Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Just as the hype surrounding the next Bitcoin block reward halving has heated up, sparking claims that a bull reversal is inbound, a leading crypto analyst has come to play whack-a-mole with optimists. Bulls may be preparing to run, but bears may have one last hurrah, as they savagely draw blood before their eventual bout of hibernation.

Related Reading: Why Investment Advisors Expect Bitcoin To Reach $17,570 By 2023

Bitcoin Could Bottom At $1,700 In Coming Months

In a recent Twitter thread, Murad Mahmudov, a Princeton graduate turned diehard crypto trader and hedge fund head hopeful, broke down why the “famous 200-week moving average (MA) support” for Bitcoin will break in coming months.

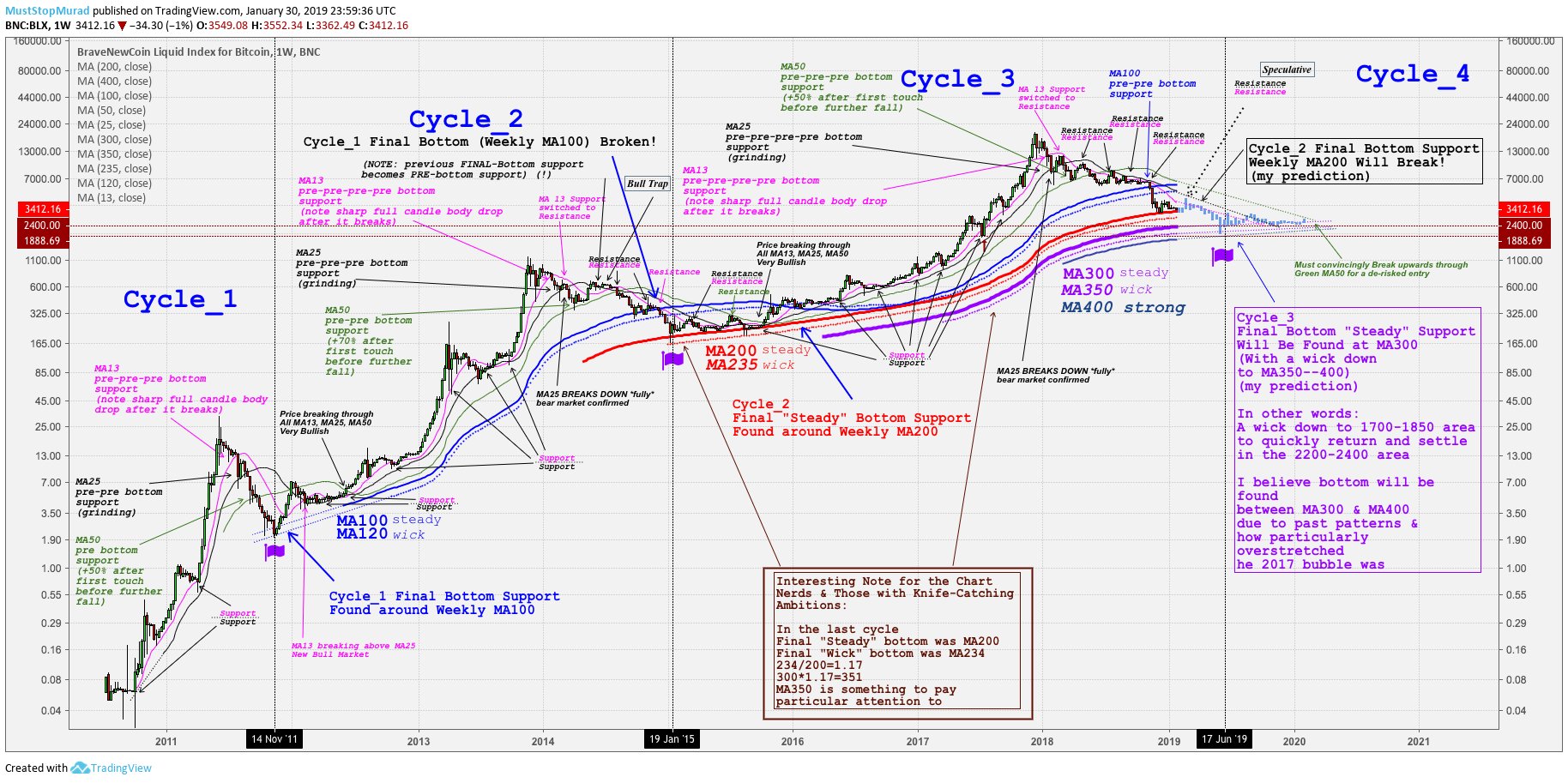

Drawing attention to the crypto market’s historical cycles, three of which have been fleshed out so far, Mahmudov noted that the key MA25, MA50, MA100, and MA200 were shifted “‘one level’ back with each cycle.” In fact, as depicted in the chart below (courtesy of Mahmudov), each multi-year market cycle, the importance of each MA level decreases, as averages pertaining to longer time frames takes their place.

And as such, Mahmudov remarked that just as the 200-week moving average was a level of utmost importance for BTC from 2015 to 2018, MA300 (and potentially MA400 too) will be integral lines to watch in the coming months.

Using his theory that the cryptocurrency market rhymes, not repeats, Mahmudov subsequently drew up an investment thesis for BTC in the coming months, citing historical trends, technical levels, and underlying fundamentals. As depicted above, the trader concluded that he expects that Bitcoin’s “steady support” will be found at an MA300 of around ~$2,400. However, he made it clear that Bitcoin could “wick down” to as low as MA350~400 in the $1,700 range, “due to past patterns and how particularly overstretched the 2017 bubble was.”

300 MA… What?

