Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is still stuck in a tight range as market sentiment declines from optimistic to bearish and market participants brace for a possible impact. The cryptocurrency was thriving on the possibility of a positive change in the macroeconomic landscape. Did bulls rush into a trap?

As of this writing, Bitcoin (BTC) trades at $16,800 with sideways movement in the last 24 hours. In the previous week, the cryptocurrency is holding onto some profits, but there is a chance the bullish trajectory will retrace back to the yearly lows.

Bitcoin Miners Will Contribute With The Downside Price Action?

On the macro scene, the U.S. Federal Reserve (Fed) is the biggest hurdle for future Bitcoin profits. The financial institution is trying to bring inflation down by hiking interest rates. This monetary policy has harmed risk-on assets.

Fed Chair Jerome Powell hinted at moderating the monetary policy, but this possibility might become less likely. Recent robust U.S. economic data could provide support for further interest rate hikes.

The market is pricing in another 75 basis points (bps) hike for December. In addition to the Fed’s tightening, the war between Russia and Ukraine adds to the market’s uncertainty. The conflict is taking a step back in mainstream media headlines, but hostilities are escalating.

#Russia‘s Putin says threat of nuclear war is on the rise. Putin says Russia considers nuclear weapons a response to an attack. Says Russia’s nuke weapons are a deterrent factor in conflicts. pic.twitter.com/5RMIc7UK6A

— Holger Zschaepitz (@Schuldensuehner) December 7, 2022

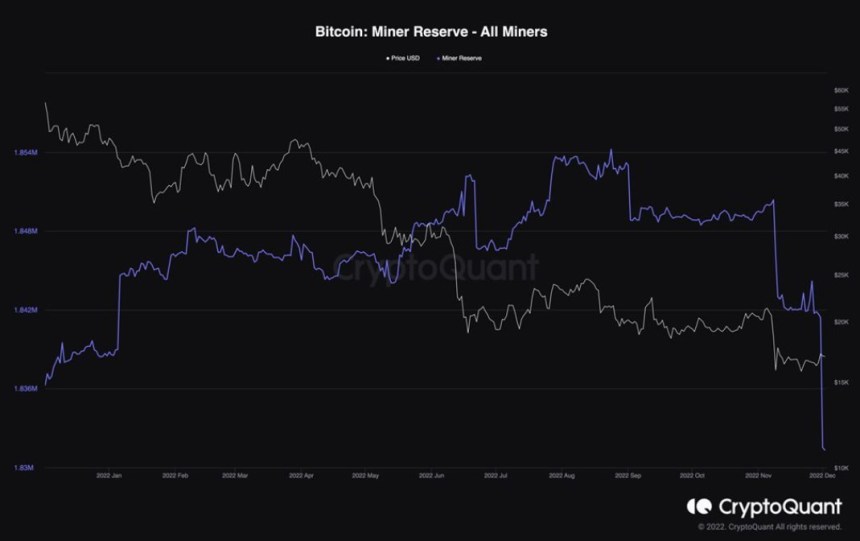

On the local scene, data from CryptoQuant shared with NewsBTC from the latest Bitfinex report indicates that BTC miners are “moving a large amount of Bitcoin out of their wallets.” These transactions are often bearish indicators for the cryptocurrency.

Miners take out BTC to sell in the market and cover their operations costs. This selling contributes to BTC’s bearish pressure. Bitfinex noted the following while sharing the chart below:

On the other hand, when the value of the indicator decreases, this indicates that miners are withdrawing coins from their wallets. Such a trend could be bearish for Bitcoin since the miners could be transferring their coins out of their wallets in order to sell them on exchanges. BTC exchange inflows have also increased slightly over the past week after declining significantly over the few weeks prior to that.

Other Factors To Consider

In addition to struggling miners, the market is seeing BTC holders sell their coins at a loss. The Spent-Out Profit Ratio (SOPR) indicator stands above one, meaning investors are capitulating and cashing out due to the current macro conditions.

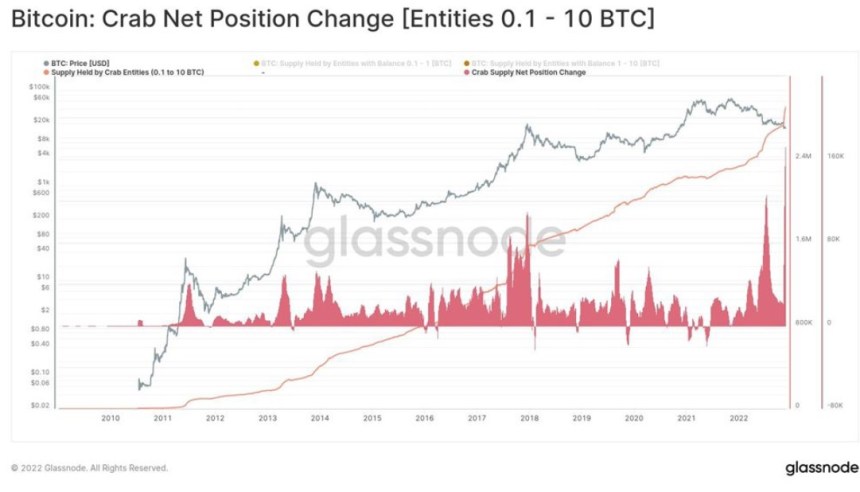

Bitfinex highlighted increased retail investors holding BTC as a positive takeaway from this data. These investors are adding to their balance while the price trends to the downside. These investor classes, the report claims, are “resilient in the face of price drawdowns” and could finally put a bottom in the BTC price.