Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the recent Bitcoin drawdown has shaken up the short-term holders, leading them to make large exchange deposits at a loss.

Bitcoin Short-Term Holders Have Transferred Huge Volume In Loss To Exchanges

As analyst James Van Straten pointed out in a post on X, the BTC short-term holders have recently participated in a large amount of loss-taking. The “short-term holders” (STHs) are the Bitcoin investors who bought their coins within the past 155 days.

The STHs make up one of the two main divisions of the BTC market, which is done on the basis of holding time, with the other cohort being known as the long-term holders (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them at any point. As such, the STHs would reflect the weak-minded side of the market, while the LTHs would be the persistent diamond hands.

Given their fickle nature, the STHs usually easily react whenever a notable sector change occurs, like a price rally or crash. Recently, BTC has registered a significant drawdown, so these investors would likely have made some moves.

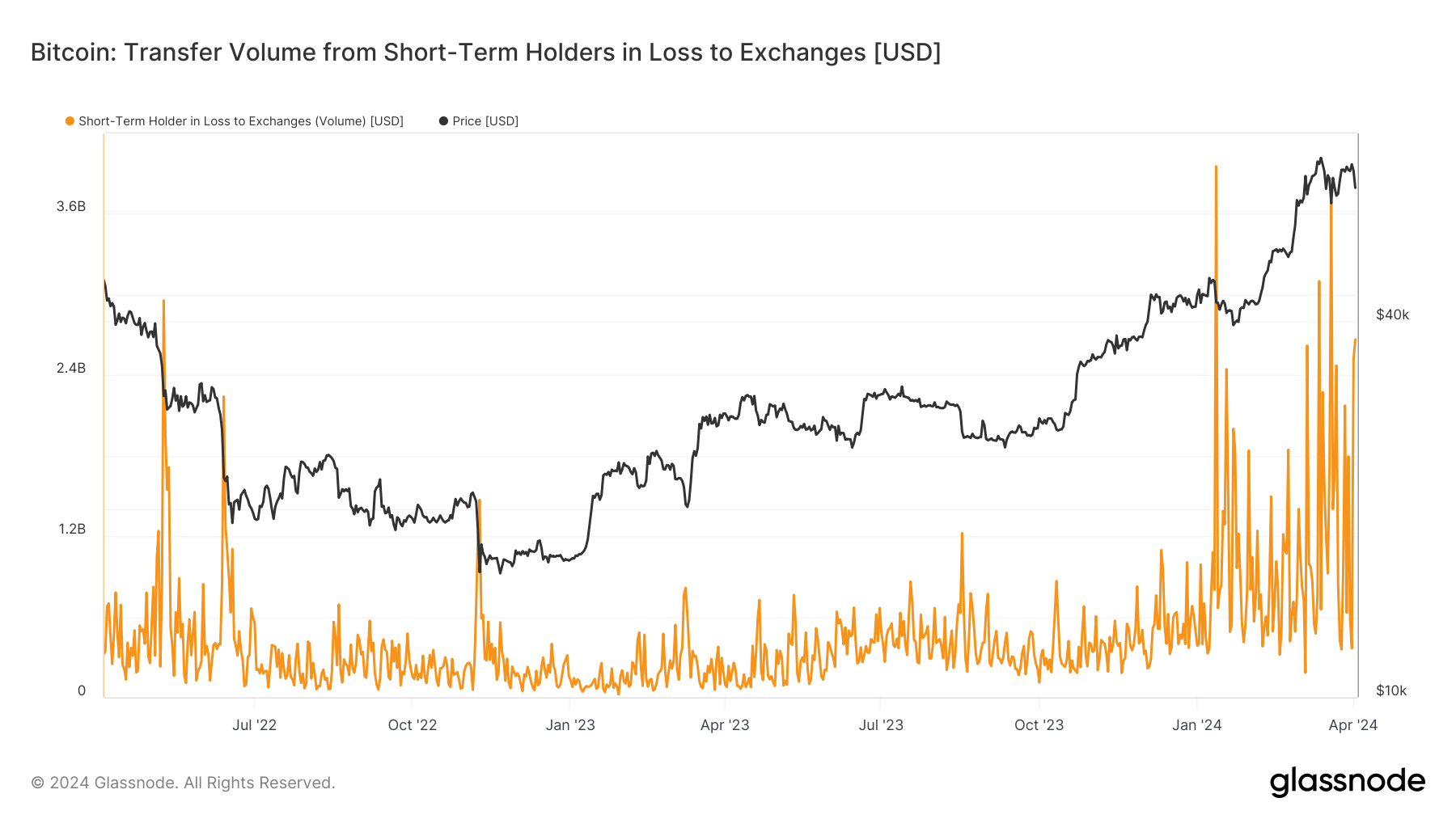

Indeed, on-chain data would confirm this. Below is a Glassnode chart shared by Straten, which reveals the trend in the transfer volume in loss (in USD) going from the wallets of the STHs to centralized exchanges.

The value of the metric appears to have been quite high in recent days | Source: @jvs_btc on X

As displayed in the above graph, Bitcoin short-term holders have recently deposited a large number of tokens holding a loss into exchange-affiliated wallets.

Exchange inflows usually suggest demand for using the services these platforms provide, which can include selling. As these latest deposits from the STHs have come following a sharp drop in the price, it would appear possible that the panic-sellers indeed made these inflows.

As the Bitcoin price is currently near the all-time high (ATH), most of the STH group would be holding a profit. So, all this loss volume can only come from those who bought at the recent highs.

This isn’t the first time the market has observed such quick capitulation from FOMO buyers this year. The chart shows that the exchange transfer volume in loss from the STHs also spiked very high during the plunge that followed the latest price ATH.

The spike back then was even greater in scale than the one witnessed recently and suggested the shakeout of the holders who the news of the ATH had driven in.

In the latest capitulation event, the Bitcoin STHs have deposited $5.2 billion worth of underwater coins to the exchanges within a two-day window.

BTC Price

Since the plunge a few days ago, Bitcoin has been unable to find any significant upward momentum, as its price has only been able to recover to $66,500.

Looks like the price of the asset has been trading sideways over the last few days | Source: BTCUSD on TradingView