Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin dropped to $96,000 on heavy selling Friday, and falling risk appetite, leaving traders and analysts parsing whether this is normal profit-taking or a larger turning point for the market.

According to on-chain and market reports, the drop wiped out more than $700 million in long positions and left November down by more than 10%.

Whale Transfers Draw Focus

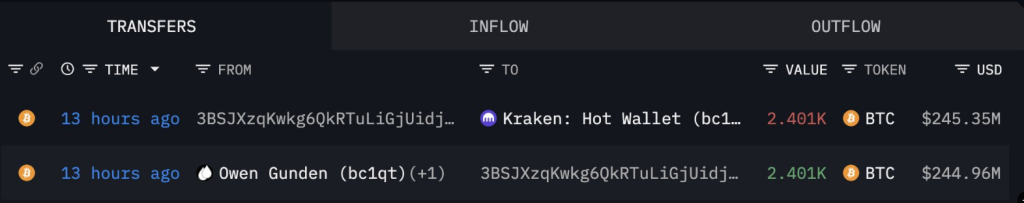

Reports have disclosed that a wallet tied to trader Owen Gunden moved 2,400 Bitcoin — about $237 million — onto the Kraken exchange, a transfer tracked by blockchain watcher Arkham.

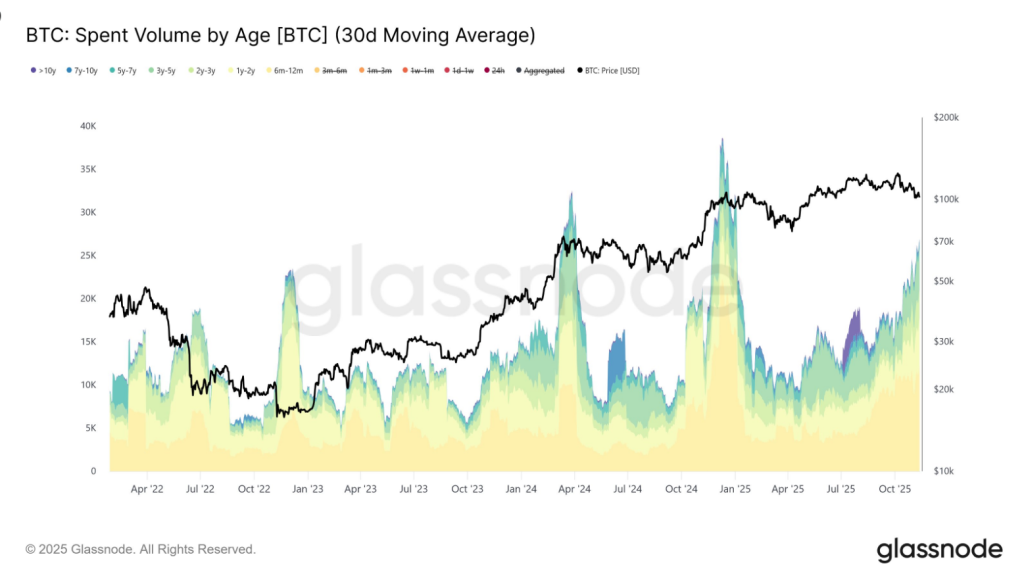

Based on analysis by Glassnode, long-term holders’ average daily spending rose from over 12,000 BTC per day in early July to roughly 26,000 BTC per day as of this week.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden just moved all of the remaining BTC out of his accounts. He deposited over HALF of his holdings directly into Kraken, depositing a total of $290.7M of BTC into Kraken.

He now has only $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

That pattern, Glassnode analysts say, looks like orderly distribution by older holders rather than a sudden mass exit. It is being framed as late-cycle profit-taking: regular, steady, and spread out.