Although Mahmudov presumably had the best intentions in mind, the analyst’s use of the 300 moving average quickly made him take flak from his peers. In response to Placeholder partner Chris Burniske’s quip on Mahmudov’s harrowing thread, Alex Krüger, a New York-based macro markets researcher, remarked, “300 MA, what a joke, only in crypto.” Four Aces echoed Krüger’s comment, noting that the 300 MA doesn’t have as much inherent importance as the 200 MA does.

Others cast Mahmudov’s use of obscure moving averages aside to note that the call for lower lows in and of itself could have holes, citing market psychology and traders’ inability to be right 100% of the time. Armin Van Bitcoin, a skeptic of much in the crypto industry, noted that the monumental run-up of 2017 saw Parabolic Trav, who capitulated, become a popular figure. By the same token, he noted that the bear market of 2018/2019 had Mahmudov, rhetorically asking the analyst when he would end his enamorment with issuing predictions.

While Mahmudov use of lesser-known technical levels was quickly lambasted, the bearish forecaster’s previous comments on this market may give his sub-$2,000 forecast a tad more credence. Per previous reports from NewsBTC, the trader recently confirmed that a long-term downtrend line for the aggregate value of all cryptocurrencies was hit for the eighth time in a row.

In even earlier tweets, Mahmudov established that “titanium level resistance” levels at $4,000 will disallow Bitcoin from breaking out convincingly, and could thus be stuck under $3,000 for months on end, potentially fall to as low as $1,800 before a trend reversal.

All this aside, Mahmudov seems bullish, even overly so, from a long-term point of view. In an interview with Tone Vays, one of Mahmudov’s fellow fervent crypto traders known for their (somewhat) inflammatory calls, Mahmudov remarked that he’s so bullish, that he wouldn’t spend the cryptocurrency for at least ten years, as the asset’s potential upside and asymmetric risk profile makes it nonsensical to use BTC at current rates.

The Tone Vays guest added that not only are cryptocurrencies like the Dotcom industry in 1994 — quite minuscule, but a potential for dramatic upside — but that there are trillions of dollars worth of equities that can flow into blockchain-based tokens over time.

Featured Image from Shutterstock