Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has maintained high prices well into the first week of November. The month is expected to follow bullish trends that were triggered in the previous month and bitcoin has not been disappointed in this regard. However, some metrics remain low compare to the price of BTC. This could be as a result of investors taking profit in the market but low enough to draw attention to them.

BTC had seen a lot of investment pour into it the week after the first ETFs went live. The record-breaking $1.4 billion inflow for the week had pushed the price of the digital asset towards a new all-time high. Yet, subsequent weeks have not fared as well in the market. One of the ways this decreased inflow has shone through has been spot trading volumes for the asset.

Related Reading | PayPal Co-Founder Says Bitcoin Price Points To Crisis In The Economy

Bitcoin Spot Trading Low

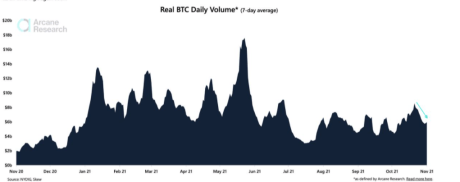

In comparison to the current price of the digital asset, spot trading volumes are expected to go up in tandem with the price hike. This has not been the case. Spot trading volumes for the week are down compared to the previous week. The 7-day trading average for the digital asset shows a significant downtrend in the same time period. An almost $1 billion decrease saw the 7-day average real trading volume for the asset drop to $6 billion.

BTC spot trading volumes remain low | Source: Arcane Research

The last time BTC was this high, spot trading volumes were significantly higher. The Spring rally saw spot volumes go up along with the price of bitcoin, driving the price higher in that regard. This time, trading volumes have continuously decreased despite the price of the digital asset hitting a new all-time on October 20th.

Spot trading volumes are crucial to the performance of the asset in the market. If the market is to see BTC challenge a new all-time high, it is expected that spot trading volumes would need to go up to accommodate for this increase. Otherwise, momentum in the asset may slow to a crawl, causing the value to stagger downwards in the meantime.

BTC price falls to $61K | Source: BTCUSD on TradingView.com

BTC Futures Premium Decline

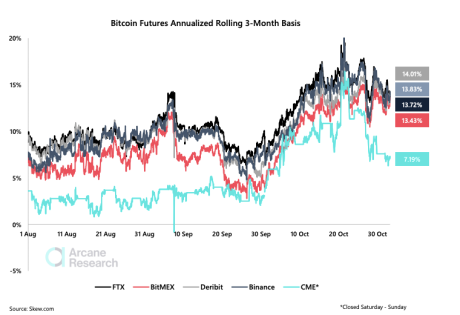

Bitcoin futures premium saw a significant uptick in October with the release of the ETFs that brought strong institutional demand into the market. The momentum was maintained for the better part of a week. However, the market is beginning to see a substantial decline in demand.

Related Reading | Bitcoin ETF Inflows Slow Down As Altcoins Interest Rebound

Futures premiums on CME saw a decline back to early October levels. Increased cash-and-carry activities in the CME Futures are speculated to be the main driver behind this decline. Still, it is a clear indication that institutional interest took a sharp downturn after the ETFs record opening in October.

Interest in BTC Futures decline after launch week | Source: Arcane Research

Open interest on CME has also recorded a decline. But this has not been the case across all open interest platforms. Open interest on top cryptocurrency exchange Binance has seen growing interest. Cash-and-carry activities indicate traders are increasing their exposure. Although some traders who had long exposure on CME had seen gains by the close of last month.

Featured image from CNBC, chart from TradingView.com