Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

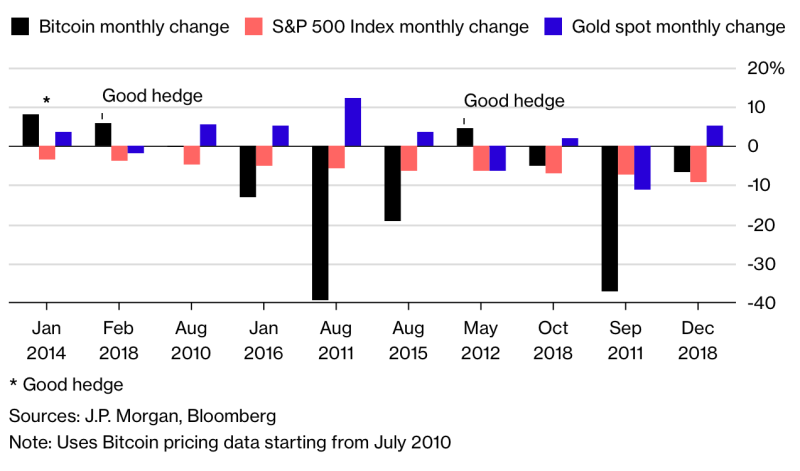

Bitcoin has fared poorly as a store of value asset in the past decade, according to John Normand.

The head of JPMorgan’s cross-asset management unit told Bloomberg that gold was a better hedge than Bitcoin since July 2010. While the precious metal proved to be a safer haven six times for the S&P 500 10-worst months, bitcoin posted positive returns on only three occasions.

Normand also cited statistics from their January 24 report. On August 31, 2011, for instance, when S&P 500 index rate fell 5.679%, investors who hedged into Bitcoin lost -39.259% of their investment. At the same time, investors who hedged into gold gained 12.2%. In another instance, on September 29, 2011, Bitcoin fell 37.317% as a hedge against S&P’s 7.176% plunge. Gold, at the same time, posted losses but they were lesser than bitcoin at 11.052%.

“Bitcoin’s correlation over the past year with all other markets has been near zero, which would seem to position it better than the yen or gold for hedging purposes,” said Normand in a JPMorgan report published January 24. “Low correlations have little value if the [hedged] asset itself is in a bear market, however.”

Biased Comparison?

The Bitcoin community was quick to respond to JPMorgan’s report. Many argued that the banking giant cherry-picked monthly data but ignored Bitcoin’s positive returns over the past ten years. A commentator also said that since Bitcoin was a new investment asset. He said that comparing the digital currency with the well-established hedge asset like gold was unfair.

“The market it just to thin,” wrote a trader. “You can’t compare markets with substantially different liquidities in this context since liquidity in itself carries substantial risk. And consequently, Bitcoin can’t make up a viable hedge, yet.”

“Utter stupidity,” said another Bitcoin enthusiast. “Any self-respecting statistician will not conclude what you did. From the diagram itself, it is clear that both are not correlated. This reduces the risk of the overall portfolio. As to whether it is a great hedge or not, we need to see more cycles [before] we conclude.”

KPMG, a Big Four audit firm, had said in its November 2018 report that bitcoin was not a store of value. However, the company had also added that with more trust and scalability among mainstream investors, the digital currency could achieve the Gold-like status.

“Institutionalization is the necessary next step for crypto and is required to build trust, facilitate scale, increase accessibility, and drive growth,” read KPMG.

2019 is About Institutionalization

Institutionalization describes the participation of large scale companies and investors in growing a small industry for its real-world potential. The involvement of FinTech companies, banks, venture capitalists, and mainstream financial giants has validated the growth of the crypto industry as a whole.

Fidelity Investments, which manages $7.2 trillion in client assets, launched cryptocurrency trading and custodian services. Intercontinental Exchange also announced that it would start the first physical bitcoin futures exchange Bakkt. Banking giant Goldman Sach also revealed its plans to launch a crypto trading desk in 2019.

Meanwhile, financial regulators across the world are attempting to build a uniform legal framework for cryptocurrencies. That expects to make investors more open towards including cryptocurrencies in their portfolio.