Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

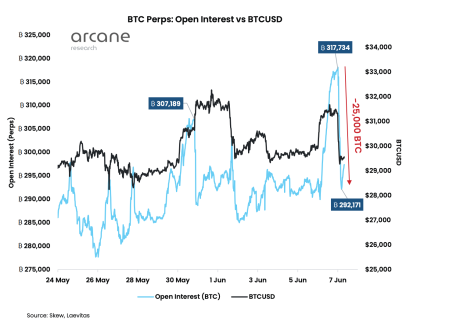

The bitcoin open interest over the past several weeks has been interesting to witness. Surges and dips appeared and disappeared just as quickly, usually following the price of the digital asset itself. Last week was no different given the movement. The bitcoin denominated open interest had plunged after only hitting a new all-time high the previous weeks. This suggests a sharp turn in the sentiment of investors after the rollercoaster of the last week.

Bitcoin Open Interest Down 25,000

Back at the beginning of June, Bitcoinist reported that a short squeeze may have been the reason behind the rally that saw bitcoin climb about $30,000 in the last days of May. This had been due to the fact that the open interest had risen drastically to a new all-time high of 307,189 BTC at this point. It was well-received in the market due to the fact that more investors were plunged back into profit but it seems the market is now retracing.

Related Reading | U.S. Macro Pressure Responsible For Entire Bitcoin Downtrend

For the past week, the bitcoin denominated open interest had been on the decline. The result of this had been 25,000 BTC wiped off the market in the space of seven days. This saw a sharp crash in the open interest and like always, a similar movement had been recorded in the price of the digital asset.

The decline brought the total open interest as of the close of market on Monday to 292,171 BTC. What followed was a decline in the price of BTC back below $29,000. The value of bitcoin has since returned but open interest had lagged.

Open interest takes a nosedive | Source: Arcane Research

It is interesting given that the open interest had hit another all-time high on Monday evening just before the crash. It had beaten the previous week’s high to touch 317,734 BTC before the crash. Given that the same trend was recorded the prior week, it suggests investor sentiment remains unstable.

Checking The Boards

The most significant decline in the bitcoin denominated open interest was recorded on the FTX crypto exchange. Most of the drop had originated from here where the exchange had seen open interest fall by 15.5% in just four hours. This would then be followed by other crypto exchanges, although to a lesser degree.

Binance which is the leading cryptocurrency exchange in the space saw open interest fall by 10.6% in the same time period. It was closely followed by the Bybit crypto exchange, which saw 9.1% wiped off its open interest in a total of four hours.

BTC loses momentum ahead of US trading hours | Source: BTCUSD on TradingView.com

Interestedly enough, Bybit which had recorded the lowest drop in open interest had seen the most impact on its funding rates. Despite that of Binance and FTX being larger, it was Bybit traders who saw a capitulation event to a worse degree.

Related Reading | Bitcoin Miner Revenues Stay Low As Price Decline Continues

Open interest is expected to recover through the next week given the interest in bitcoin perpetuals. However, the probability of the digital asset holding high remains low given recent trends.

Featured image from SciTechDaily, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…