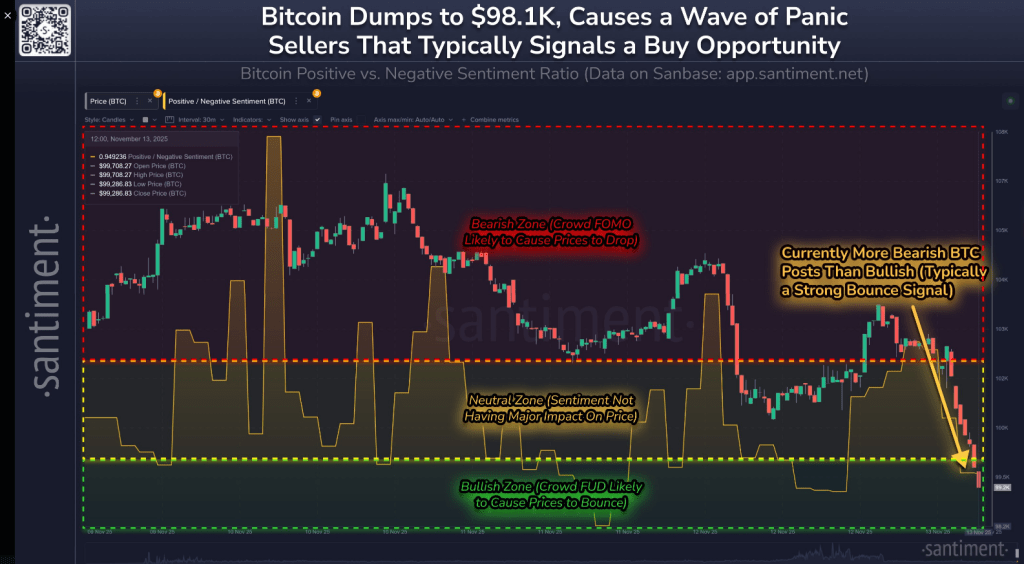

According to Santiment, Bitcoin has fallen below $100K for the second time this month, triggering a burst of fear and worried posts from retail traders.

📉 Bitcoin has dumped below $100K for the second time this month. Predictably, this has caused a wave of FUD and concerned social media posts from retail traders. As shown below:

🟥: Significant bullish/greedy bias (usually when markets are getting too much FOMO, prices will go… pic.twitter.com/rowUv3xIMd

— Santiment (@santimentfeed) November 13, 2025

No Meltdown: Late-Cycle Signals And On-Chain Readings

Vincent Liu, CIO at Kronos Research, disclosed that structured selling and steady rotation of gains often show up in late-cycle phases.

He cautioned that this phase doesn’t automatically signal a final peak, provided there are still buyers ready to take in the extra supply.

Being in a late cycle doesn’t mean the market has hit a ceiling, he pointed out. It just shows momentum has eased, and bigger forces like macro trends and liquidity are now in control, he said.

“Rate-cut doubts and recent market weakness have slowed the climb, not ended it,” Liu said. In other words, there’s no meltdown or anything like it.

On-chain indicators are being watched closely; Bitcoin’s net unrealized profit ratio stood near 0.476, a level some traders interpret as hinting at short-term lows forming.

That reading is only one of several signals, Liu added, and must be tracked alongside liquidity and macro conditions.

A closer look at the monthly average spending by long-term holders reveals a clear trend: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day today (30D-SMA).

This steady rise reflects increasing distribution pressure from older investor cohorts — a… pic.twitter.com/wECe58CV66— glassnode (@glassnode) November 13, 2025

Market Pain Came From Stocks And Rates

The cryptocurrency sell-off came as crypto-related stocks plunged. Broader markets were weak as well, with the Nasdaq down 2% and the S&P 500 off 1.3%.

Cipher Mining fell 14%, Riot Platforms and Hut 8 dropped 13%, while MARA Holdings and Bitmine Immersion slid over 10%. Coinbase and Strategy were down about 7%.

Based on reports, large institutional flows have pressured prices. Firms including BlackRock, Binance and Wintermute reportedly sold more than $1 billion in Bitcoin, a wave of selling that produced a quick 5% drop inside minutes.

Meanwhile, social sentiment turned sharply negative, and the Crypto Fear & Greed Index hit 15, reflecting “extreme fear” among traders.

Featured image from Unsplash, chart from TradingView