Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Following the steep corrections seen in late July, the Bitcoin market made a modest recovery in the past week, rising by 2.73% according to data from CoinMarketCap. However, another rejection amidst this price resurgence forces the premier cryptocurrency to now trade within the $116,000 price region. While the crypto market awaits the token’s next move, cumulative trading activity signals potential for a major price surge to a new all-time high.

Golden Ratio In Sight: Bitcoin Targets $131K After Volume Shelf Hold

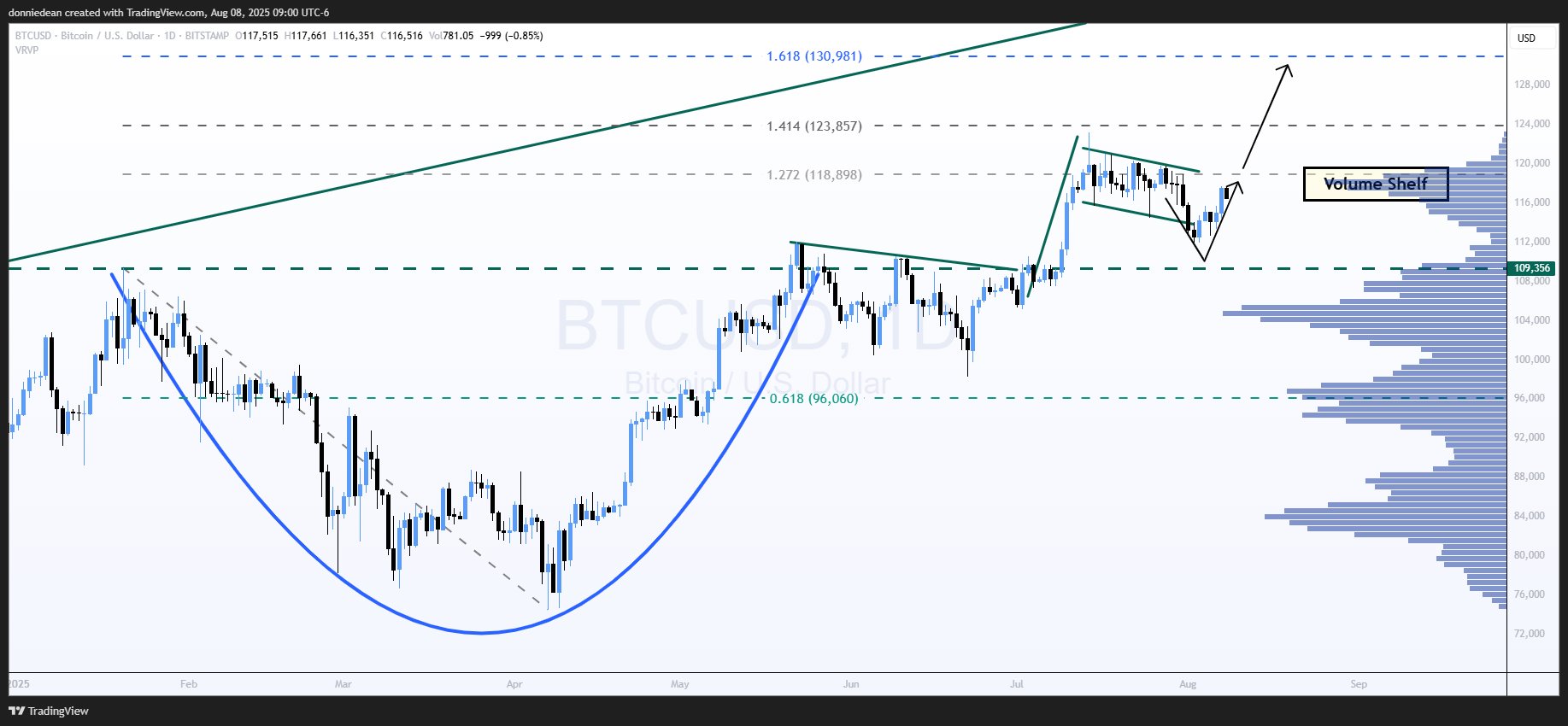

In an X post on August 8, popular financial market analyst Donald Dean shares an interesting bullish price prediction on the Bitcoin market. Based on the existence of a volume shelf on the BTCUSDT daily chart, Dean tips the crypto market leader to soon attain a $131,000 market valuation.

By way of explanation, a volume shelf refers to a price level where a significant amount of trading activity/volume has occurred. In the chart above, this level of trading is indicated by the horizontal bars on the right side of the chart. A volume shelf tends to act as a strong resistance or support zone because many traders are assumed to have bought or sold at this level.

According to Donald Dean’s analysis, Bitcoin is currently hovering around a volume shelf between $116,000 – $118,000, which has been identified as a potential launch area. If Bitcoin can consolidate decisively above this range, it suggests that this level has enough buying interest to potentially act as a springboard for the next leg up.

Interestingly, Dean predicts that this accumulation phase would provide the momentum needed to propel BTC toward the 1.618 Fibonacci extension level, a key technical milestone known as the “golden ratio.” This level, positioned around $131,000, represents the next major price target for the Bitcoin market, signaling a potential 12.93% gain on the present market prices.

Bitcoin Market Overview

At the time of writing, Bitcoin was trading at $116,756, after a minor decline of 0.02% over the past 24 hours. Meanwhile, market trading volume has fallen by 20.97% and is valued at $55.24 billion.

Data from CoinCodex indicates that market sentiment remains strongly bullish, with the Fear & Greed Index at 67. Despite this optimism, analysts expect BTC to hold within its current range, projecting prices of $117,167 in five days and $115,980 in thirty days, and a potential dip to $112,688 over the next three months.