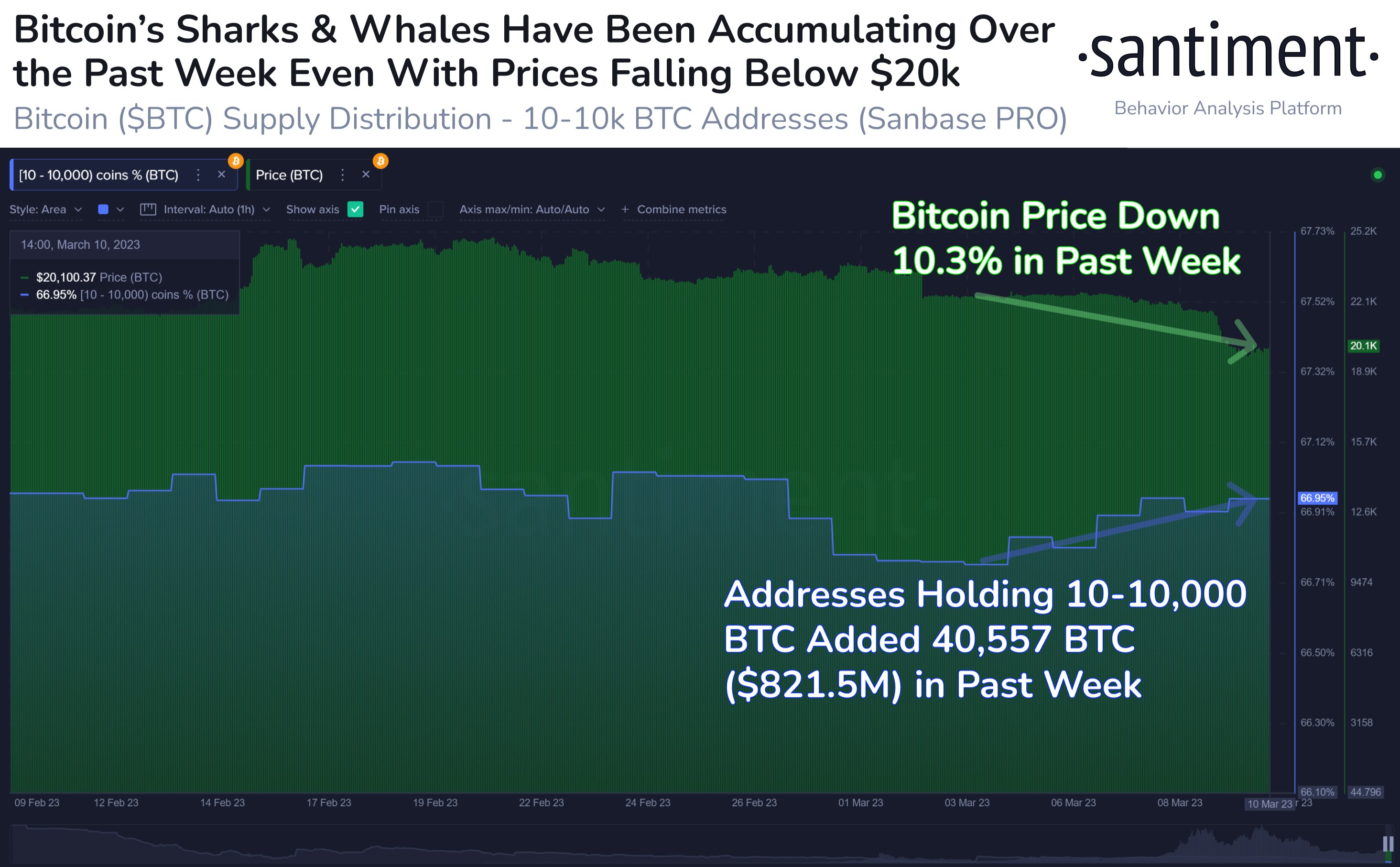

On-chain data from Santiment shows Bitcoin sharks and whales accumulated around $821.5 million in the asset during the recent dip in the price.

Bitcoin Sharks And Whales Have Added 40,557 BTC To Their Holdings Recently

As per data from the on-chain analytics firm Santiment, the sharks and whales weren’t behind the dip in the price seen earlier. The relevant indicator here is the “BTC supply distribution,” which tells us which wallet groups currently hold what percentage of the total Bitcoin supply.

Wallets are divided into these groups based on the total number of coins they are holding right now. For example, the 1-10 coins cohort includes all wallets that are carrying a balance between 1 and 10 BTC.

If the Supply Distribution metric is applied to this specific group, then it would measure the percentage of the BTC supply that wallets satisfying this condition as a whole are holding at the moment.

Now, in the context of the current topic, the range of interest is wallets holding between 10-10,000 BTC. There are three different wallet groups falling inside this range, so here is a chart that shows the combined Supply Distribution data for these groups over the past month or so:

The value of the metric seems to have been climbing in recent days | Source: Santiment on Twitter

This coin range covers two important cohorts for Bitcoin: the sharks and whales. Since these holders can have such huge wallet amounts (the range converts to $225,000 at the lower end and $225 million at the upper bound), their movements can have noticeable influences on the market, and because of this reason, their wallets can be the ones to watch for.

As displayed in the above graph, the Supply Distribution of these sharks and whales has trended up in March, meaning that the total percentage of the BTC supply that is in their wallets has been increasing.

In total, these investors have added an additional 40,557 BTC to their holdings during this surge. With this latest accumulation, these investors now own around 67% of the entire circulating supply.

Interestingly, the price of the cryptocurrency had actually been going down while these sharks and whales were buying the coin. Usually, during price declines, these humongous investors shed some of their holdings as it’s the selling from these holders themselves that’s often behind the price plunge.

However, as this hasn’t been the case this time, it would appear that the latest selloff may not have been driven by the sharks and whales. The fact that these investors were rather buying during the price drawdown would suggest that they still hold bullish convictions about Bitcoin and saw the dip as a profitable accumulation opportunity.

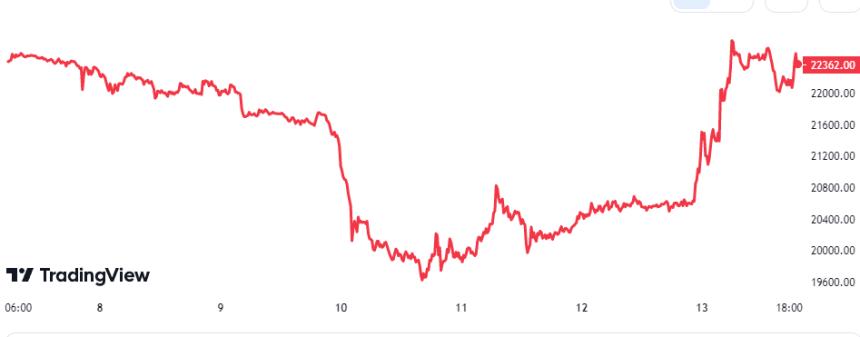

It would also seem that the buying pressure from these whales has ended up having a positive effect on the coin, as the asset’s price has seen some sharp upwards momentum in the past day.

BTC Price

At the time of writing, Bitcoin is trading around $22,300, down 1% in the last week.

Looks like the price of the cryptocurrency has sharply surged in the past day | Source: BTCUSD on TradingView