Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After another day of sideways trading, Bitcoin has once again been unable to close its daily candle above $7,200, making the cryptocurrency prone to seeing further weakness in the weekend and week ahead.

The benchmark cryptocurrency may not be able to make any meaningful trend defining moves in the days ahead either, as one analyst is noting that the direction the U.S. stock market trends next week will be pivotal for Bitcoin.

This suggests that the coming weekend will be rather lackluster, potentially leading the crypto to enter yet another prolonged bout of sideways trading.

Bitcoin Struggles to Surmount $7,200 as Analysts Foresee Prolonged Consolidation

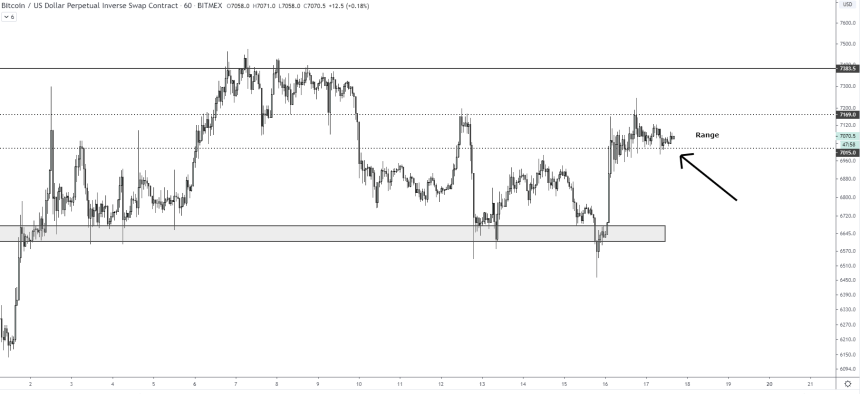

At the time of writing, Bitcoin is trading up nominally at its current price of $7,115, which marks a slight climb from its daily lows of $7,050 – the level at which the crypto has been trading at throughout the past day.

Currently, BTC is trading just below its key resistance at $7,200, which is where the crypto has faced multiple rejections at throughout the past couple of days.

Analysts are now noting that despite the resistance at $7,200, the key level that bulls need to surmount if they want to spark a notable uptrend sits at $7,400, as a break above this level could be enough to spark another uptrend.

Josh Rager – a popular analyst on Twitter – spoke about this level in a recent tweet, noting that he doesn’t anticipate it to be broken in the coming days due to the notoriously boring price action seen by BTC on weekends.

“Super exciting $150 range for BTC ever since the move up from sub $6600. Expecting some consolidation before the next move – still watching $7400 as the area to break. Saturdays are notoriously known to be boring so not expecting much tomorrow and more action on Sunday,” he noted.

BTC May Not Make Any Meaningful Movements Until the S&P 500 Reopens

Rager isn’t the only analyst that thinks BTC won’t see any meaningful price action this weekend, as another trader notedthat he believes the crypto’s price action will be unimportant until the S&P 500 establishes a firm trend – leading Bitcoin to follow suit.

“BTC weekend expectations. No meaningful move for SPX, so BTC will take liquidity while it waits. Most likely trades below 6900 and above 7200 for a short amount of time at some point. Quick scalps can target a move back towards mean pricing (7050~),” he explained.

It does appear that the coming couple of days will be quite boring for Bitcoin, but it is possible that as time drags on it will be better able to establish a macro trend as the traditional markets gain greater stability.

Featured image from Unsplash.