Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Another day, another MicroStrategy bitcoin buy. The Michael Saylor-led company is relentless in its BTC accumulation strategy. In a similar position, the bitcoin mining giant Marathon Digital Holdings doubles down on its no-selling policy. Which is also a BTC accumulation strategy. Will these two giants go down in history as pioneers?

Related Reading | Treasury Management Firm Says CFOs Avoid Risk, Bitcoin Won’t Become Corporate Vehicle

These companies are adopting the Bitcoin Standard as a way of life. Let’s look at MicroStrategy and Marathon’s stats, where do these new acquisitions put them on the BTC leaderboard? And, how did the market react to both news?

MicroStrategy, Even More Aggressive

The man himself, Michael Saylor announced the acquisition via his very active Twitter:

“MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per bitcoin. As of 4/4/22 MicroStrategy hodls ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin.”

MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per #bitcoin. As of 4/4/22 MicroStrategy #hodls ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin. $MSTRhttps://t.co/Z45OuJU5KI

— Michael Saylor⚡️ (@saylor) April 5, 2022

To clarify, MacroStrategy is a MicroStrategy subsidiary. This seems to be the buy the company did with the $200M bitcoin-collateralized loan they took a week ago. Our sister site Bitcoinist explains and clarifies:

“The company took the loan via MacroStrategy, a subsidiary created with the purpose of holding its parent company’s Bitcoin funds. As per the release, the $205 million loans were issued under the Silvergate Exchange Network (SEN) and its Leverage program and will mature on March 23, 2025.

The SEN was launched in 2020, the release clarified, to address the demand for BTC collateralized loans.”

Even though 129,218 BTC is a lot for just one entity, it’s beneficial to remember that those are not Michael Saylor’s coins. The treasury belongs to MicroStrategy, a public company owned by many. Still, they own almost triple what Tesla owns. And MicroStrategy keeps on buying.

https://twitter.com/cz_binance/status/1511337405911080970

Binance’s CEO Changpeng Zhao reacted to the news with high praise. “Many people talk about buying the dip. But when the dip comes, they panic and sell (as oppose to buy). This is how you do it,” he wrote.

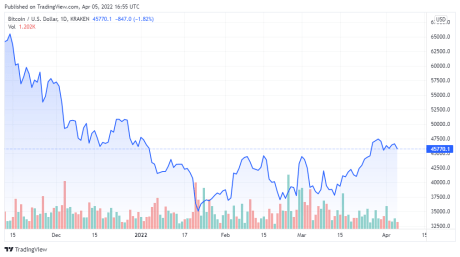

BTC price chart for 04/05/2022 on Kraken | Source: BTC/USD on TradingView.com

Marathon, Even More “Hodling”

In a recent press release, Marathon Digital Holdings announced very healthy-sounding numbers. The company “produced a record 1,258.6 self-mined bitcoin during Q1 2022, a 556% increase from 191.8 self-mined bitcoin in Q1 2021 and a 15% sequential increase from 1,098.2 self-mined bitcoin in Q4 2021.” Plus, in March alone, they “successfully deployed 1,320 miners.”

About the increase, the company’s CEO Fred Thiel said:

“In the first quarter of 2022, we increased our bitcoin production 15% from the prior quarter and produced a record 1,259 bitcoin even as the global hash rate rose by approximately 17%,”

Where does that put them on the bitcoin leaderboard? Well, Marathon “increased total bitcoin holdings to approximately 9,373.6 BTC with a fair market value of approximately $427.7 million.” The company’s accumulation strategy began in October 2020, the last time Marathon sold bitcoin.

Related Reading | Allied Payment Partners NYDIG, Adds Bitcoin To Corporate Treasury

MicroStrategy, The Leaderboard, And The Market

According to the Bitcoin Treasuries list, these acquisitions put both companies at the bookends of the Top 5. That is:

- MicroStrategy, 125,051 BTC

- Tesla Inc., 42,902 BTC

- Galaxy Digital Holdings, 16,400 BTC

- Voyager Digital LTD, 12,260 BTC

- Marathon Digital Holdings, 8,956 BTC

Nevertheless, the market seems to have reacted negatively to the news. At 9 am, BTC traded in the $47K range. It dropped continually during the day and around noon it was trading in the $45.5K range. Is MicroStrategy to blame? Or was it just a coincidence?

Featured Image by terimakasih0 on Pixabay | Charts by TradingView