Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the Bitcoin exchange whale ratio has been surging recently, a sign that may be bearish for the cryptocurrency’s price.

Bitcoin Exchange Whale Ratio (72-Hour MA) Has Observed A Rise Recently

As an analyst in a CryptoQuant post pointed out, the metric’s value is now close to the risk area. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows.

The most significant transfers to exchanges generally come from the whales, so the ratio’s value tells us what part of the total inflows is being contributed by these humongous holders.

Whales make up a large part of the inflows when the indicator’s value is high. Since one of the main reasons investors use exchanges is for selling purposes, this value can suggest the whales are currently doing a massive dump. Naturally, the BTC price could see a bearish effect from such selling.

On the other hand, the low-value metric implies whales are making up a relatively healthy part of the inflow activity right now. Depending on other factors, such a trend could be neutral or bullish for the asset’s value.

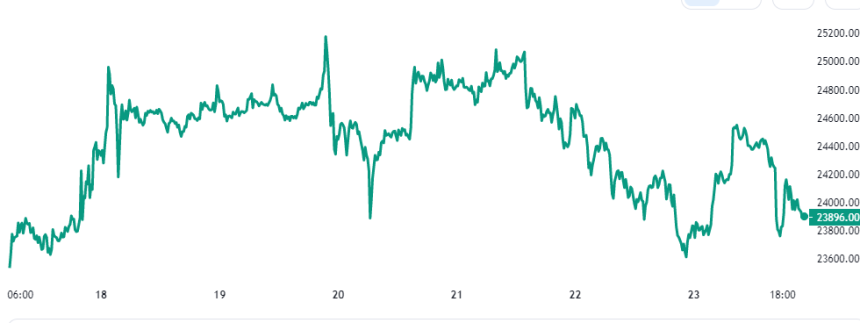

Now, here is a chart that shows the trend in the 72-hour moving average (MA) Bitcoin exchange whale ratio over the last few weeks:

The 72-hour MA value of the metric seems to have been elevated in recent days | Source: CryptoQuant

The above graph shows that the 72-hour MA Bitcoin exchange whale ratio has recently climbed. Following this rise, the indicator has now hit a value just below the 0.85 level.

The 0.85 level (at which 85% of the inflows are coming from the whales) has historically held significance for the metric; above it, BTC enters a risk zone. When the indicator enters this area, selling from the whales has usually led to price declines in the past.

A recent example occurred earlier in the month and is also visible in the chart. Back then, the 72-hour MA exchange whale ratio only touched this line, and the BTC price followed up by forming a local top before seeing some drawdown soon after.

Interestingly, the indicator’s value surged just before the latest leg up in the rally, briefly taking BTC to the $25,000 level. However, the metric’s value plunged just as the move started, suggesting that the whales’ reduced the selling pressure and may have allowed the price to move upwards and dump from higher.

Now it remains to be seen if the indicator will cross the level in the coming days and cause a decline in the price or if the surge will stop like the instance above, letting the rally continue in the process instead.

BTC Price

At the time of writing, Bitcoin is trading around $23,900, down 4% in the last week.

It looks like BTC has seen some decline in the last two days | Source: BTCUSD on TradingView