In the past 20 minutes, Bitcoin has rocketed higher. After trading around $7,000 for most of Wednesday, the cryptocurrency started to rally, hitting a local high of $7,770 just minutes ago — 9% higher than the weekly open and a more impressive 14% higher than the weekly low.

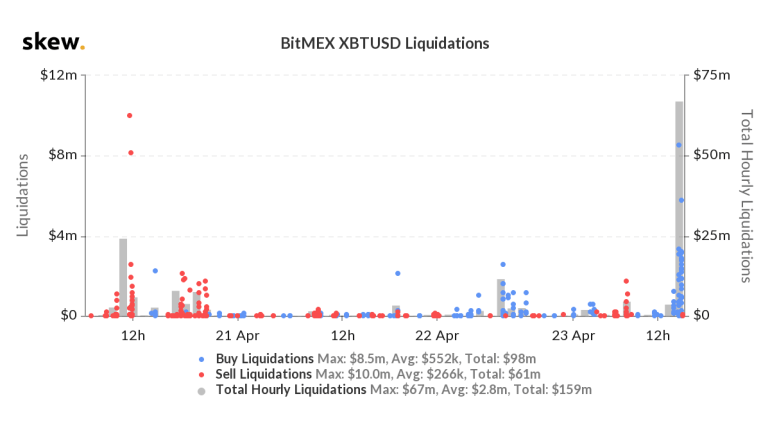

This was a move that surprised crypto investors across the board. Case in point: data from Skew.com, which tracks crypto derivatives, registered that nearly $70 million worth of short positions on BitMEX was entirely liquidated during the move — the highest amount of liquidations in an hour seemingly since the “Black Thursday” crash on March 12th.

It isn’t clear what exactly pushed the cryptocurrency so much higher, but considering that the BitMEX funding rate has been negative for the past few days, this pump may have been a textbook short squeeze.

The S&P 500 also continued to reverse higher on Thursday morning, gaining 1% in the trading session thus far, nearing multi-week highs. With Bitcoin operating with a positive correlation to the S&P 500, according to a report from the Kansas City Federal Reserve, the crypto market is likely benefiting from the rally in equities.

Bitcoin Needs to Hold This Level

According to crypto trader Josh Rager, Bitcoin reaching this level is “major,” noting how the $7,700-7,800 acted as support and resistance for the cryptocurrency on multiple occasions over the past year.

He added that while there is an initial rejection from the aforementioned key horizontal level, a “close above $7,400” would be a higher high for this market, and may thus lead too “bullish continuation.”

https://twitter.com/Josh_Rager/status/1253331521387159552

The call for bullish continuation has been echoed by trader Nunya Bizniz, who noted that Bitcoin’s chart from the February highs of $10,500 to now has formed a “classic BARR” bottom, marked by the textbook phases normally seen with this formation.

Per the trader, the textbook formation — technician Thomas Bulkowski’s “best performer” out of 56 chart patterns — suggests Bitcoin will trade as high as $10,000 by the start of May, just prior to the block reward halving.

Featured Image from Unsplash