Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has recovered above $23,000 multiple times now, but the digital asset remains in a perilous position. This is because the recovery alone has not been able to assure that the bull trend would endure. Rather, it has been falling the brief buying and selling pressures that have been plaguing investors in recent times. The bitcoin open interest also mirrors this fact and shows just how easy it would be for bitcoin to lose its position.

Bitcoin Open Interest Stays Elevated

For the past week, the bitcoin open interest has been on the rise. After hitting above 300k the previous week, there was no stopping this part of the market. However, it also pointed to more peculiarities about the current bitcoin uptrend.

Related Reading | Why Cardano (ADA) May Breakout In A Bull Run To $1

For one, the elevated bitcoin-denominated open interest shows that there is very high leverage in the crypto market. As with any market, having such high leverage always puts the value of the digital asset in a perilous position. It could swing either way resulting in a short squeeze or a long squeeze. Whatever the case may end up being, the results are often the same; there are significant price swings that would go in either direction.

BTC recovers above $23,000 | Source: BTCUSD on TradingView.com

With the current movement of bitcoin, it is more likely that a long squeeze would be the end of it. This would likely see the price drop back down and touch $20,000. But if the off chance that it does end in a short squeeze, then bitcoin’s price could very well revisit $25,000.

Funding Rates Fall

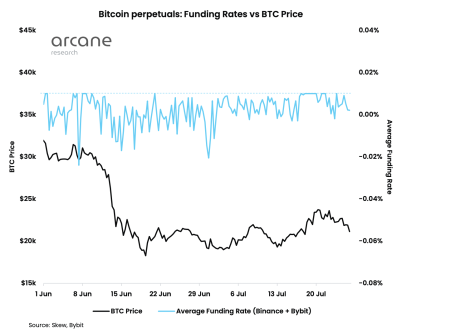

Last week, the market had seen some much-needed bullish sentiment on the part of perpetual traders when the funding rates had recovered to neutral levels. Given that the funding rates had spent weeks swinging below neutral, this was a welcome change, however briefly.

It would seem the positive recovery would only last a single week as bitcoin funding rates have begun to swing back into the negative. It shows a straight decline down from neutral, indicating that traders were returning to more careful trades.

Funding rates fall below neutral | Source: Arcane Research

Interestingly, though, is the fact that despite the decline in the funding rates, they still continue to maintain higher lows. It shows better prospects compared to the month of June, which was characterized by funding rates remaining perpetually below neutral.

Related Reading | Bullish Sentiment Spills Over To Institutional Investors As Ethereum Inflows Balloons

What this shows is that although bitcoin traders are being more careful, they have not entirely written off the digital asset. This improvement in market sentiment has shone through in bitcoin’s recent recovery. However, for this to continue, funding rates would need a reversal from here.

Featured image from GoBankingRates, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…