Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has rallied over the past week following the release of inflation figures in the United States. With a positive reaction from investors, BTC has consolidated above its yearly high and is currently retesting the next resistance level at $25,000.

With an apparent easing of macroeconomic conditions and investors regaining confidence in the crypto industry, the market’s most prominent cryptocurrency appears poised for bullish continuation in the coming weeks.

At the time of writing, Bitcoin is currently trading at $24,850 with a gain of 0.7% in the last 24 hours, indicating that BTC is forming a range for what appears to be a breakout above $25,000.

Bitcoin continues to post huge gains in the seven-day timeframe, with an increase of 14.3%. And in the last 30 days, Bitcoin has continued to perform positively, with a growth of 9.6%.

Is BTC Poised For A Bullish Breakout?

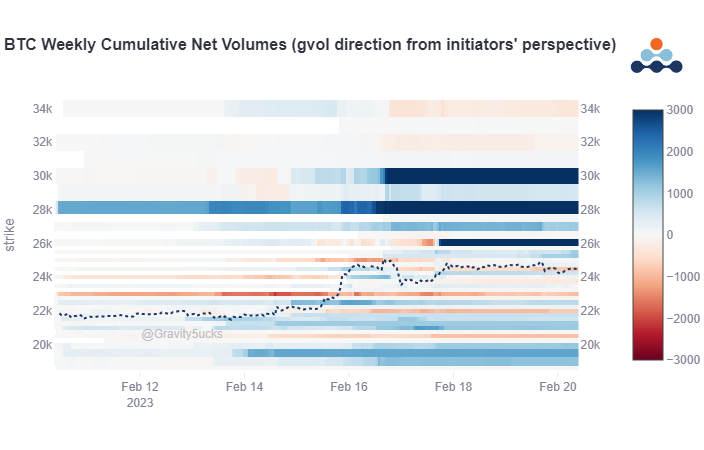

As BTC spot positions continue to target the $25,000 resistance level, options flows have become active recently, in line with Bitcoin price action.

According to data from crypto market research firm Deribit Insights, options activity is focused on the upside, with a significant amount of net call buyers between the $26,000 and $30,000 area, representing the zone of substantial interest for investors.

With February 24th options expiring in the 25K-30K range, call buying accelerates, and implied volatility (IV) rises as does spot. Deribit Insights says call spreads are “optimal buying structures as call skews and IV increase,” this market structure could support a continuation of the BTC rally.

Both options and spot buying volume are increasing; bullish investor expectations characterize the market sentiment. In addition, BTC capitalization has marked a new 1-month high of $383.4 billion as the price of Bitcoin attempts to break and consolidate above the $25,000 resistance level.

Checkmate For Bears?

While Bulls try another attempt on the next resistance wall around $25,000 after multiple attempts, a “Notorious B.I.D” whale is buying spot price to push the price of Bitcoin up above the resistance zone, according to crypto market analysis firm Material Indicators Co-founder Keith Alan:

Multiple rejections from $25k correlates perfectly with BTC macro TA which is a valid reason to TP at these levels, but Notorious B.I.D. is still trying to push price up. Based on the history, and the potential to rip through upside illiquidity, I’m still scalping longs

In addition, Material Indicators added on a Twitter post that from a technical analysis (TA) perspective, the Bitcoin price made a local top, with ask liquidity spreading from the $25-25.5K range into the active resistance zone.

If Bitcoin breaks above the next obstacle, it could end the bear market for good. A full breakout by Bitcoin could position the largest cryptocurrency for new yearly highs and a possible climb to the $27k level. The current resistance level could be the last hope for the bears.